In 2022, equity markets posted their worst calendar year return since the global financial crisis in 2008, as losses this year were significant. During the year, there was a substantial change in style leadership where growth stocks strongly underperformed value stocks.

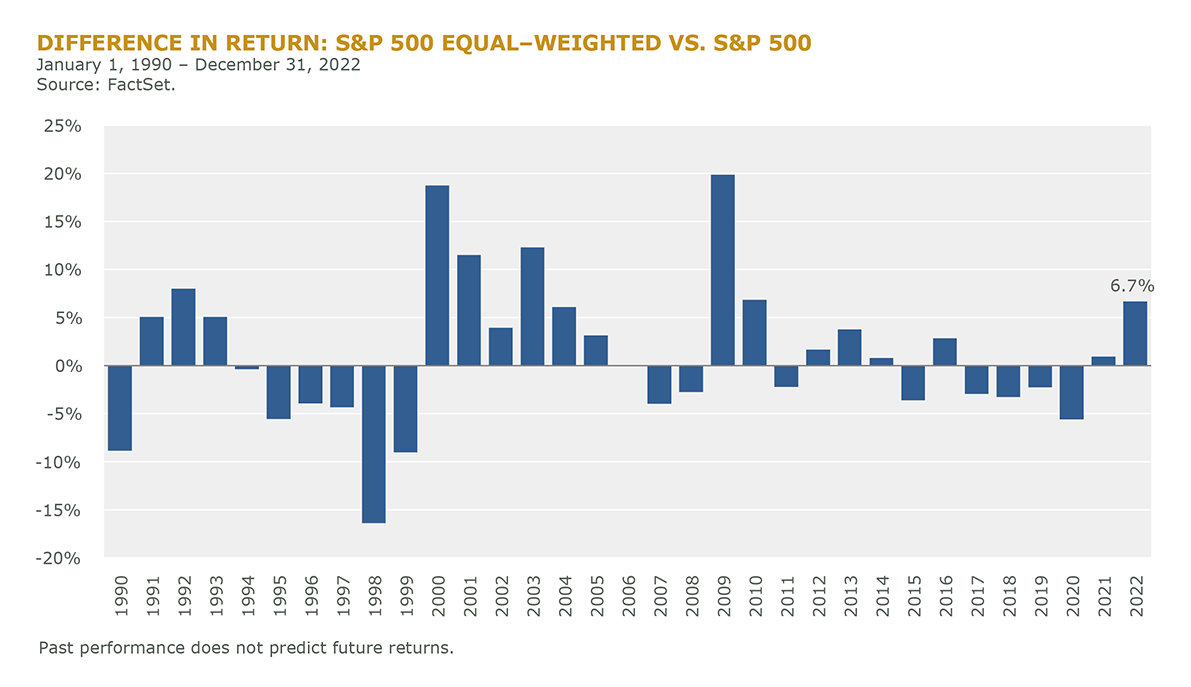

The mega-cap growth stocks plummeted during the year. As a result, the equal-weighted index outperformed the cap-weighted index. The risk to the top of the market was featured in our work over the past several years. We expect this theme to continue with a potential for geographic consequence as well – it’s difficult for the U.S. to outperform the World ex. U.S. when the mega-cap stocks, predominately U.S. growth stocks, continue to underperform the average stock.

The strength in value stocks (and lack of performance in growth stocks) can be explained by the substantial performance in energy stocks – making for historic sector dispersion between the best and worst-performing sectors.

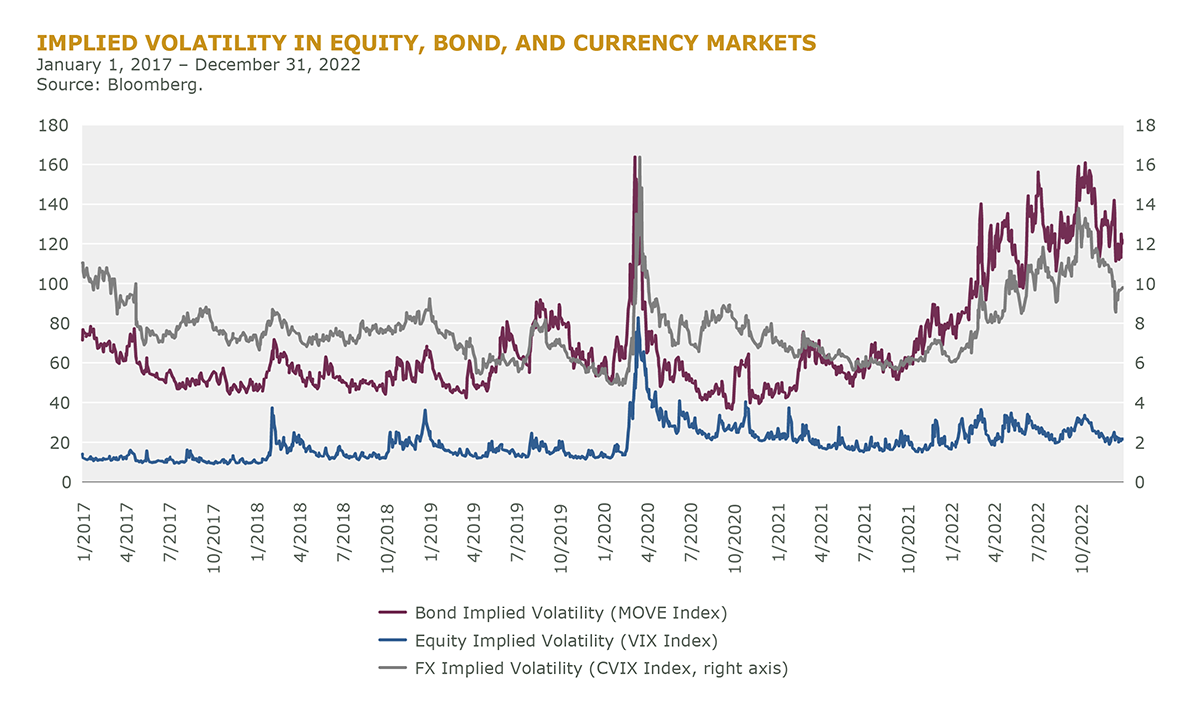

As volatility spiked during the year, low-volatility portfolios strongly outperformed the broad market indexes, as expected. Yet, equity volatility remains relatively low, given historical observations and based on sharp rises in Bond and FX volatility. It’s challenging to think that the VIX index, which is a proxy for equity volatility, won’t rise too.

Additionally, we are already seeing an increase in systematic risk rising as the correlation of returns among stocks increased sharply throughout the year, and it is now above median levels in many equity markets. This reflects a shift whereby systematic risks, as opposed to idiosyncratic risks, significantly influence overall stock returns.

What’s Next?

The higher daily volatility, drawdowns, and cross-asset correlations we saw last year have the potential to stay with us in the years ahead. As such, we are currently working with a partner to deliver an innovative equity strategy engineered to deliver alpha in all markets, navigate time-varying volatility, and provide convexity in sharp drawdowns. We’ll share more in the months ahead.