Your equity strategies are typically your largest source of portfolio volatility, and it’s clear we’re seeing more pronounced and frequent equity volatility today. Market pundits will attribute it to economic cycles, geopolitical uncertainty, algorithmic trading, market sentiment, etc., but regardless of how one ascribes today’s volatility, we know it’s different. More importantly, it may also be more difficult to manage.

Volatility is a critical factor in investment decisions and the trends we’re seeing in equity volatility have potentially insidious consequences:

- Drag on cumulative returns

- Lower risk-adjusted returns

- Wider bid-ask spreads

- Reduced liquidity

- Increased market impact costs

Of course, we’re big advocates of using defensive equity solutions, but we also recognize the limits of traditional risk management techniques, especially in today’s markets. The tools required to mitigate and diversify the evolving face of equity volatility must change – and capturing the upside is essential. Investors need innovation in equity investing.

Rising Long-term Volatility

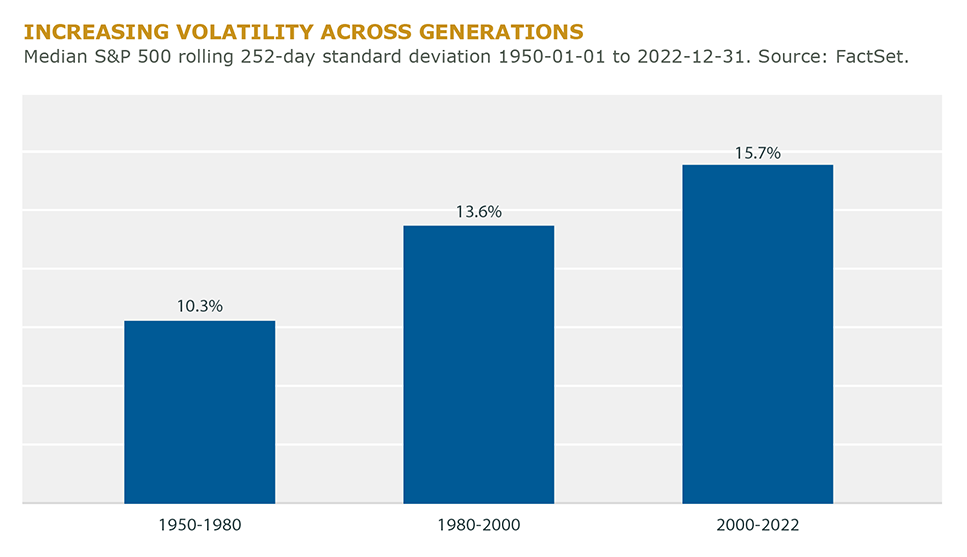

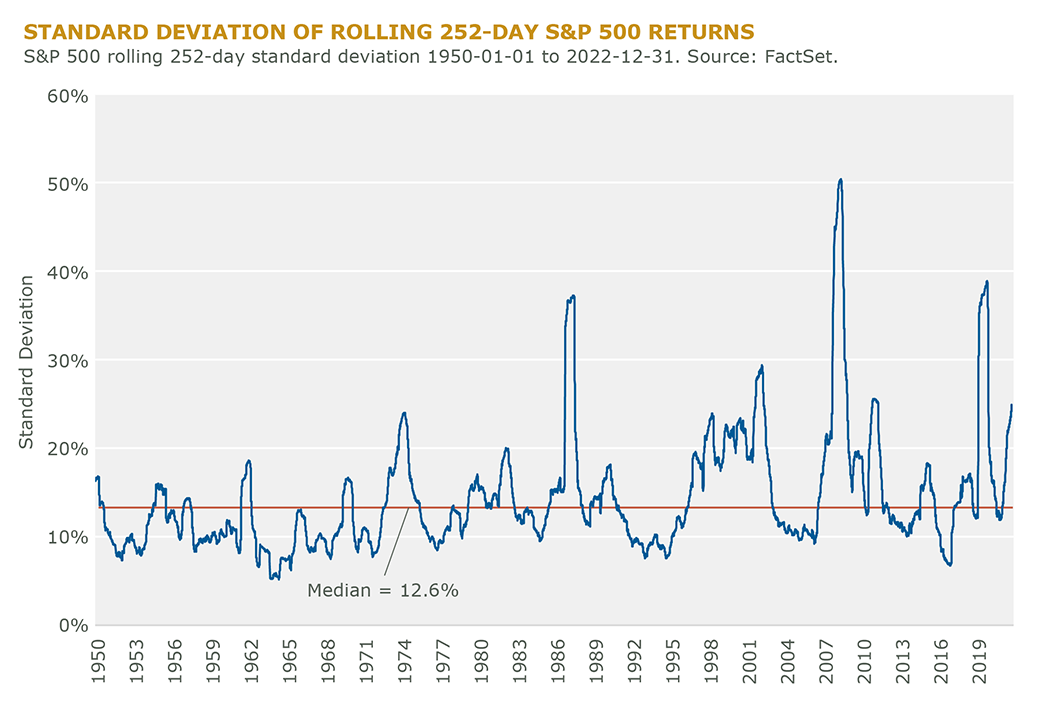

The volatility we’re experiencing today is not what your predecessors managed. The median standard deviation of rolling one-year S&P 500 returns in the post-WWII period has been 12.6% (see figure below), which is acceptable to many investors given the market’s returns during that period; however, you might not want to build your asset allocation on it.

Volatility has been steadily rising over the decades. Median volatility from 1950 to 1980 was only 10.3%. It rose to 13.6% in the subsequent 20 years. Since the turn of the millennium, median equity market volatility has jumped to 15.7% — a 50% increase in 40 years (see figure below).

Higher Short-term Volatility

The increasing magnitude of long-term volatility has been accompanied by higher bouts of short-term volatility. These episodes are just as important as long-term volatility for the reasons we’ve outlined, yet they are more challenging to mitigate without hedges that can impair upside capture and result in excessive trading expenses.

We examined the frequency of daily returns that exceed two standard deviations above their mean since 1950, which are about ± 2% return days. These are very big daily moves in the market. Only 154 trading days in the 30 years between 1950 and 1980 exceeded this threshold. The share of such events doubled to 4% between 1980 and 2000, and since 2000, investors have seen 9% of trading days exceeding this threshold. That’s more than a four-fold increase since 1980.

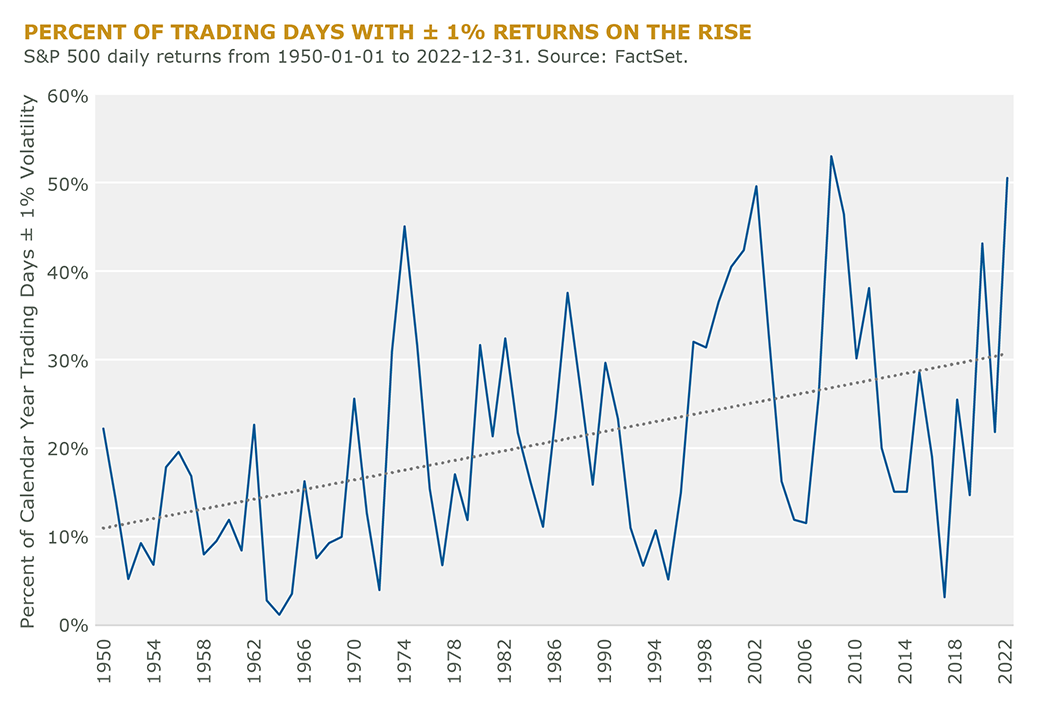

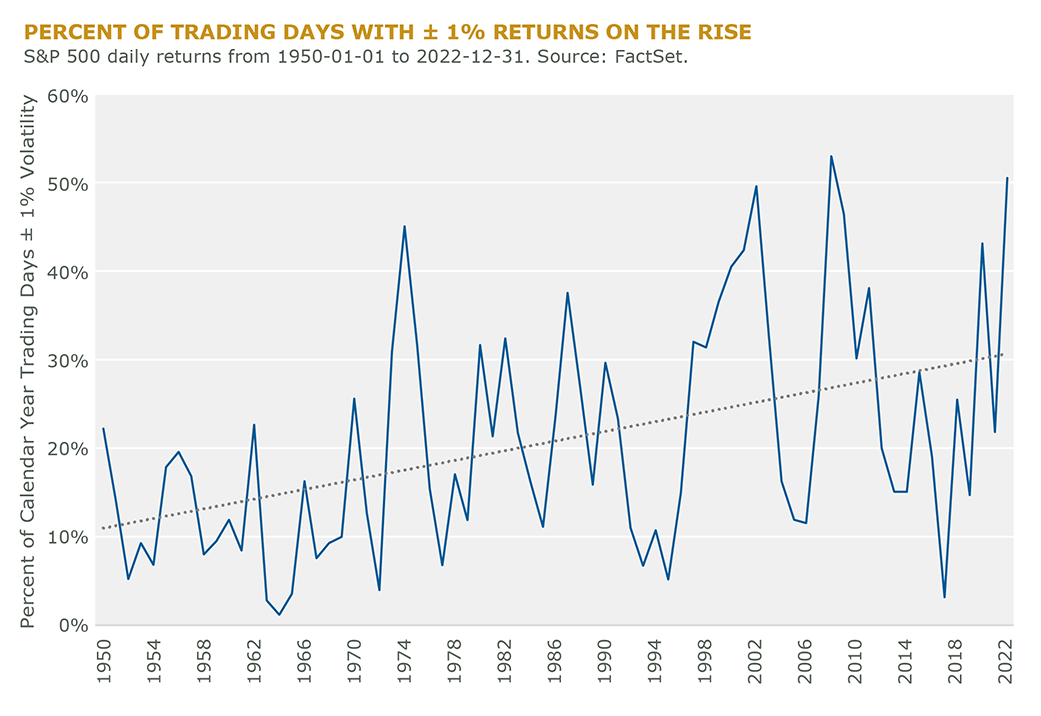

We’ll concede that risk-seeking investors may be comfortable with navigating 2nd percentile events; however, one standard deviation events (± 1% return day) have also been marching higher. Below are the percentage of trading days in each calendar year with ± 1% returns (see figure below). Over 50% of the trading days in 2022 moved ± 1%.

The Long and Short of It

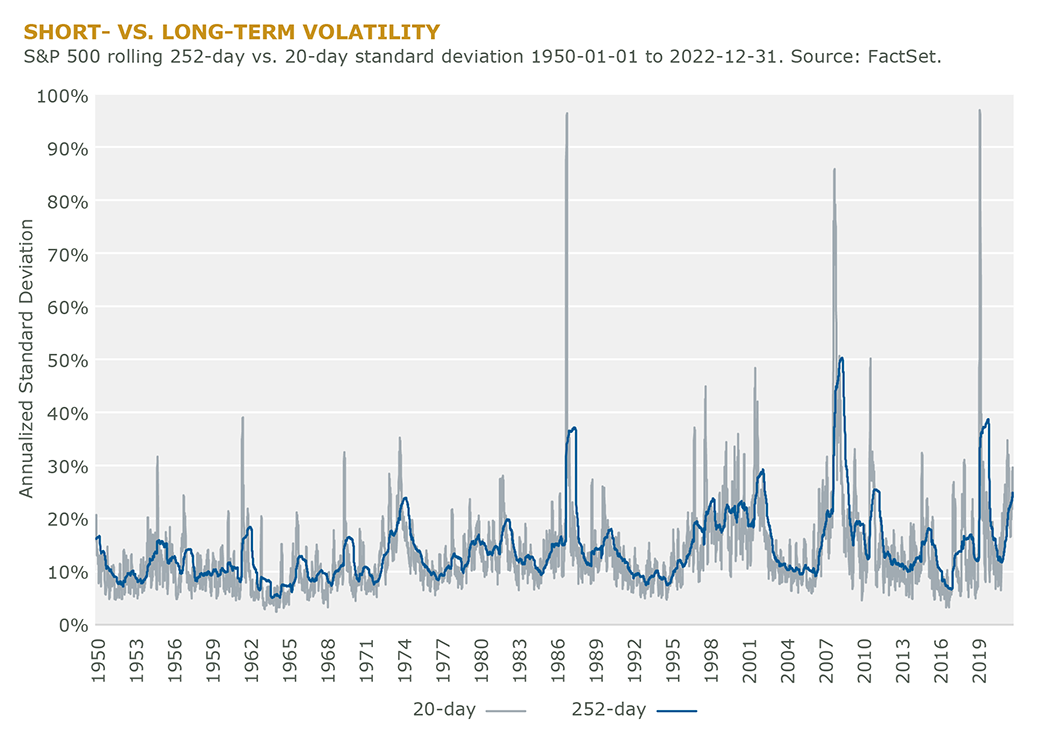

We can map long- and short-term volatility cycles by comparing the rolling 252-day standard deviation of daily returns illustrated in the first figure to a rolling 20-day standard deviation of daily returns (see figure below).

The illustration makes clear the increasing short-term volatility spikes relative to the longer-term volatility cycles most equity strategies are designed to mitigate. To address these short-term volatility events, traditional equity risk management techniques often require higher trading frequency or detract from capturing upside opportunities. They are generally inadequate to address both cycles efficiently while still delivering alpha.

To that end, Intech has developed an all-season equity strategy that attempts to efficiently address long- and short-term volatility cycles to deliver:

- more positively skewed investment returns;

- reduced systemic risk exposure;

- improved diversification; and

- higher risk-adjusted returns.

The Intech team is excited to introduce this new, innovative investment solution in the coming months. Designed for today’s evolving equity markets, the strategy seeks to consistently outperform the capitalization-weighted equity market with less risk while boosting performance during extreme short-term market moves.

If you’d like to learn more, don’t hesitate to contact us.