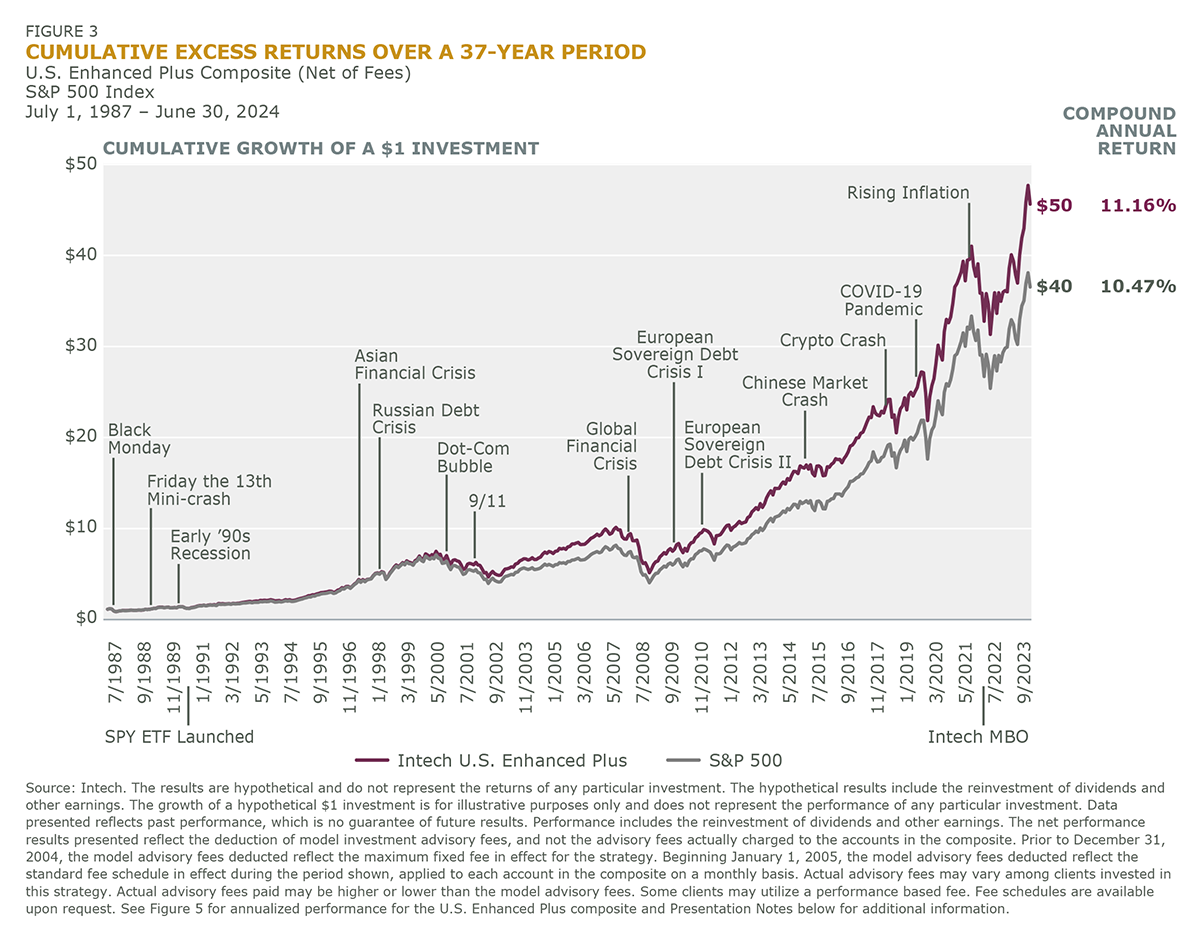

Jack Bogle’s low-cost, broad diversification principles have profoundly shaped our investment landscape. While he championed passive indexing, he might appreciate how much Enhanced Indexing aligns with his philosophy today – especially for institutional investors.

Enhanced Indexing has re-emerged as an essential arrow in investors’ quivers, revitalized and retooled for today. This “passive plus” approach combines the best of Jack Bogle’s investment tenets while pursuing the performance efficiency required for today’s more normalized markets.

Answers for a Post-ZIRP World

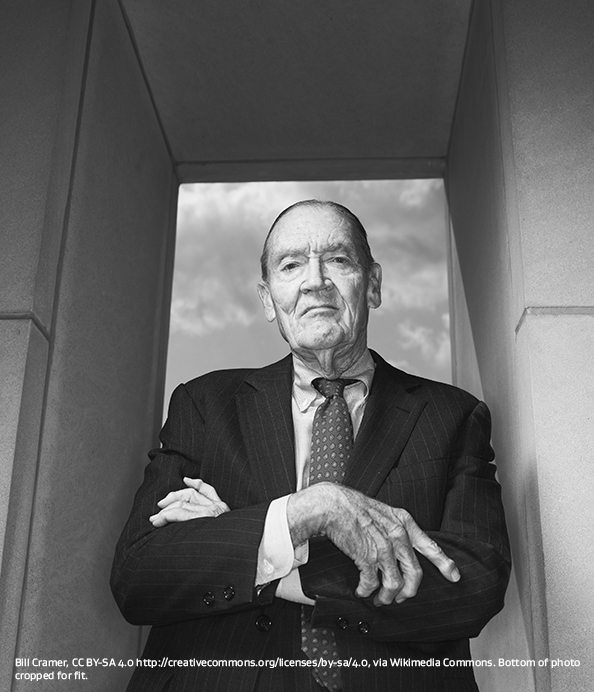

From October 2008 through March 2022, global financial markets operated under a near-zero interest rate policy (ZIRP) regime to stimulate economic growth following the financial and global pandemic crises. This period fundamentally altered the landscape for investment and risk assessment. As we transition to a more normalized interest rate environment, significant implications arise for equity risk premiums (ERP) and the strategies investors employ (Figure 1).

Investors today face higher concentration in equity indexes, reducing diversification in their passive allocation and increasing risk exposure. Simultaneously, narrowing ERP complicates the investment landscape by taking the all-you-can-eat alpha buffet away from high-active-risk managers. These dynamics necessitate a reevaluation of equity allocations as weaknesses in traditional barbell investing become more apparent.

…narrowing ERP complicates the investment landscape by taking the all-you-can-eat alpha buffet away from high-active-risk managers.

Core Tenets of Bogle’s Common-Sense Investing

Broad Diversification

Jack Bogle famously said, “Don’t look for the needle in the haystack. Just buy the haystack!” At Intech, we also buy the haystack. Our Enhanced Indexing strategies select only securities from their benchmark indexes, applying marginal over- and under-weights to optimize diversification. This process seeks broad diversification at a lower cost relative to higher active risk managers, akin to what Bogle advocated through index investing.

Management Costs Undermine Results

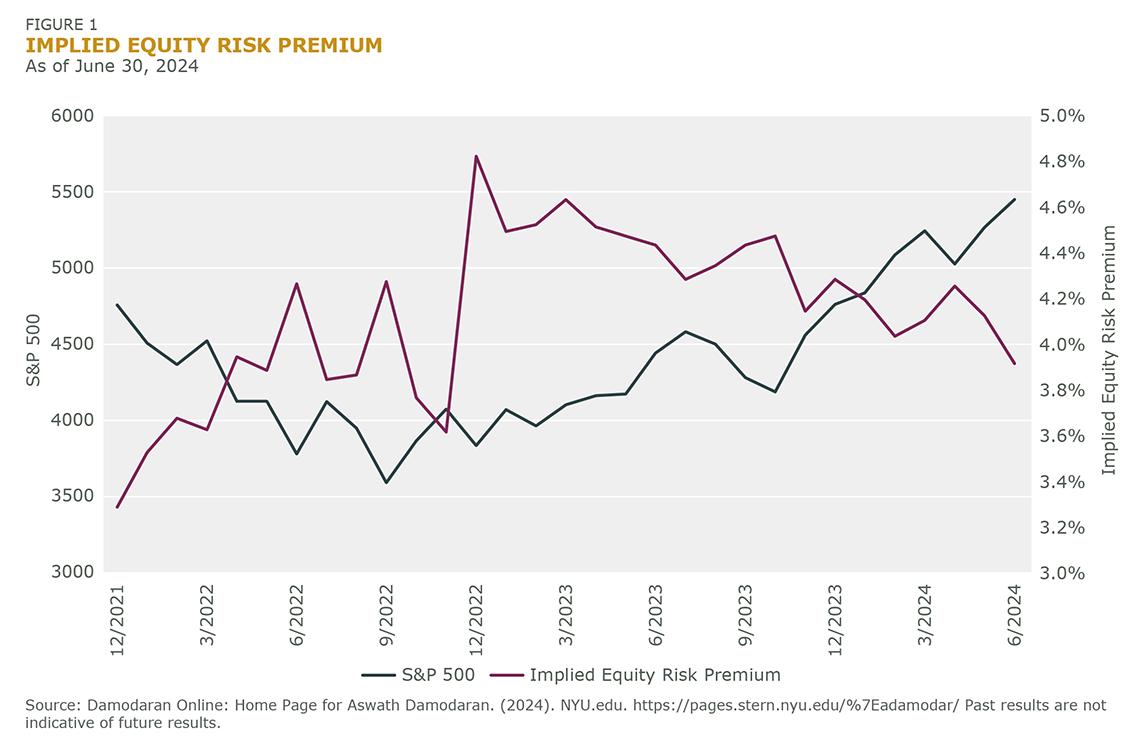

Bogle’s assertion, “In investing, you get what you don’t pay for,” resonates with us. Intech U.S. Enhanced Plus strategy’s published fees are in the bottom quartile compared to active management peers, contributing to the potential to outperform passive solutions (Figure 2).

Importance of Compounding

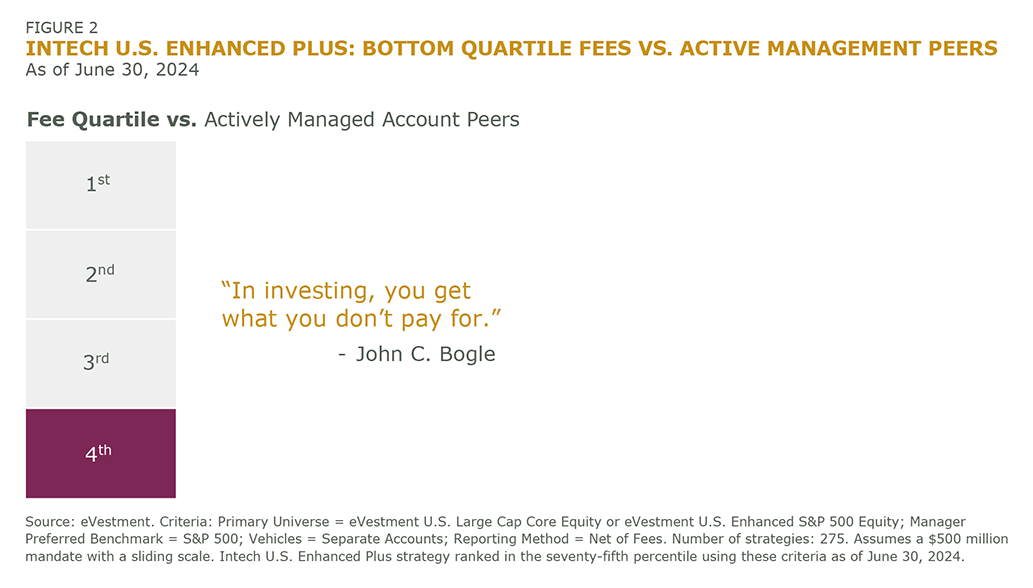

Jack Bogle famously noted, “The miracle of compounding returns is overwhelmed by the tyranny of compounding costs.” This highlights the importance of minimizing costs to maximize the benefits of compounding. However, it’s equally critical to recognize the opportunity cost of not achieving small excess returns, which can significantly benefit your plan when compounded over time.

However, it’s equally critical to recognize the opportunity cost of not achieving small excess returns, which can significantly benefit your plan when compounded over time.

Consider the impact of just 50 basis points of excess return per year on a $100 million hypothetical portfolio, equating to an additional $500,000 annually. Over time, these seemingly modest gains can translate into substantial contributions, directly enhancing the financial well-being of beneficiaries. Failing to capture these excess returns represents a lost opportunity to grow the portfolio more effectively.

To illustrate this point, let’s look at the cumulative growth chart of hypothetical $1 invested in Intech U.S. Enhanced Plus from July 1, 1987 (inception) through June 30, 2024, versus the S&P 500 Index (Figure 3). This exhibit demonstrates how just 68 bps in annualized excess returns—net of fees—compound over time, leading to meaningful increases in the portfolio’s value over investing in the index alone. Of course, 36+ years of past performance cannot guarantee future results.

The power of excess return compounding is a critical driver of long-term investment success, underscoring the importance of disciplined, consistent investment strategies that aim to capture even incremental alpha.

Avoid Speculation

Jack Bogle wisely noted, “Speculation leads you the wrong way. It allows you to put your emotions first, whereas investment gets emotions out of the picture.” At Intech, we share this sentiment; our quantitative stock-selection process is devoid of emotions.

Portfolio expectations shouldn’t rely on speculation either. We encourage our clients to make informed decisions based on historical data and mathematical analysis. This transforms expectations from speculative guesswork into a disciplined, evidence-based approach, offering a more structured path to meeting actuarial targets and fiduciary responsibilities.

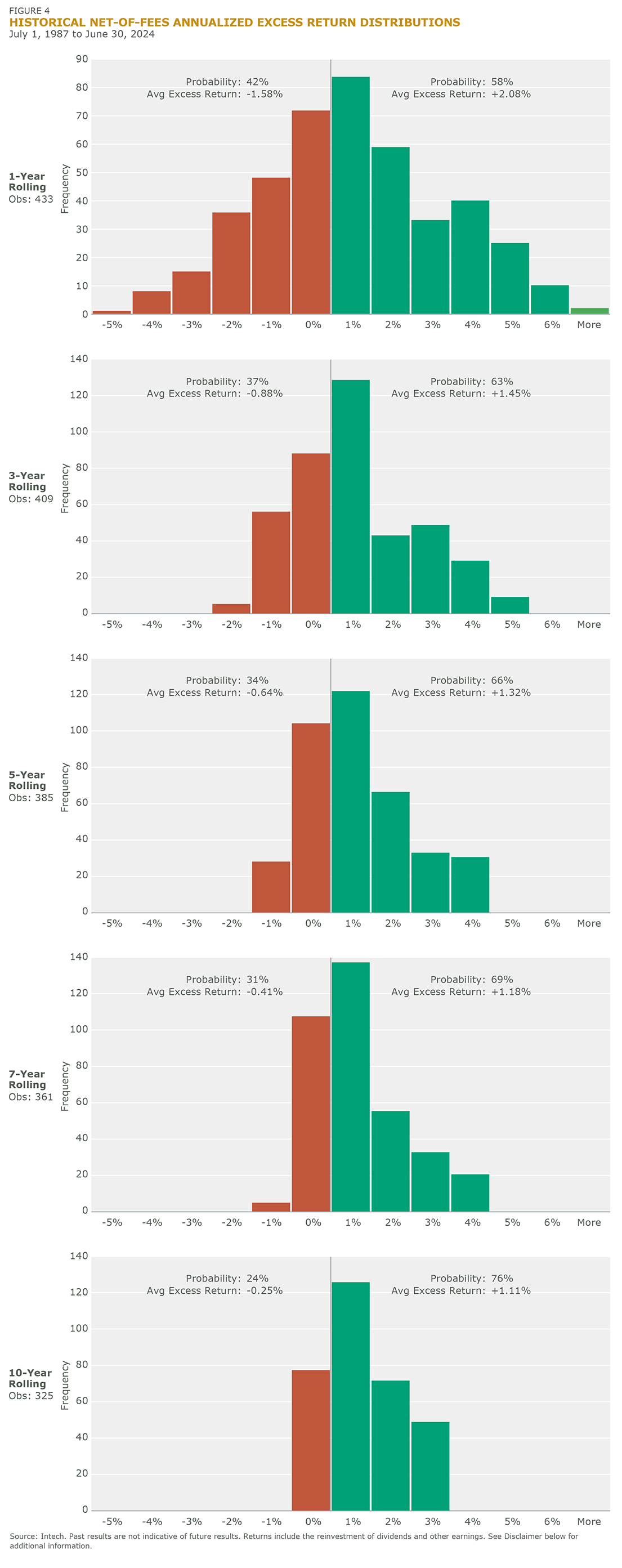

A historical analysis of Intech U.S. Enhanced Plus returns—net of published fees—shows that over longer holding periods, the likelihood of achieving positive excess returns has been higher. For instance, over a typical 10-year holding period, investors historically experienced a 77% chance of achieving a 1.11% annualized excess return or a 23% chance of receiving roughly the benchmark return. Enhanced indexing’s small active positions relative to an index mitigate the more speculative outcomes associated with higher active risk strategies.

… investors historically experienced a 77% chance of achieving a 1.11% annualized excess return or a 23% chance of receiving roughly the benchmark return.

Stay the Course

Jack Bogle’s sage advice, “Stay the course. No matter what happens, stick to your program,” has long been a bedrock of prudent investing. Our Intech U.S. Enhanced Plus strategy illustrates the wisdom of staying the course across different capital market environments.

Re-examine the progression of the histograms in Figure 4. As the holding period lengthens, the range of outcomes narrows. These histograms demonstrate that historically, the probability of achieving positive excess returns increased with the length of the holding period.

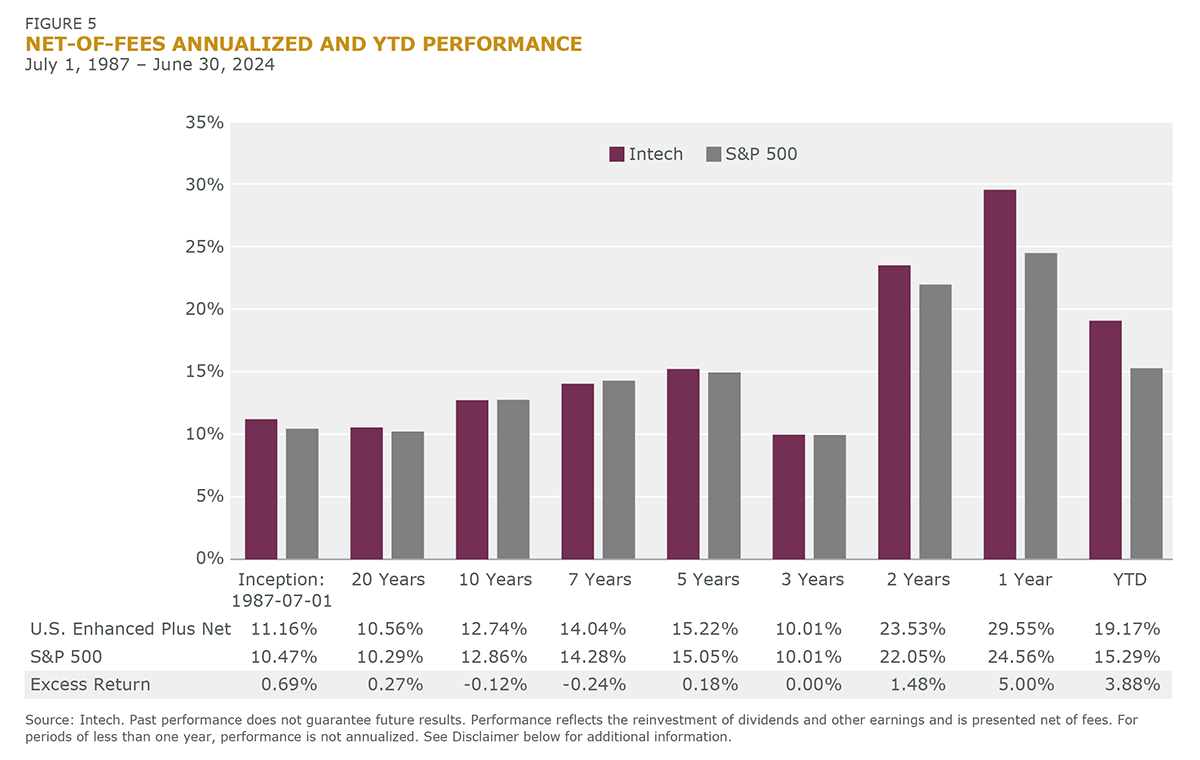

We’ll readily admit that the ZIRP era presented prolonged headwinds to our strategy but explore Figure 5: a snapshot of historical net-of-fees annualized performance. Investors who invested in the ZIRP-era – those with 3-10 years tenure – potentially realized benchmark-like returns after fees. Longer-term investors who “stuck to their program” through the ZIRP era had the potential to attain positive excess returns. More recent investors have seen higher excess returns, as we transition back into a more normalized interest rate environment. As of June 30, 2024, the Intech U.S. Enhanced Plus strategy has outperformed the benchmark, reaffirming its potential efficacy in more traditional market conditions.

Two takeaways should be clear from this illustration. First, Bogle’s timeless wisdom of staying the course reveals itself clearly in Enhanced Indexing. Second, a renaissance in Enhanced Indexing is potentially underway.

Conclusion

Jack Bogle’s timeless wisdom underscores the importance of disciplined, long-term investing. The Intech U.S. Enhanced Plus strategy aligns well with these principles, offering a robust approach to navigating various market conditions and meeting actuarial goals.

Explore how enhanced indexing can help you meet your specific goals. Let’s discuss an active management path for aligning your equity portfolio with Bogle’s common-sense principles.

Contact us today to learn more.