Executive Summary

The second quarter of 2024 showcased a rebound in global equity markets, driven by optimism surrounding potential Federal Reserve rate cuts and the strong performance of AI-related stocks. Despite this positive momentum, market breadth narrowed significantly, and sector performance was highly divergent. Looking ahead, while broader market participation is anticipated, several risks and challenges remain.

Key Takeaways

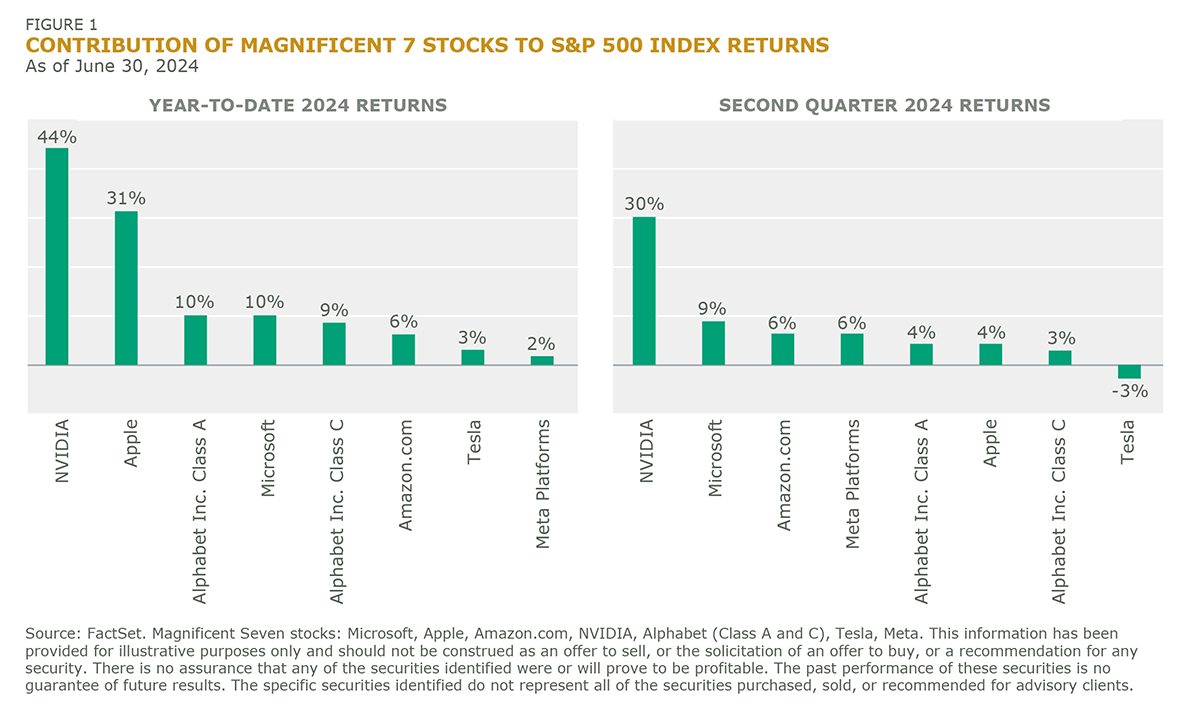

AI Stock Dominance: Nvidia alone contributed to 44% of the S&P 500 Index’s return, underscoring the significant impact of AI-related equities.

Rate Cut Expectations: Anticipated Federal Reserve rate cuts could enhance market breadth and support a wider range of outperforming equities.

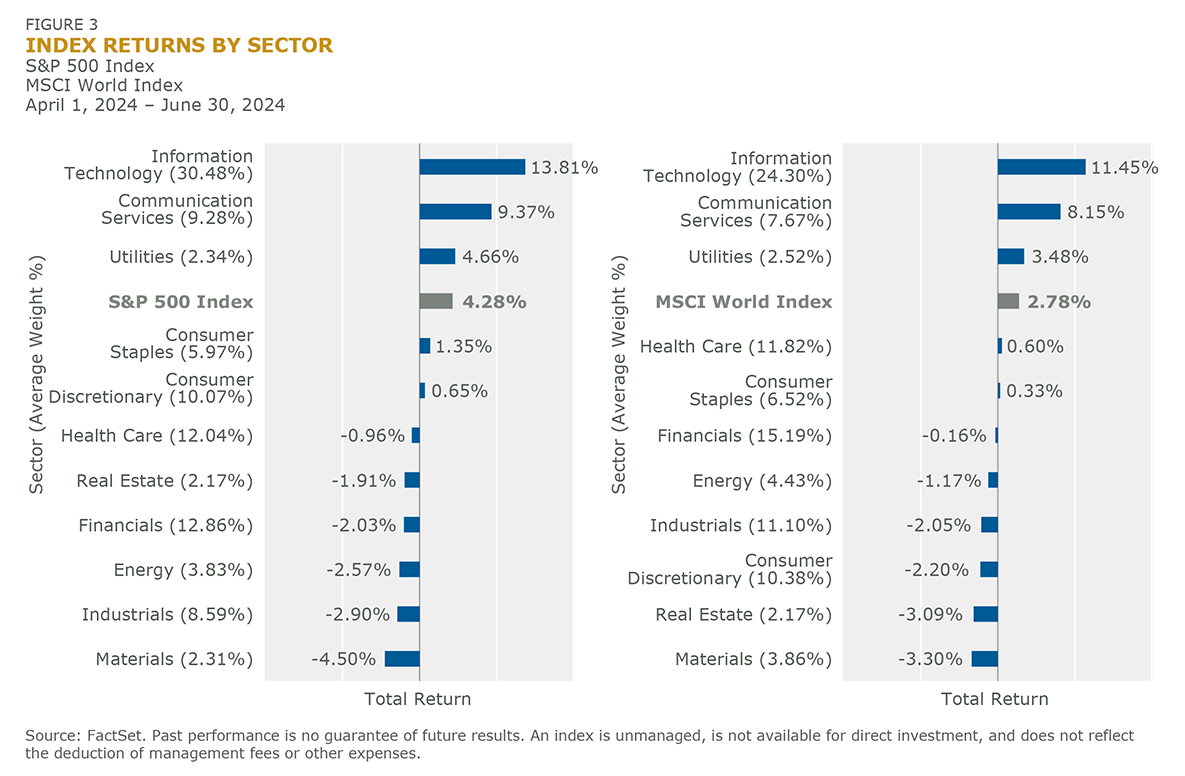

Sector Disparities: Information Technology and Communication Services led gains, while Utilities, Consumer Staples, and Energy lagged.

Strategic Diversification: Emphasizing diversification and robust risk management will be crucial to navigating potential macroeconomic and global uncertainties.

Market Overview

Global Equity Markets

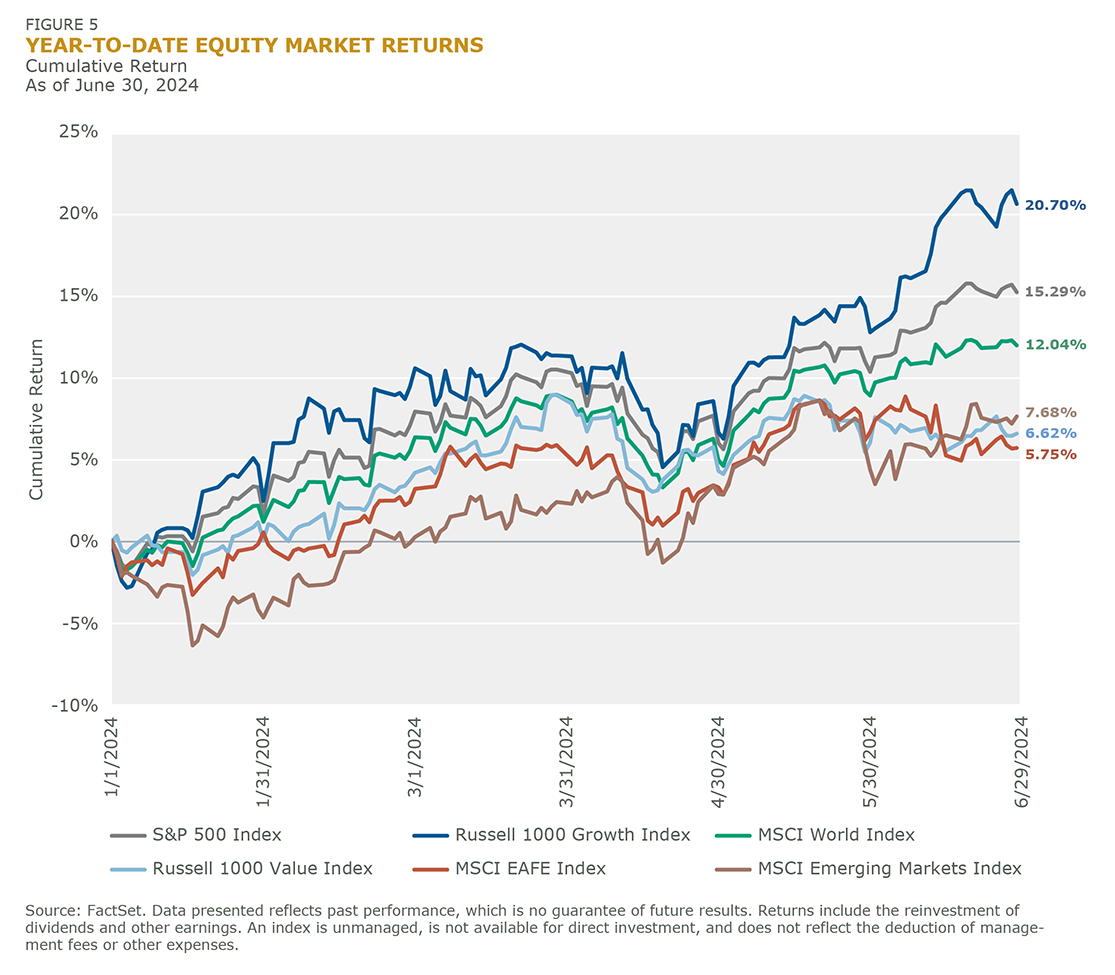

Despite a pullback in April, global equity markets rebounded strongly during the second half of Q2 2024. Investors were buoyed by the renewed prospect of rate cuts later this year, fueling gains predominantly in larger companies and sectors related to Artificial Intelligence (AI). This positive sentiment, however, was not uniformly shared across all sectors. Cyclical sectors posted negative returns for the quarter, highlighting a divergence in performance across the market.

Concentration in AI Stocks

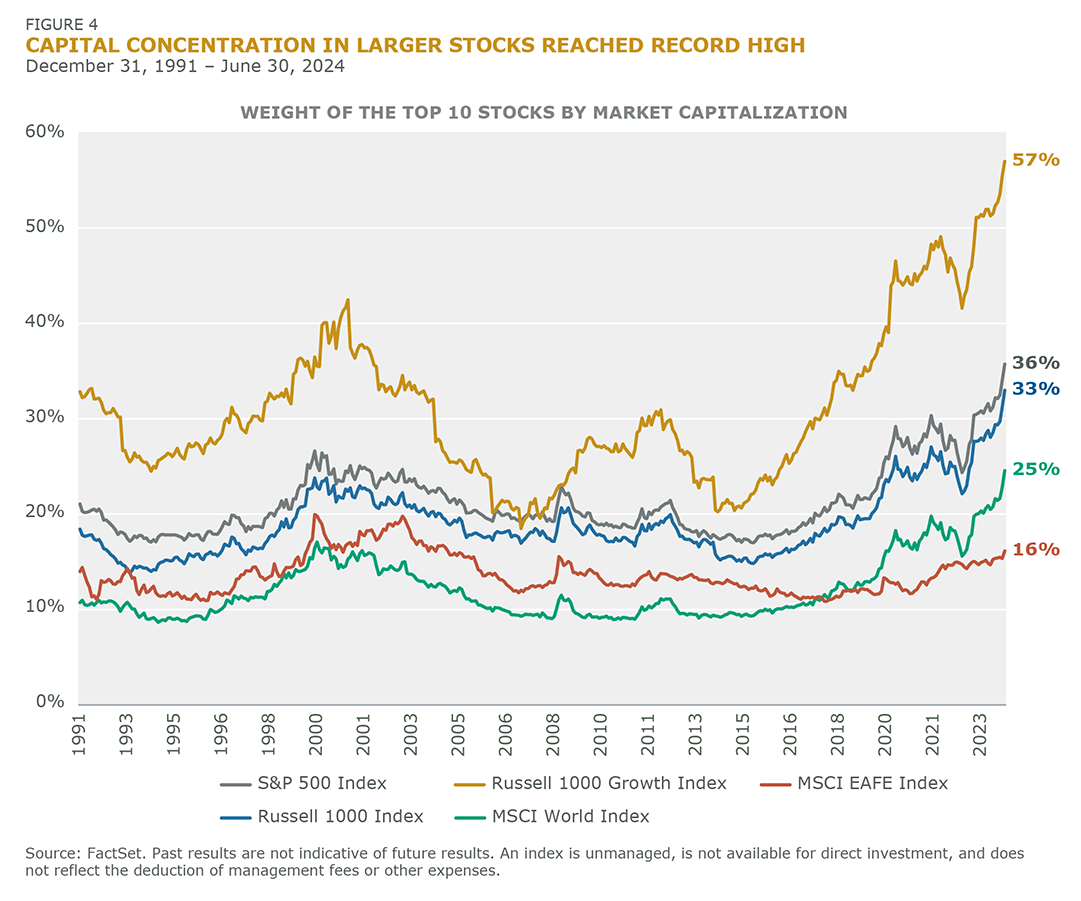

The second quarter saw a return to extreme levels of market concentration, reminiscent of trends observed in 2023. The AI sector, particularly stocks like Nvidia, played a pivotal role in driving market performance. Nvidia alone contributed 44% of the S&P 500 Index’s return for the quarter. Overall, the magnificent-7 companies have contributed 116% and 59% to the S&P 500 Index return during the second quarter and year-to-date, respectively, ending June 30, 2024. The dominance of AI-related stocks underscores the continued investor enthusiasm for technological innovation and its potential impact on future growth.

Market Breadth and Dispersion

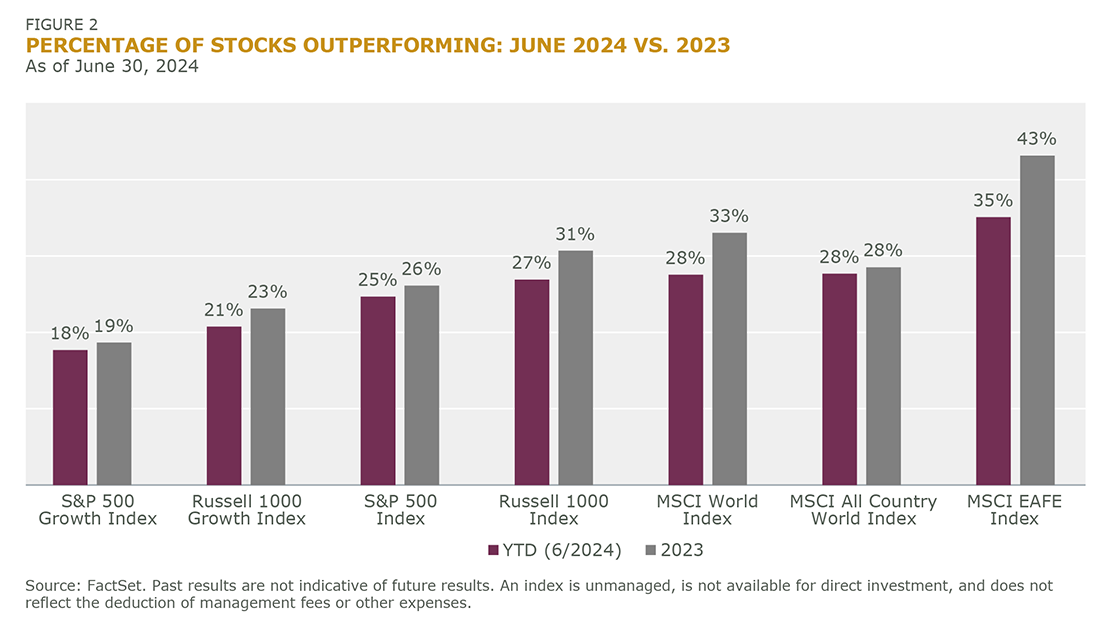

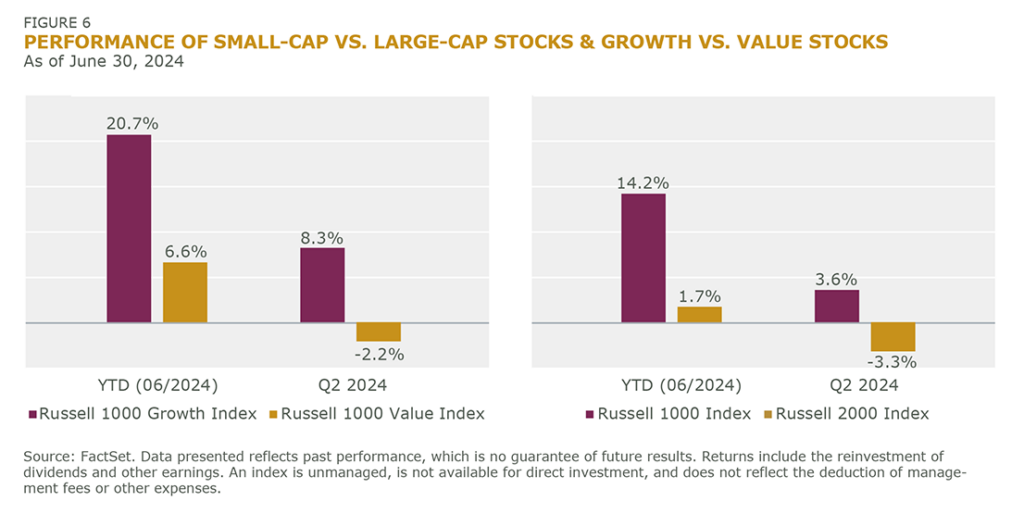

A notable shift occurred in market breadth during the second quarter. Following a brief period in Q1 2024 where smaller-cap and value stocks saw increased participation in the market rally, Q2 2024 marked a reversion to a more concentrated market environment. Mega-cap U.S. stocks, particularly those within the AI sector, vastly outperformed their smaller counterparts. This was evident as growth stocks significantly outpaced value stocks, and cap-weighted indexes outperformed equal-weighted ones.

U.S. markets experienced above-average dispersion of returns, indicating a wide variation in stock performance. In contrast, non-U.S. markets exhibited less pronounced dispersion. Overall market breadth, measured by the percentage of outperforming stocks, dropped significantly from the previous quarter and even lower than the already subdued levels seen last year, both in U.S. and non-U.S. markets.

Sector Performance

The performance disparity across different sectors was pronounced. Information Technology and Communication Services led the way, driven by strong returns from key players like Nvidia and Apple. Conversely, sectors such as Utilities, Consumer Staples, and Energy lagged, reflecting varying investor sentiment and economic conditions impacting these industries differently.

Key Takeaways

- Rate Cut Prospects: The anticipation of Federal Reserve rate cuts has been a significant driver of market sentiment, particularly benefiting larger and growth-oriented stocks.

- AI Dominance: The sustained performance of AI-related stocks highlights their pivotal role in current market dynamics.

- Narrow Market Leadership: The concentration of market gains among a few mega-cap stocks suggests a narrow leadership, raising questions about the sustainability of this trend.

- Sector Divergence: Varied performance across sectors underscores the importance of sector-specific factors and economic conditions in shaping investment outcomes.

The second quarter of 2024 was characterized by a rebound in global equity markets, driven by optimism around rate cuts and strong performance in AI-related stocks. However, the market’s narrow breadth and sector divergences indicate a complex and nuanced investment landscape.

Looking Ahead

Market Breadth and Interest Rates

We anticipate an increase in market breadth as the Federal Reserve is expected to cut interest rates, assuming the U.S. avoids a recession. This potential rate cut could alleviate some of the current economic pressures and provide a more supportive environment for a broader range of equities. Historically, lower interest rates have encouraged investment across a wider spectrum of market sectors, potentially reducing the dominance of a few mega-cap stocks.

Mega-cap Growth Stocks

While we expect broader market participation, it is important to note that mega-cap U.S. growth stocks are likely to maintain their strong performance due to their robust competitive positioning, earnings growth, and financial strength. These stocks have shown resilience and adaptability in various market conditions, and their fundamentals continue to support a positive trajectory.

Broadening Equity Markets

A broadening of the equity markets could provide greater alpha opportunities, allowing for diversification and the capitalization of emerging trends. Smaller-cap and value stocks, which have lagged behind their larger counterparts, may see improved performance as investor sentiment shifts and market dynamics evolve.

Risks and Challenges

Despite the optimistic outlook for broader market participation, several risks and challenges remain:

- Macroeconomic Conditions: The potential for a U.S. recession and slowing earnings growth could exert downward pressure on equity market multiples. High valuations may further exacerbate these pressures, leading to increased volatility and market corrections.

- Systematic Risk: Current macroeconomic conditions may heighten systematic risk, worsening existing market imbalances. Decisive action through fiscal and monetary policies will be essential to mitigate these risks and stabilize the market.

- Global Uncertainties: Geopolitical tensions, trade issues, and global economic slowdowns could impact market stability and investor confidence, adding layers of complexity to the investment landscape.

- Rotation Trade: Markets expectations for a tax reduction or interest rate decline could result in a steepening rate curve, higher GDP growth, and capital rotation into smaller and cyclical stocks.

Strategic Considerations

Given varying scenarios and risks, it is crucial for investors to adopt a balanced approach, focusing on diversification and robust risk management. Identifying uncorrelated sources of return and leveraging both fundamental and volatility models can help navigate the complexities of the current market environment.

While the outlook for the remainder of the year suggests increased market breadth and continued strength in mega-cap growth stocks, it is essential to remain vigilant of the potential risks and challenges. Strategic diversification, supported by comprehensive risk management, will be key to capitalizing on emerging opportunities while mitigating downside risks.

Conclusion

The second quarter of 2024 demonstrated the resilience and adaptability of global equity markets amidst a backdrop of economic uncertainty and sector divergence. The anticipated rate cuts by the Federal Reserve have fueled optimism, particularly benefiting larger and growth-oriented stocks, with a notable concentration in AI-related equities like Nvidia. Despite the overall positive market sentiment, the narrow breadth and extreme market concentration present challenges that warrant careful navigation.

Looking forward, the expectation of increased market breadth and broader equity participation offers promising opportunities. However, investors must remain vigilant of potential risks such as macroeconomic downturns, heightened systematic risks, and global uncertainties. By maintaining a balanced approach and leveraging robust risk management strategies, investors can effectively navigate the complexities of the current market environment and capitalize on emerging trends.

Subscribe to our quarterly newsletter to gain insights on the equity markets from the Intech perspective or contact us to learn more.