What Happened in Q2?

- U.S. large-cap stocks outperformed small-caps, with the S&P 500 Index gaining 10.9% compared to the Russell 2000 Index, which rose by 8.5%.

- U.S. growth stocks regained dominance over value stocks, fueled by a tech-led rally. Dynamic sectors like technology (+23.7%), communication services (+18.5%), and consumer discretionary (+11.5%) outperformed defensive areas such as utilities (+4.3%) and consumer staples (+1.1%).

- Momentum surged as investors piled into recent outperformers such as NVIDIA (+45.8%) and Meta (+28.2%), helping the MSCI USA Momentum Factor ETF rise 19.4%.

The quarter had a volatile start. In April, newly-announced tariffs triggered a broad selloff, as investors reacted to the risk of rising input costs and slower global trade. Markets rebounded sharply in May. In June, a 12-day conflict between Iran and Israel increased geopolitical uncertainty and briefly disrupted investor sentiment. However, a ceasefire by quarter-end helped U.S. equity indexes reach new all-time highs as investors viewed the global landscape to be relatively more stable.

International and emerging markets slightly extended their Q1 2025 leadership, with the MSCI EAFE Index (+12.1%) and MSCI EM Index (+12.2%) outperforming the S&P 500 Index. Strong economic momentum and currency tailwinds, such as an 8% appreciation of the Euro relative to the U.S. Dollar, supported non-U.S. equity performance.

International equities also traded at more attractive valuations, with the MSCI EAFE Index’s forward 1-year P/E at 14.7 versus 22.1 for the S&P 500 Index.

Intech’s quantitative strategies generated positive relative returns in this environment. Our proprietary models dynamically adjusted active weights, leaning into volatility signals and stock-specific opportunities. Portfolios benefitted from gains in high- momentum names like NVIDIA and Meta while maintaining diversified exposures.

During the second quarter of 2025, our flagship U.S. Enhanced Plus strategy outperformed its benchmark, the S&P 500 Index, by 1.1% (0.96% net). The U.S. Small-Mid Cap Enhanced Plus strategy also outperformed its benchmark, the S&P 1000 Index, by 4.3% (4.2% net). Our Global Large Cap Core and International Large Cap Core strategies outperformed their respective benchmarks by 3.7% (3.5% net) and 4.2% (4.0% net).1

The Current State of Affairs

As we enter the second half of the year, markets appear stable but richly valued. The Fed has adopted a data-dependent stance, and inflation has moderated. However, uncertainty persists around global growth, credit conditions, and geopolitical tensions. Corporate earnings continue to exceed expectations: 78% of S&P 500 companies beat Q2 estimates, but dispersion in results has increased, which may benefit active quantitative strategies.

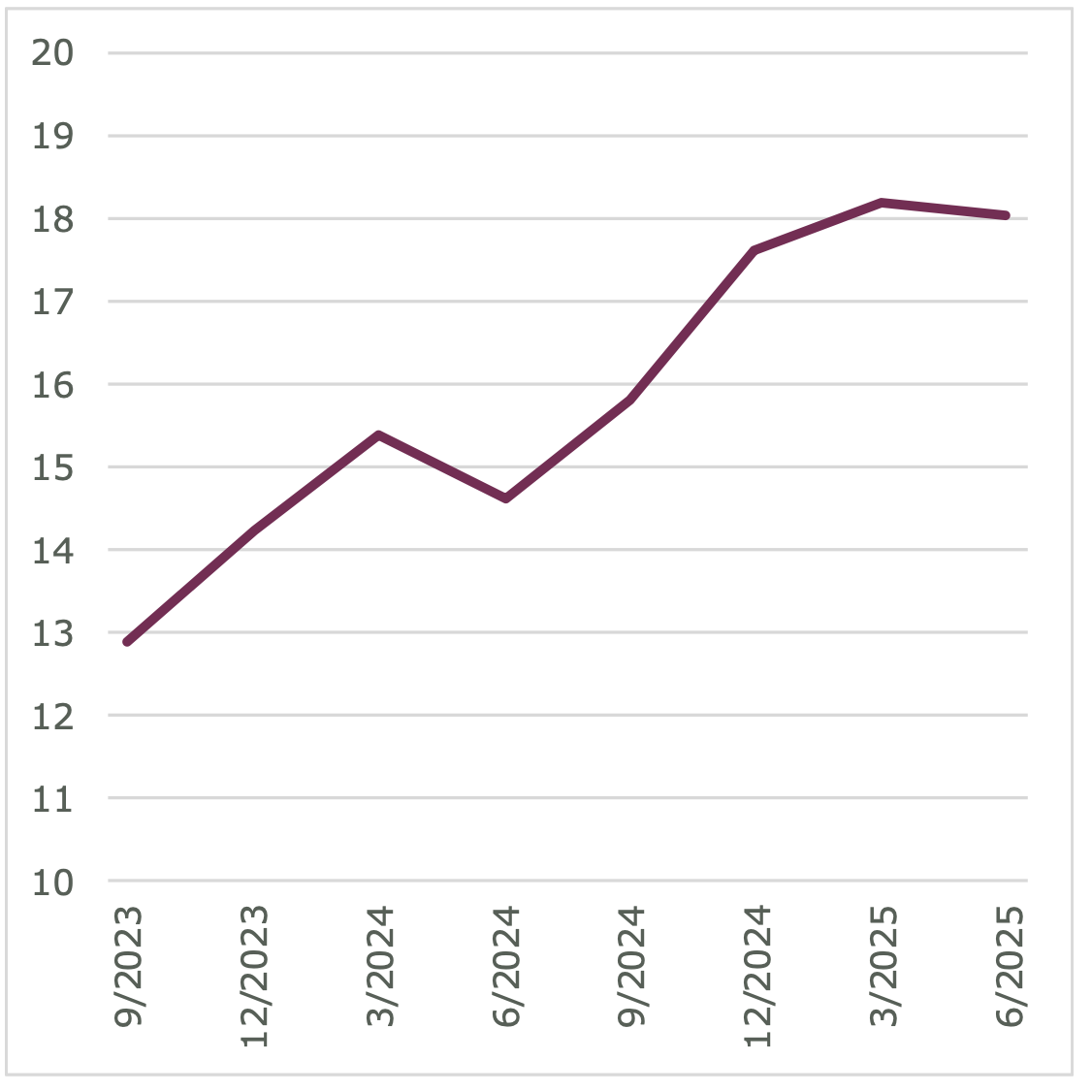

Furthermore, while today’s market may appear calm on the surface, return dispersion within the index has increased. That means a wider spread between stock winners and laggards, especially within the S&P 500 Index. Figure 2 illustrates the spread between the 25th and 75th percentile trailing returns of index constituents over time.

Intech remains focused on harnessing this return dispersion via complementary alpha models. Our volatility model identifies stocks with favorable rebalancing characteristics. Our stock alpha model integrates value, quality, and informed trading signals to guide positioning. Together, these models respond dynamically to market changes without relying on directional macro forecasts.

We’ve observed increasing stock-level differentiation that supports our investment approach. Our portfolios remain broadly diversified, but tilt toward stocks with stronger fundamentals and volatility profiles that offer rebalancing profit potential. In our relative risk strategies, we target a beta of 1.0 to deliver consistent alpha across market environments.

Looking Forward: Q3 2025 Outlook

As we head into Q3, we expect market leadership to remain fluid. Investors continue to weigh mixed macro signals, including evolving Fed policy, moderating inflation, and uneven global growth.

While the recent equity rally may reflect improving sentiment, uncertainty could increase particularly due to the market’s reaction to the recently passed “Big Beautiful Bill” and persistent concerns over widening trade deficits. Both factors may introduce new volatility if investor sentiment shifts abruptly.

Outside the U.S., international and emerging markets continue to lead, extending their outperformance from earlier in the year (see figure 3). Supportive valuations, favorable currency trends, and more accommodative policy backdrops in several regions suggest potential for continued strength abroad. We remain attentive to these developments across our global strategies, while applying the same disciplined investment process.

We anticipate continued stock-level return dispersion, which may benefit our quantitative approach. Our models don’t forecast macro outcomes directly, but they adapt systematically to changes in market signals. The process reallocates capital to new target weights as the opportunity set evolves, driven by earnings results, volatility patterns, and investor behavior.

While the momentum factor contributed positively in Q2, it remains a modest part of our stock alpha model. We incorporate it thoughtfully alongside value, quality, and informed trading signals to reduce reliance on any single source of return and enhance consistency.

Conclusion

Overall, we remain focused on an environment defined more by dispersion than direction. We continue to execute a disciplined, repeatable process that seeks to capture rebalancing profits and stock-level alpha while actively managing risk and turnover.

About Intech

Intech is a global quantitative asset manager that applies advanced mathematics and systematic portfolio rebalancing to harness a reliable source of excess returns and a key to risk control — stock price volatility. Intech applies its investment approach across four investment platforms which differ by risk-return objective: relative or absolute. Intech also integrates fundamental-based information to identify stocks with favorable underlying characteristics, complementing its volatility-based models that target stocks with attractive trading profit potential due to their volatility characteristics. These strategies only differ by the client’s desired benchmark and risk budget and include enhanced equity, active equity, defensive equity, and absolute return investment solutions within the U.S., global, and non-U.S. regions.

Main Office

Intech Investments, LLC

250 South Australian Avenue

Suite 1700

West Palm Beach, FL 33401

United States of America

+1-561-775-1100

1 Past performance is not indicative of future results. The securities identified and described do not represent all securities purchased, sold, or recommended and may not be representative of all holdings. No assurance can be made that similar results will be achieved in the future. Please see standard annualized composite performance in the Disclosures.