Introduction

“High conviction” in our business often evokes images of active managers who plunge into the intricate depths of a select handful of companies. These managers stand out for their detailed understanding and steadfast commitment to their investment decisions. They dare to deviate from the shelter of market benchmarks, placing large, audacious bets in the pursuit of exceptional returns. When these bets pay off, their conviction is validated by superior performance.

Yet, this well-established notion of high-conviction investing is just one facet of a more complex structure. In fact, I would argue that there exists another, somewhat underappreciated, form of high conviction that is equally compelling – a conviction that is driven by targeted portfolio outcomes rather than individual stock picks.

This alternate form of conviction doesn’t shy away from diversification – instead, it embraces it. It acknowledges that conviction and diversification are not mutually exclusive but can coexist harmoniously to create robust, resilient portfolios. This conviction is not so much about ‘betting big’ on a few selected stocks but about systematically targeting specific portfolio outcomes.

In this blog post, I’ll explore this less conventional form of high conviction, one that emphasizes portfolio outcomes over individual stock selection, as illustrated by the new Intech All Season Equity strategies. As we traverse this landscape, I invite you to open your mind to a broader interpretation of conviction – one where diversification is not a detractor but a powerful ally.

Dissecting the Traditional Notion of High Conviction

Let’s first take a closer look at the traditional high conviction approach. At its core, it revolves around a few key principles.

Firstly, it’s about conducting in-depth research into a relatively small number of companies. The aim is to understand these companies inside and out, dissecting their business models, evaluating their competitive positioning, scrutinizing their financial health, and envisioning their future prospects. This intimate familiarity with the companies they invest in is a hallmark of high conviction managers.

Secondly, high conviction managers aren’t afraid to diverge from the market benchmarks. They’re willing to make substantial bets on the companies they believe in, even when those bets go against the prevailing market sentiment. This willingness to diverge from the crowd is a testament to their faith in their research and their conviction in their investment choices.

Thirdly, these managers aren’t swayed by short-term market movements. They’re in it for the long haul, unfazed by temporary dips in performance or bouts of market volatility. They have faith in their investment choices and are willing to wait for their long-term potential to be realized.

Lastly, high conviction investing typically results in concentrated portfolios. By making sizable investments in a select few companies, these managers put their money where their mouth is, tangibly demonstrating their conviction. The concentrated nature of their portfolios is a concrete manifestation of their high conviction approach.

Taken together, these characteristics paint a vivid picture of the traditional high conviction approach. But as we’ll see, high conviction investing doesn’t have to be confined to these parameters. It can take on a different form, one that’s less visible on the surface but equally powerful in its impact. In the territory of quantitative investing, we’ll find a different brand of conviction, one that’s not centered around individual stocks, but around portfolio outcomes.

The Quantitative Path to Conviction

Now, let’s shift our focus to the quantitative side of the coin. Here, conviction doesn’t revolve around individual stocks but around portfolio outcomes.

Now, let’s shift our focus to the quantitative side of the coin. Here, conviction doesn’t revolve around individual stocks but around portfolio outcomes.

This means that instead of aiming for performance results by betting on the “right stocks,” most quantitative managers target specific outcomes by systematically applying robust statistical models across a broad investment universe. This approach serves investors in two ways. First, targeted results are time-bound. Second, outcome-driven conviction is more adaptable to market conditions.

Quantitative managers tend to focus on portfolio outcomes with a defined investment horizon. They are not waiting indefinitely to see if their models pay off; instead, they target specific outcomes within a predefined time horizon. This is a major shift from the traditional approach, where the time horizon for outcomes can be uncertain and sometimes long-drawn.

Moreover, a quantitative approach may offer some advantage in adapting to varying markets. For instance, markets with narrow breadth, where only a small subset of stocks drives performance, are difficult for many managers, but particularly those with concentrated portfolios. Rather than being constrained by high opportunity costs associated with holding non-performing stocks, quantitative managers will seek to take advantage of opportunities across a broad portfolio of securities with one purpose in mind – meeting portfolio outcomes.

Case Study: Intech All Season Equity Strategies

Let’s take a look at Intech All Season Equity strategies, a new quantitative equity approach that integrates a modest 5% allocation to futures, collateralized by portfolio cash. These new strategies embody a conviction in portfolio outcomes.

The strategies don’t begin with security forecasts; instead, they start with a focus on very specific, measurable objectives. Our conviction is the belief that the aggregate impact of numerous well-modeled bets – as opposed to the narrow conviction of a few companies – will generate the outcomes we’re targeting.

The equity component of these quantitative equity strategies makes many smaller bets across a wide array of equities, driven by a systematic model. Rather than aiming for the right outcomes by picking a few “winning” stocks, this strategy targets specific outcomes by consistently applying the model across the equity universe.

The futures component of the strategies highlights our conviction in leveraging futures positions to potentially enhance returns and manage risk. Our futures investing model is diversified, participating in 17 equity futures, 8 developed market currency futures, 20 fixed-income futures, and 22 commodity futures. Like the equity component, this is not about hoping for the best from a few futures contracts; it’s about systematically deploying and integrating a futures strategy to target desired outcomes.

Combining these components into a single, cohesive strategy underlines conviction in our investment process. We’re not hoping for the right outcomes; we’re targeting specific outcomes by systematically applying our models. This is conviction in portfolio outcomes in action.

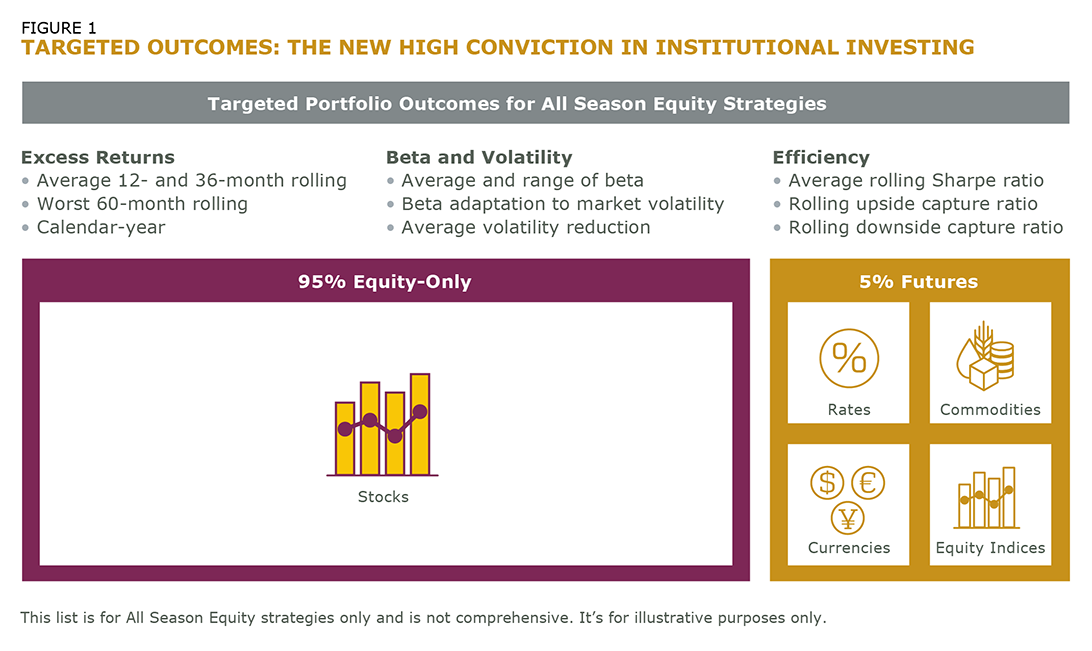

What are these measurable outcomes in which we ground our convictions? Well, they are fewer than the number holdings in a typical concentrated portfolio, but more than our compliance pros will let us share in a blog post (Figure 1). Don’t hesitate to contact us for details, however.

Make Conviction Work for You

For institutional investors and their consultants, understanding this reframed concept of conviction offers a fresh lens through which to evaluate and select investment strategies. The traditional approach of conviction in stock picking and the quantitative approach of conviction in portfolio outcomes each have their unique merits and can play a role in an institution’s investment portfolio.

For institutional investors and their consultants, understanding this reframed concept of conviction offers a fresh lens through which to evaluate and select investment strategies. The traditional approach of conviction in stock picking and the quantitative approach of conviction in portfolio outcomes each have their unique merits and can play a role in an institution’s investment portfolio.

A high conviction traditional strategy can offer the potential for outsized returns but comes with its own set of risks, including outsized losses, high opportunity costs, and an uncertain time horizon for outcomes. On the other hand, a high conviction quantitative strategy focuses on targeted outcomes, seeking to take advantage of opportunities across a wide breadth of assets. Adaptability is rooted in the conviction of outcomes, as greater breadth enables quantitative managers to navigate varying market conditions with agility and precision.

Interestingly, despite their differences, both types of strategies can exhibit high tracking errors relative to their benchmarks, reflecting a similar active risk profile. In the case of a quantitative multi-asset strategy, this might be a result of numerous independent bets across a wide array of assets, while for a concentrated portfolio, it could be due to large bets on a few selected assets. This similarity underlines the point that conviction can manifest in different forms and strategies, each with its unique attributes and implications.

Ultimately, the choice between these two approaches, or indeed a combination of both, depends on the institution’s investment objectives, risk tolerance, and desired outcomes. It’s about aligning the form of conviction – be it in stock picking or portfolio outcomes – with the specific needs and goals of the institution. Some investors may be drawn to the potential for higher returns with stock-based conviction strategies, while others may favor the diversification benefits and potential stability of outcome-based conviction strategies.

Conclusion

The investment world is evolving, and with it, our understanding of what constitutes a high conviction strategy. While traditional strategies centered around stock picking have their place, it’s crucial for institutional investors and their consultants to recognize the power and potential of conviction in portfolio outcomes.

Intech All Season Equity strategies are a prime example of this form of conviction. By systematically applying statistical models across a broad investment universe, such a strategy targets specific portfolio outcomes within a predefined time frame. The goal is to offer adaptability to varying market conditions, enhance control over targeted outcomes, and deliver more stable returns.

For institutional investors seeking to navigate the complexities of today’s investment landscape, embracing this broader concept of conviction could be a game-changer. It’s about time we redefine what high conviction means to us and recognize the potential that conviction in portfolio outcomes brings to the table. The future of institutional investing may well hinge on this paradigm shift.