Two years post-MBO, Intech stands proud and entirely independent, our ties to the former parent company now a chapter behind us. This anniversary isn’t just a date—it’s a declaration of our autonomy and the success driven by our performance-first culture, and validated by a recent feature in Pensions & Investments (Figure 1). As we reflect on our transformative journey, we’re driven by the liberty to innovate and the capacity to execute strategies that resonate with our clients’ goals. Today, we celebrate a redefined Intech—resolute, unbound, and forward-looking.

FIGURE 1: EXCERPT FROM PENSIONS & INVESTMENTS (Read the Full Article)

Marques, in a recent interview, said since the MBO Intech has:

- Refreshed an investment team that had been too hesitant in updating the “stochastic portfolio theory” models developed in the 1980s by a coterie of Princeton University mathematicians, led by E. Robert Fernholz—the intellectual foundation for Intech’s 1987 launch. Marques pointed to Ryan Stever, a veteran of Acadian Asset Management and BlackRock, as a key hire, brought in to complement long-time CIO Adrian Banner.

- Slashed trading costs by more than 12 basis points, or 70%, by introducing automated algorithmic trading, to the benefit of clients’ bottom lines.

- And most importantly, worked to neutralize its models’ small-cap bias, a detractor from investment returns when market concentration is increasing as it has—spectacularly—since 2016, with the relentless rise of a handful of megacap U.S. growth stocks in leading benchmark indexes.

Our Path to Independence: Four Key Strategic Initiatives

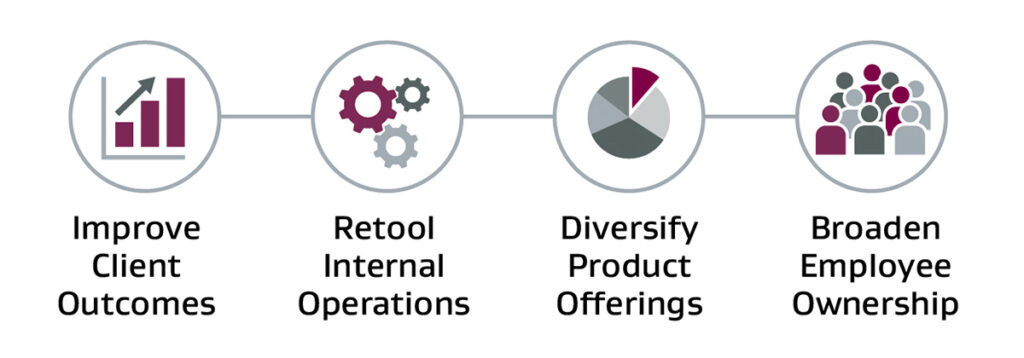

Our post-MBO efforts have been a testament to strategic foresight and adaptability. Transitioning from a part of a larger corporate entity to an agile, independent, employee-owned firm, we’ve embraced the creative freedom and responsibility that come with autonomy. Our strategic initiatives have been at the heart of this transformation: improving client outcomes, retooling internal operations, diversifying product offerings, and broadening employee ownership (Figure 2).

FIGURE 2: FOUR STRATEGIC INITIATIVES

Improving Client Outcomes: Our Foremost Priority

In the two years since our MBO, Intech has concentrated on bolstering a performance-first culture, which is our guiding star. This focus has manifested through several critical initiatives that have reshaped our investment landscape:

Increased CIO Focus with the New CEO: A seamless transition in leadership allowed our CIO to devote his energies fully to portfolio management and research. This increased focus was instrumental in fine-tuning our model framework, allowing greater flexibility to introduce new data sources.

Hiring Complementary Investment Talent: We’ve augmented our team with the addition of Dr. Ryan Stever, Co-CIO, and Katherine Hardenburgh, Director of Research, who bring complementary skills to the table. This talent infusion has enriched our capabilities, ensuring a multidimensional approach to generating alpha.

Launching a Cloud-Based R&D Platform: Our new, state-of-the-art R&D platform unlocks the effortless creation and retirement of data environments, efficient integration of new data sources, and seamless addition of third-party tools. Notably, it enables us to rapidly test and refine strategies in a low-risk setting, bolstering innovative thinking.

Integrating New Alpha Sources: With the new R&D platform, we’ve leveraged vast and varied data streams, enhancing our ability to identify unique investment opportunities and risks. This integration has empowered our investment teams with deeper insights and a more proactive investment process.

Continuous Improvement: We’ve introduced three investment process enhancements since the MBO; two have been particularly crucial. May 2023 enhancements sought to address the impact of size exposure on our strategies. Our latest enhancement is foundational to Stochastic Portfolio Theory, introducing a fundamental alpha model to complement the volatility model.

New Algorithmic Trading Capabilities: In October 2022, Intech upgraded its algorithmic trading capabilities. By leveraging cutting-edge technology, we’ve optimized trading efficiency, resulting in total trading costs that are lower than 94% of our peers (Source: Virtu Financial Group, 12/31/2023), increasing the potential for better performance.

These initiatives collectively reflect Intech’s dedication to client success. They are not standalone changes but part of a concerted effort to ensure that our clients’ investments are managed with the utmost precision, care, and foresight. As we celebrate this anniversary, we reaffirm our pledge to deliver service and outcomes that not only meet but exceed our clients’ expectations.

Operational and Technological Advancements

As part of our post-MBO evolution, Intech has made significant strides in operational and technological advancements, foundational to our continued success and client service enhancement. Critical to these achievements and our new R&D platform was the hiring of Paul Cassell as our new Chief Technology Officer. Paul’s contributions to the changes at Intech cannot be overstated, as he has brought to bear his 25+ years of industry experience, including eight years as the Chief Information Officer at the NYSE.

Hybrid-Cloud IT Architecture: We’ve transitioned to a hybrid-cloud-based IT architecture, which has vastly improved our data processing capabilities and provided a flexible and secure environment for our research and trading platforms. This shift has empowered us to be more responsive to market changes and client needs.

Operational Independence: A pivotal step in our journey was the disconnection and migration of operations, finance, sales, and other internal systems from our former parent. This strategic move has not only given us operational autonomy but also customized agility that aligns with our growth trajectory and innovation goals.

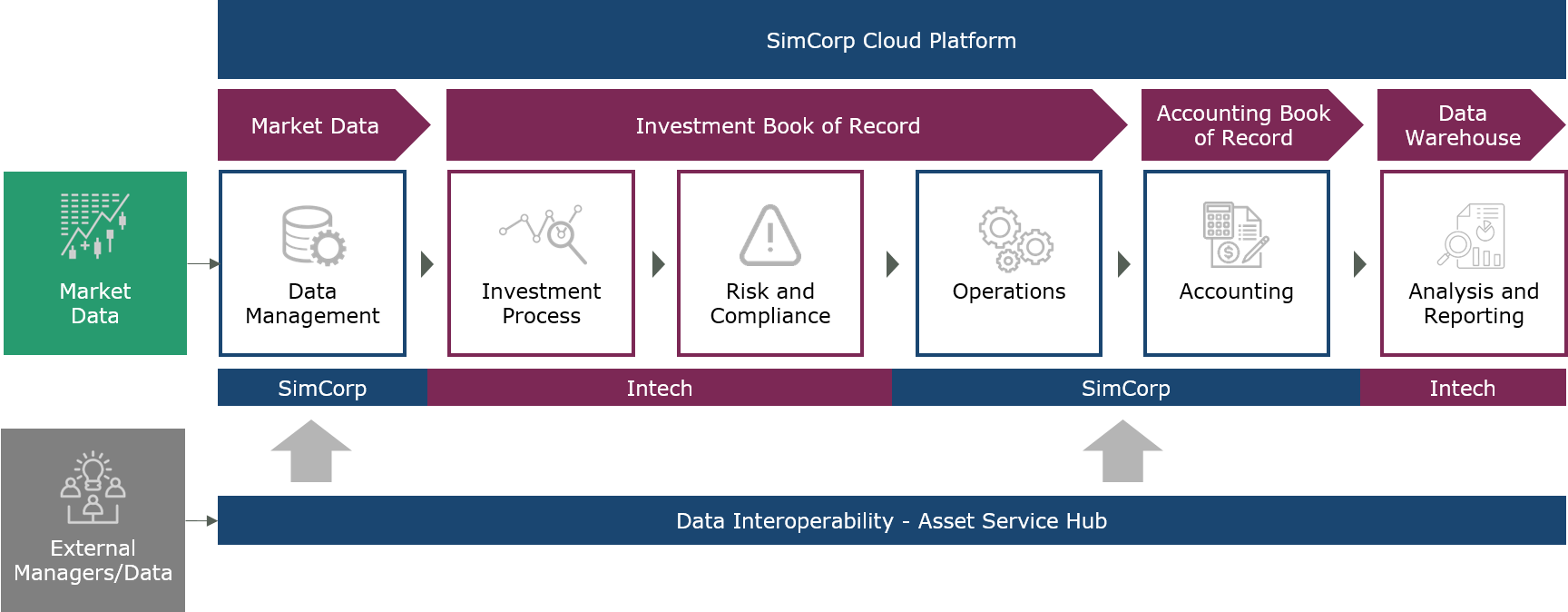

SimCorp Partnership: In tandem with these developments, we have migrated our post-trade, performance, compliance, and all activities related to our investment book of record to our new partner, SimCorp. Key benefits of our partnership include a more holistic overview of our business operations, the seamless integration of managed processes, and transparent access to data across all of our post-trade operations, which enables us to make even stronger investment decisions for our clients. The collaboration is anticipated to bring about a quantum leap in our operational efficiency and scalability (Figure 3).

FIGURE 3: NEW INVESTMENT OPERATIONS INFRASTRUCTURE

These operational upgrades are more than infrastructural enhancements; they represent our commitment to operational excellence and a future-ready stance in the fast-evolving financial landscape.

Product Portfolio Expansion and Rationalization

In the spirit of progress and adaptation, Intech’s product portfolio has undergone strategic rationalization to align with the evolving demands of the market and the needs of our clients. This considered approach has been twofold: a calculated consolidation and an innovative expansion.

Streamlined Offerings for Strategic Focus: We made the critical decision to close six strategies that no longer met our stringent criteria for performance potential and strategic fit. This rationalization process was essential to enhance our organizational focus and to direct our resources toward opportunities with the highest value proposition for our clients.

Launching Innovative Strategies for Dynamic Markets: With the landscape of investment continuously shifting, Intech introduced new strategies, such as Intech All Season Core Equity. Launched in January 2023, this strategy is designed to thrive across varying market conditions, featuring a strategic 5% allocation to exchange-traded futures to mitigate the rising impact of global macro factor risks on equity portfolios.

Anticipating and Meeting Client Needs: Additional new product introductions are on the horizon, funded by new clients and shaped by a deep understanding of our clients’ objectives. We aim to offer solutions that not only withstand but capitalize on the dynamic nature of today’s investment environment.

“Additional new product introductions are on the horizon, funded by new clients and shaped by a deep understanding of our clients’ objectives.”

In redefining our product portfolio, Intech reaffirms its dedication to delivering tailored, performance-oriented investment strategies. This ongoing evolution of our offerings reflects our proactive stance in a complex financial landscape and our unwavering commitment to our clients’ success.

Employee Ownership and Corporate Culture

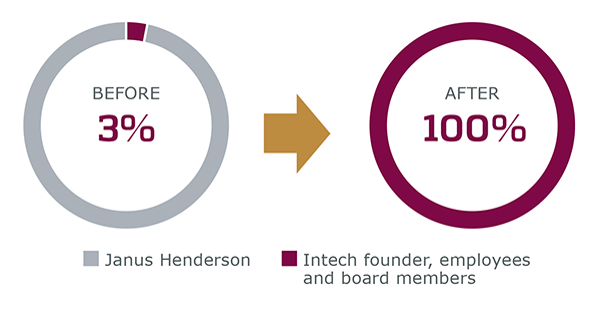

The move towards employee ownership was a defining moment in the evolution of Intech’s corporate culture. This shift has not only empowered our employees but has also cultivated a profound sense of engagement and partnership across the firm. By embedding ownership in the hands of those who are closest to the work, we’ve unlocked a wealth of innovation and collaboration that is directly aligned with the interests and successes of our clients (Figure 4).

FIGURE 4: EMPLOYEE OWNERSHIP PRE- AND POST- MBO

Performance-First Orientation: Our evolution champions a performance-first philosophy, where we forge every initiative and strategy with our clients’ success at the forefront. Team members’ ownership cultivates a deep, personal investment in the enduring prosperity of our client partnerships. Our performance-first culture ensures our relentless pursuit of performance excellence, keeping us intimately aligned with each client’s unique goals and ambitions.

Deepened Employee Engagement: With a stake in the outcome of our collective efforts, each member of our team is deeply invested in the success of our strategies and, by extension, the success of our clients. This shared sense of purpose has galvanized our commitment to excellence and integrity in all that we do.

Fostering Collaboration and Innovation: Employee ownership has fostered an environment where open communication, shared ideas, and innovative thinking are not just encouraged – they are the norm. Our culture thrives on the diverse perspectives and expertise that our team members bring to the table, driving us to explore new frontiers in quantitative investment management.

The culture at Intech today reflects these principles in action – a culture where every employee-owner is motivated to contribute to our firm’s legacy of innovation and client service. It is this culture that will propel us into the future, continuing to serve as the foundation upon which we build our growth and success.

Looking Forward: Goals and Aspirations

As we stand at this juncture of our company’s history, we look to the horizon with clear goals and aspirations that drive us forward. Our commitment to innovation is unwavering; we seek not just to adapt to the evolving demands of the investment landscape but to anticipate and shape them. We aim to enhance our client service excellence continuously, ensuring that each strategy we develop and every decision we make aligns with our clients’ success.

Our strategies are rooted in the bedrock of our foundational principles and the pioneering spirit of our investment philosophy. We believe in a future where our quantitative edge and disciplined approach continue to deliver distinctive value.

Conclusion: A Thank You to Our Clients and Team

To our valued clients, this anniversary is as much yours as it is ours. Your trust in Intech’s capabilities and your partnership in our journey are the greatest endorsements of our efforts. Your commitment, particularly through the pivotal moments of the past two years, has been the catalyst for our growth and success.

To the Intech team, your unwavering dedication and brilliance have been the driving force behind every achievement. Our journey has been one of collective effort and shared victories, and for that, I am profoundly grateful.

Looking to the future, we are filled with optimism. With our new independence and the solid foundation we have built together, we are excited about the opportunities ahead. Our promise is to continue pushing the boundaries of excellence and innovation, driving value for our clients, and upholding the trust you have placed in us.

Thank you for two remarkable years! Here’s to many more to come, where we continue to grow, innovate, and excel — together.