Intech specializes in delivering quantitative equity investment solutions for clients worldwide. Our investment activities are anchored in three fundamental philosophical principles: a steadfast commitment to the scientific method, a strategic focus on the pivotal role of volatility, and the harmonious integration of diverse sources for alpha generation. These guiding tenets form the bedrock of our approach, advancing precision, resilience, and innovation in serving our client’s diverse needs.

What We Believe

The Intech Way

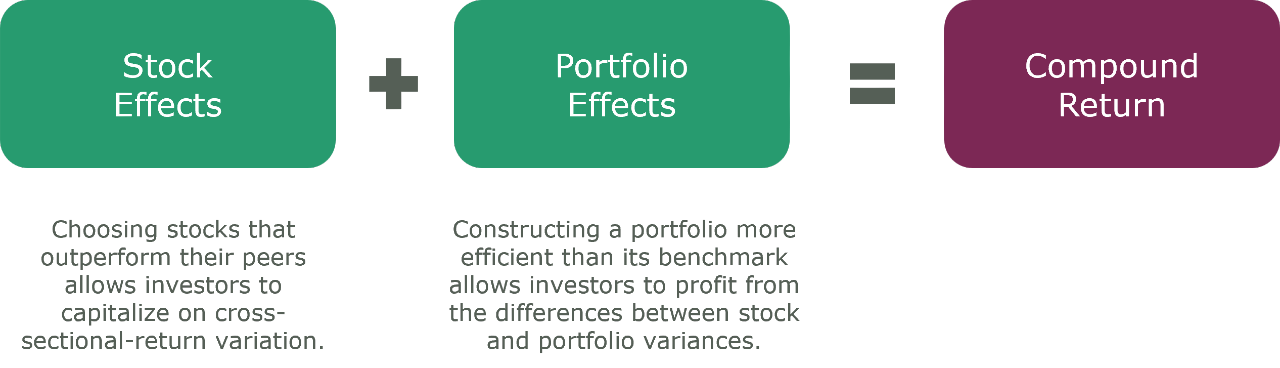

We believe the key to alpha generation lies in understanding two pivotal components of compound returns: stock effects and portfolio effects. Stochastic Portfolio Theory – the seminal work of our founder – provides the framework that facilitates the integration of these two essential return sources.

Our investment process leverages both aspects of this equation. We seek to use stock price volatility and correlations to create a portfolio that is more efficient than its benchmark (portfolio effects), prioritizing mispriced stocks with improving fundamentals and business prospects (stock effects). We then attempt to capture a trading profit by systematically rebalancing the portfolio to replenish diversification.

Investment Solutions

Intech offers investors four investment platforms, which we customize to target benchmarks, geographies, return objectives, risk budgets, or sustainability goals. For every strategy, our investment team harnesses technology, data, and mathematical processes to pursue optimal returns for our clients – regardless of market conditions.

Featured Strategy: Intech All Season Core Equity Strategies

Intech All Season Core Equity Strategies are our latest innovative equity solutions designed to navigate frequent regime changes in today’s new market order. Their primary objective is alpha resiliency:

- Excess return across all market regimes

- Time-varying volatility management

- Positive convexity in tail-risk events