Building Balance: Is Broader Market Leadership Taking Shape?

The third quarter of 2024 brought a notable shift in market dynamics as leadership broadened beyond the large-cap technology stocks that had previously dominated returns. Smaller-cap stocks, value, and high-dividend sectors joined the rally, reflecting a more diversified market environment where a variety of sectors contributed to performance. Such broadening underscores the importance of diversification, particularly when volatility brings different parts of the market to the forefront.

From this perspective, Q3’s expanding market breadth offers a chance to reflect on how varied sectors, styles, and sizes can interact and contribute to a balanced equity landscape. The evolving participation across market segments suggests a resilience that may lessen the market’s dependence on any single sector, providing Intech’s process the potential for more opportunities as we approach the new year.

Meanwhile, the effects of rising interest rates and the approaching U.S. Presidential election add layers of complexity to this environment. With the prospect of continued fluctuations, understanding the underlying drivers of diversified leadership can provide a clearer view of the opportunities and challenges that lie ahead.

Market Environment and Expanding Leadership

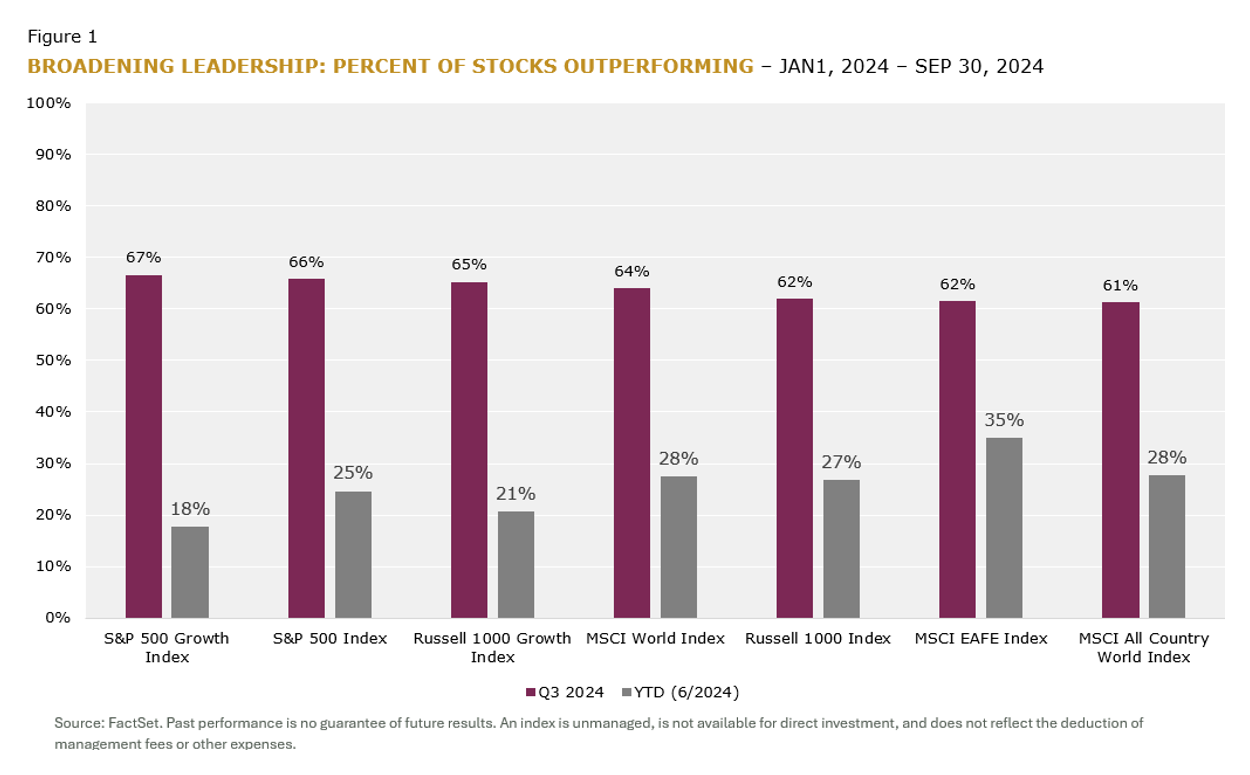

Last quarter the market saw a shift away from concentrated gains in large-cap technology stocks, with leadership expanding to include a broader array of sectors. This widening participation is evident across smaller-cap stocks, value-oriented sectors, and high-dividend payers. Figure 1 illustrates this expansion, with a notable increase in outperforming stocks across the S&P 500, Russell, and MSCI indices in Q3 compared to the first nine months of the year. This diversified leadership points to a healthier, more balanced market structure, where performance is supported by a range of market segments rather than a narrow concentration.

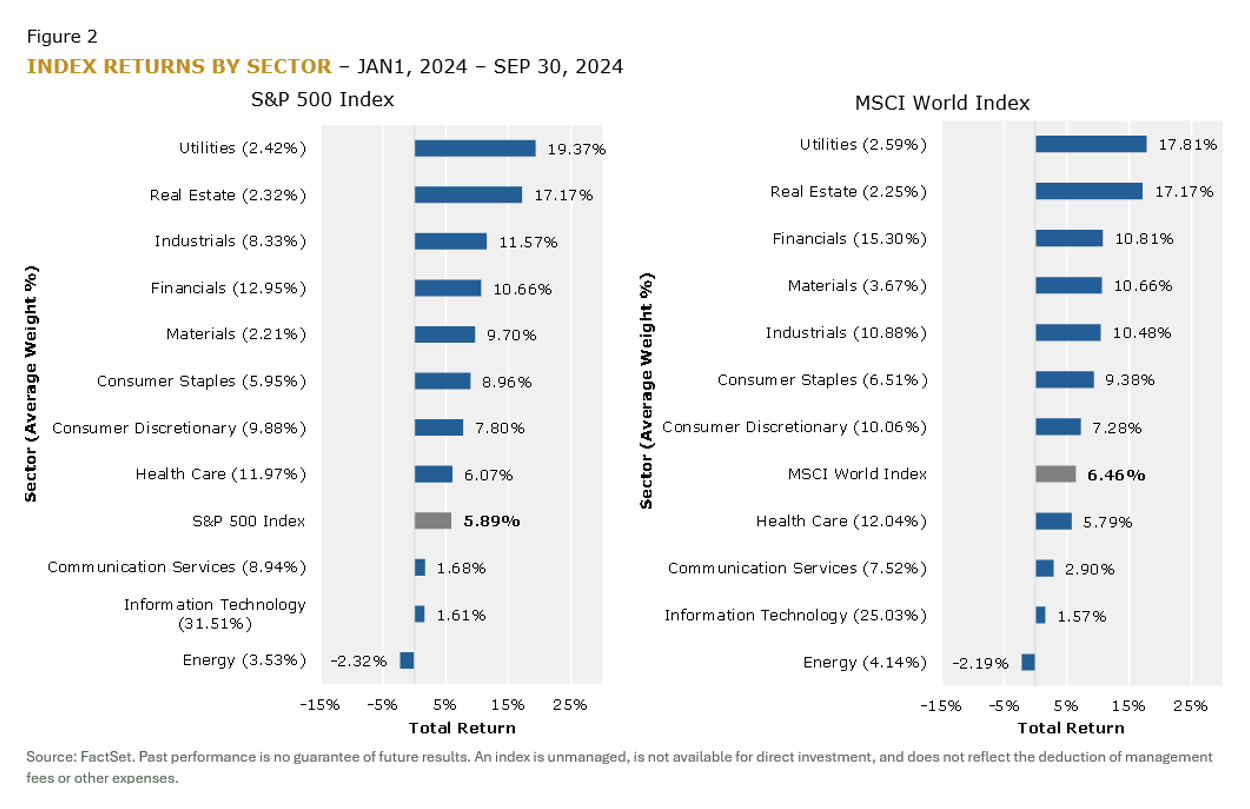

Interest rate dynamics also played a significant role in Q3, given a shift from fighting inflation to supporting the economy. The market’s reaction benefited rate-sensitive sectors like utilities, real estate, and financials. Utilities and real estate, favored for stability and income potential, gained as elevated rates drew investors toward sectors that provide consistent returns amid economic uncertainties. Utilities are also benefiting from an increase in demand for electricity to run AI data centers – it’s not the big technology stocks that dominated AI growth in the first half of the year. Financials, meanwhile, were buoyed by improved lending profitability, showcasing their adaptability in a higher rate environment. Figure 2 highlights the strength of these sectors, underscoring their role in broadening market leadership and reflecting a shift toward areas that are resilient under varying rate conditions.

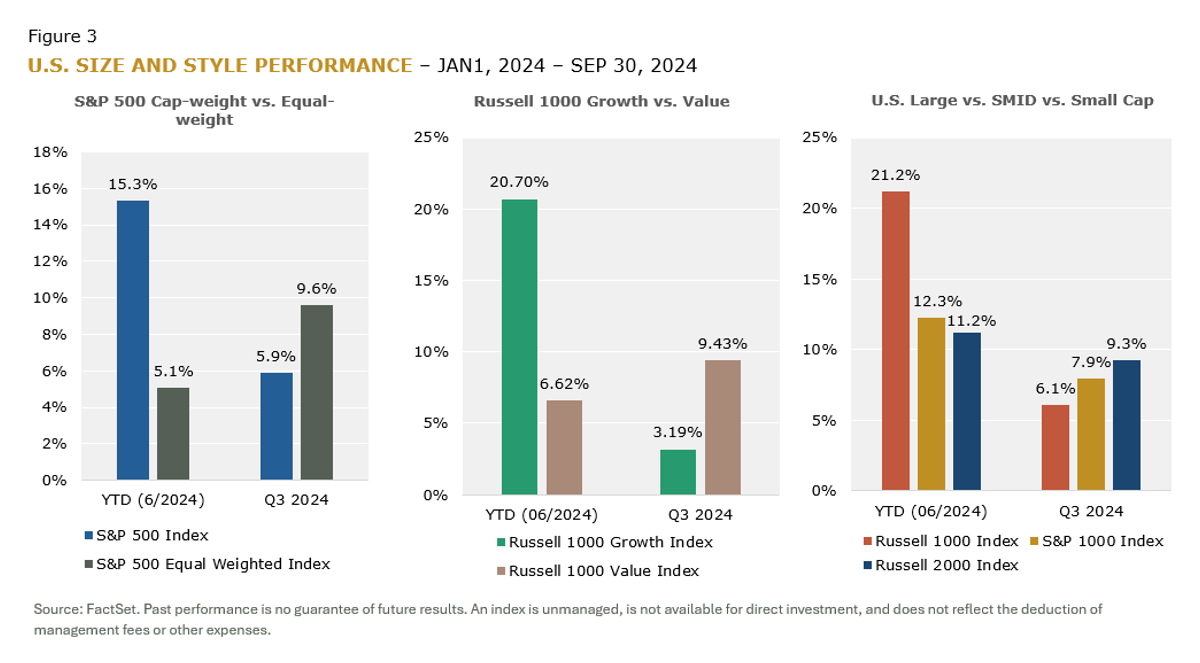

Additionally, the quarter saw significant differentiation across size and style indices, reflecting the expanding breadth of leadership. Smaller-cap and value stocks emerged as strong performers, joining large-cap stocks in the rally and underscoring a more balanced equity landscape. Figure 3 provides insight into this trend, illustrating how smaller-cap stocks, alongside value indices, gained traction as the market diversified beyond a concentrated tech-led rally. Small cap stocks are domestic oriented and have a much lower percentage of revenues outside the U.S. versus large cap stocks, making them more sensitive to domestic economic growth and interest rate declines. This size and style rotation complements the broader theme of diversified leadership and signals a shift in investor preferences toward a wider range of opportunities.

Influence of the U.S. Presidential Election

The upcoming U.S. Presidential election adds another dimension to the market landscape. Election cycles often bring heightened attention to policy-sensitive sectors, with varying degrees of market impact based on anticipated regulatory and fiscal shifts. Sectors such as energy, healthcare, and technology could see fluctuations as investors assess potential policy changes and how they might affect corporate profitability or sector dynamics.

While elections can contribute to market volatility, the expanded participation across multiple sectors in Q3 suggests a more resilient foundation. A market environment where diverse sectors contribute to performance is less reliant on single sources of strength, providing a broader buffer against potential policy shifts. By spreading leadership across sectors, the market may be better positioned to absorb the effects of election-related uncertainties as they unfold.

Looking Forward

Investors remain cautious ahead of upcoming earnings reports, but we expect stock rotation to continue broadening, contributing to a more balanced market rally. With interest rates easing, though still restrictive, U.S. economic growth has surpassed expectations, and recession risks appear lower in the near term. As the U.S. enters a rate-cutting cycle, expectations for future interest rate adjustments have become more measured compared to earlier in the year. Fewer rate cuts, for the right reasons, could support positive market performance, where good news is once again viewed positively.

As we close out the year, the broad-based leadership we’ve observed provides a foundation for potential resilience and opportunities, but that path is not likely a straight line. While smaller-cap stocks, defensive sectors, and value-oriented names have gained traction, big-cap tech will undoubtably find renewed interest. It underscores the inherent variability in market trends – shifts in market breadth are rarely uniform or predictable.

Broader influences, including interest rate adjustments and the U.S. Presidential election, may continue to shape the market environment in ways that drive sector rotations. Given these dynamics, it’s reasonable to expect that leadership could alternate between concentrated growth areas and a more diversified array of sectors as investors navigate ongoing macroeconomic influences.

Ultimately, the market’s recent changes signal opportunities for adaptive investment processes. While we’ve seen expanding leadership, future quarters could see both concentration and breadth play out in tandem. At Intech, we remain focused on identifying opportunities that reflect both resilience and adaptability—qualities that will be essential in today’s evolving market environment.

Subscribe to our quarterly newsletter to gain insights on the equity markets from the Intech perspective or contact us to learn more.