Introduction

In our evolving financial landscape where generating alpha, managing risk, and maintaining capital efficiency have become increasingly critical, the key lies in our ability to adapt and adopt innovative strategies. These growing complexities have nudged us beyond the comfort zone of traditional investment avenues, challenging us to explore a more sophisticated and nuanced approach to portfolio management.

The Intech All Season Equity strategies embody this refined perspective, focusing on the integration of long and short futures contracts across various asset classes – equities, fixed income, commodities, and currencies – underpinned by a modest cash allocation from a long-only equity portfolio. The strategies seek to exploit the often-overlooked potential of implicit leverage within futures contracts, driving returns that greatly outweigh the capital utilized. In this blog, we dissect these intricacies, spotlighting how implicit leverage and futures contracts can be leveraged to optimize capital efficiency and create a resilient investment portfolio.

Venturing Beyond Equities: Synthesizing Futures

We recognize the pressing need for investment strategies that effectively handle systematic risk, provide performance convexity during tail risk events, and offer a steady flow of alpha. At Intech, our All Season Equity strategies are designed with these necessities in mind, setting aside a modest 5% of portfolio cash to collateralize futures contracts, optimizing returns and mitigating risk.

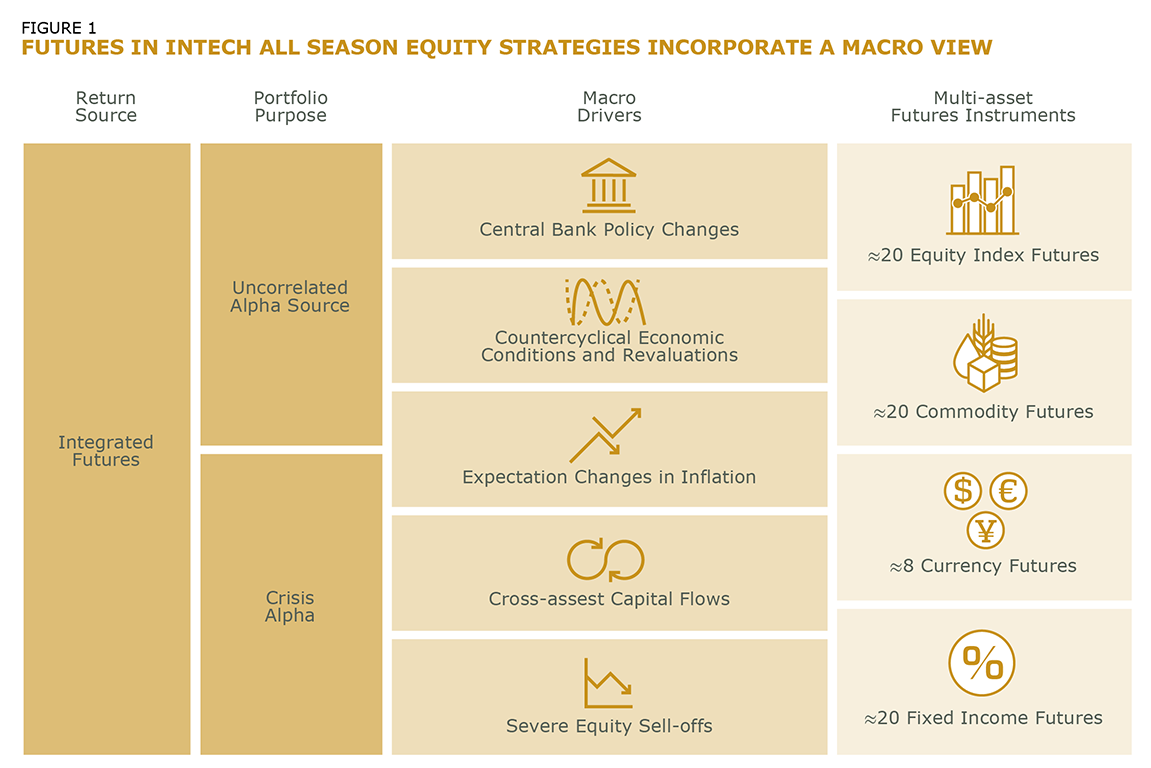

By synthesizing an equity portfolio with futures contracts, spanning four asset classes – equities, fixed income, commodities, and currencies – we integrate a more comprehensive view of the financial landscape. Each type of futures contract possesses unique benefits and risks, helping us navigate the broader economic waves that constantly reshape the financial markets.

Equity Futures Contracts provide a strategic tool for broad market exposure. Their inherent leverage can amplify returns in bullish markets without tying up significant capital, while short positions in these contracts offer a cushion during equity downturns, mitigating the risk of considerable losses.

Fixed Income Futures Contracts, on the other hand, allow investors to hedge against equity market downturns. Their typical negative correlation with equities provides opportunities for investors to profit from appreciating bond prices in declining equity markets. Short positions in these contracts serve as a balance against rising interest rates, ensuring stability in shifting economic climates.

Commodity Futures Contracts expose investors to diverse economic conditions, offering potential hedges against inflation and diversification benefits distinct from equities or bonds. The implicit leverage in these contracts can amplify returns during commodity price rallies, without necessitating considerable capital commitment.

Currency Futures Contracts offer a defense against currency risk and an avenue to expand beyond domestic markets. Implicit leverage in these contracts can enhance returns when predictions about future exchange rate directions prove accurate, offering downside protection during equity market downturns.

Leveraging Futures: A Macro Lens for Equity Portfolios

The potential power of integrating futures investing with an equity portfolio lies in the multitude of investment opportunities it unravels. It opens the window to broader macroeconomic events influencing financial markets, typically providing a source of uncorrelated returns and crisis alpha for the portfolio.

These macro events – changes in central bank policy, countercyclical economic conditions, inflation expectation shifts, cross-asset capital flows, severe equity sell-offs – impact various asset classes. Having the insight and agility to adapt your portfolio accordingly can be a powerful weapon in your arsenal of portfolio growth and preservation.

Futures contracts have the potential to allow investors to swiftly adapt to these macro changes. Thanks to their wide range, they can provide a broader perspective of financial markets than individual equities. This understanding allows us to position ourselves strategically ahead of macro events, taking long positions when markets are expected to rise and short positions when a downturn is anticipated. Adding futures to an equity portfolio can also offer uncorrelated returns and serve as a potential hedge during severe equity sell-offs, enhancing portfolio resilience and return potential.

Unlocking Capital Efficiency through Leverage

In a challenging financial climate where traditional avenues for return enhancement often find themselves stretched to their limits, achieving capital efficiency has become an indispensable part of investment strategy. In this context, the importance of futures contracts and the leverage they offer is pronounced.

In a challenging financial climate where traditional avenues for return enhancement often find themselves stretched to their limits, achieving capital efficiency has become an indispensable part of investment strategy. In this context, the importance of futures contracts and the leverage they offer is pronounced.

Futures contracts are essentially agreements to buy or sell an underlying asset at a predetermined price at a future date. This allows for exposure to a wide range of asset classes without the need for significant upfront capital – a feature that serves to enhance capital efficiency. In essence, the investor can access larger positions than what their capital would usually permit, which, if managed carefully, becomes an instrument for potentially enhancing returns and managing risk.

Picture futures contracts as a “financial magnifying glass.” They have the potential to amplify a small investment, increasing its influence on a portfolio’s overall performance. This leverage capacity doesn’t require a large outlay of capital. Instead, it uses a modest portion of the portfolio as collateral. For instance, in the case of Intech All Season Equity strategies, we employ just 5% of the portfolio.

Let’s put this into practice using a hypothetical scenario.

Consider an equity portfolio of $100 million. From this, we dedicate a small fraction – 5% or $5 million – to futures contracts. Through the power of implicit leverage, this $5 million can give us exposure equivalent to a much larger sum, say $100 million. This is called the notional value. Despite only committing a fraction of our total portfolio, we can potentially drive returns as if we had invested a significantly larger amount.

Let’s assume that due to well-strategized trades, the futures segment of the hypothetical portfolio generates a return of 3%. Given our leveraged position, this 3% return on the $100 million exposure would equate to a gain of $3 million. Now, assume the equity-only component generates $4 million in return, or 4.2%. The total hypothetical portfolio return is 7% — great in a low-return environment – but the futures contributed about 40% to that return.

However, it’s equally crucial to remember that the leverage provided by futures contracts is a double-edged sword – it can significantly amplify losses in addition to gains. In our example, if the equity market were to decline, the investor could face losses in their futures position. Indeed, outside our example, an investor could lose more than their original investment in the worst case scenario. Such risk underscores the necessity for rigorous risk management when integrating futures into an investment strategy, a critical aspect we incorporate in our Intech All Season Equity strategies. Intech All Season Equity strategies’ futures position is fully collateralized by a cash position and the investor is protected from losing more than their original investment. What’s more, the strategy constrains the total volatility of the futures component to just 5%, further aiming to contain potential losses.

Intech All Season Equity strategies’ futures position is fully collateralized by a cash position and the investor is protected from losing more than their original investment.

Understanding and harnessing the power of implicit leverage within futures contracts allows investors to enjoy the benefits of larger market exposure while committing to a smaller upfront investment. It’s why futures can contribute and detract to portfolio returns more than their modest allocations would suggest. Magnified gains must be balanced against the possibility of magnified losses. At Intech, we believe that careful management of this balance is the key to utilizing the power of implicit leverage effectively and creating a more resilient portfolio. This principle of balance, of capital efficiency with risk management, is central to our Intech All Season Equity strategies and our commitment to delivering resilient alpha in various market conditions.

Conclusion

In the ever-evolving financial landscape, relying solely on traditional equity investments falls short. Investors who are seeking to enhance capital efficiency, guard against systematic risks, and generate sustainable alpha may want to consider investment strategies like those offered by Intech All Season Equity.

These strategies strive to accomplish these objectives by harnessing the potential of diversified futures contracts, with a lean collateralization of 5% cash from a long-only equity portfolio. We’re excited about this comprehensive approach, merging the upside potential of equities with the diversified scope of futures contracts and their inherent leverage. These strategies offer a potential way to mitigate risk in volatile markets while opening new avenues for alpha generation.

At Intech, we believe that our All Season Equity strategies provide a toolkit for institutional investors seeking to navigate today’s unpredictable markets. Our commitment to investment innovation drives us to redefine boundaries, offering solutions that potentially enable investors to navigate in an ever-evolving investment landscape.