As the market climbed in the early stages of 2024, we are witnessing moderate shifts in the dynamics of the equity market, one that may suggest a departure from the trends established in recent years. This evolution, emerging from a period of prolonged accommodative monetary policies that favored market-cap-based indexes, hints at a potential move towards a more diversified market fabric.

Driven by the overarching macroeconomic environment, this shift potentially challenges the long-standing dominance of mega-cap technology-oriented stocks. It may signify a potential turning point for market-capitalization-based indices, where passive investors might now face a critical juncture, compelling them to reexamine their strategy in a landscape less reliant on a few influential companies.

Macroeconomic Context and Implications

Transition from Accommodative Policies

The current markets are starting to reflect the departure from the extended period of low-interest rates and quantitative easing that has characterized much of the past decade. As central banks globally adjust their stances, moving away from these ultra-accommodative policies, we are beginning to see the ripple effects across various asset classes.

Shifting Equity Risk Premiums

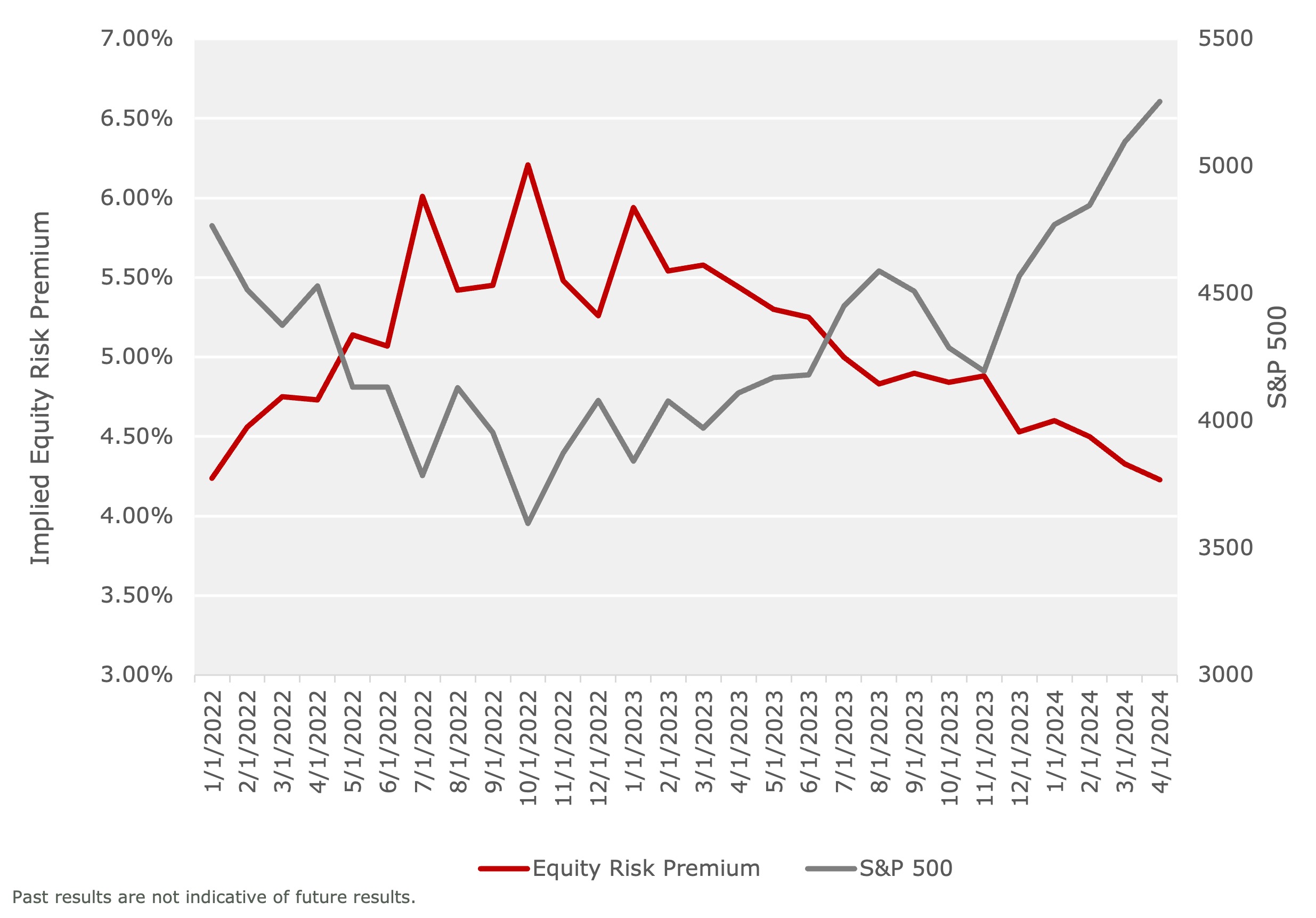

In the wake of these policy shifts, the equity risk premium — a key determinant of investor return expectations — is undergoing a not-so-subtle recalibration. As the market climbed higher during the quarter, the S&P 500 implied equity risk premium fell to 4.23%, its lowest value since 2008 according to Damodaran Online (Figure 1). The era of relatively straightforward gains, fueled by expansive monetary policies, is giving way to a more complex investment landscape, where the assessment of risk and potential returns demands a more discerning approach.

FIGURE 1: IMPLIED EQUITY RISK PREMIUM

Source: Damodaran Online: Home Page for Aswath Damodaran. (2024). NYU.edu. https://pages.stern.nyu.edu/%7Eadamodar/

Implications for Market Valuations

This transition phase in macroeconomic policy is exerting pressure on market valuations, particularly in sectors that have enjoyed inflated valuations. Mega-cap technology-oriented stocks, which have been at the forefront of market rallies, are now under scrutiny as investors reevaluate risk-return profiles in this new economic environment.

Inflation and Interest Rate Dynamics

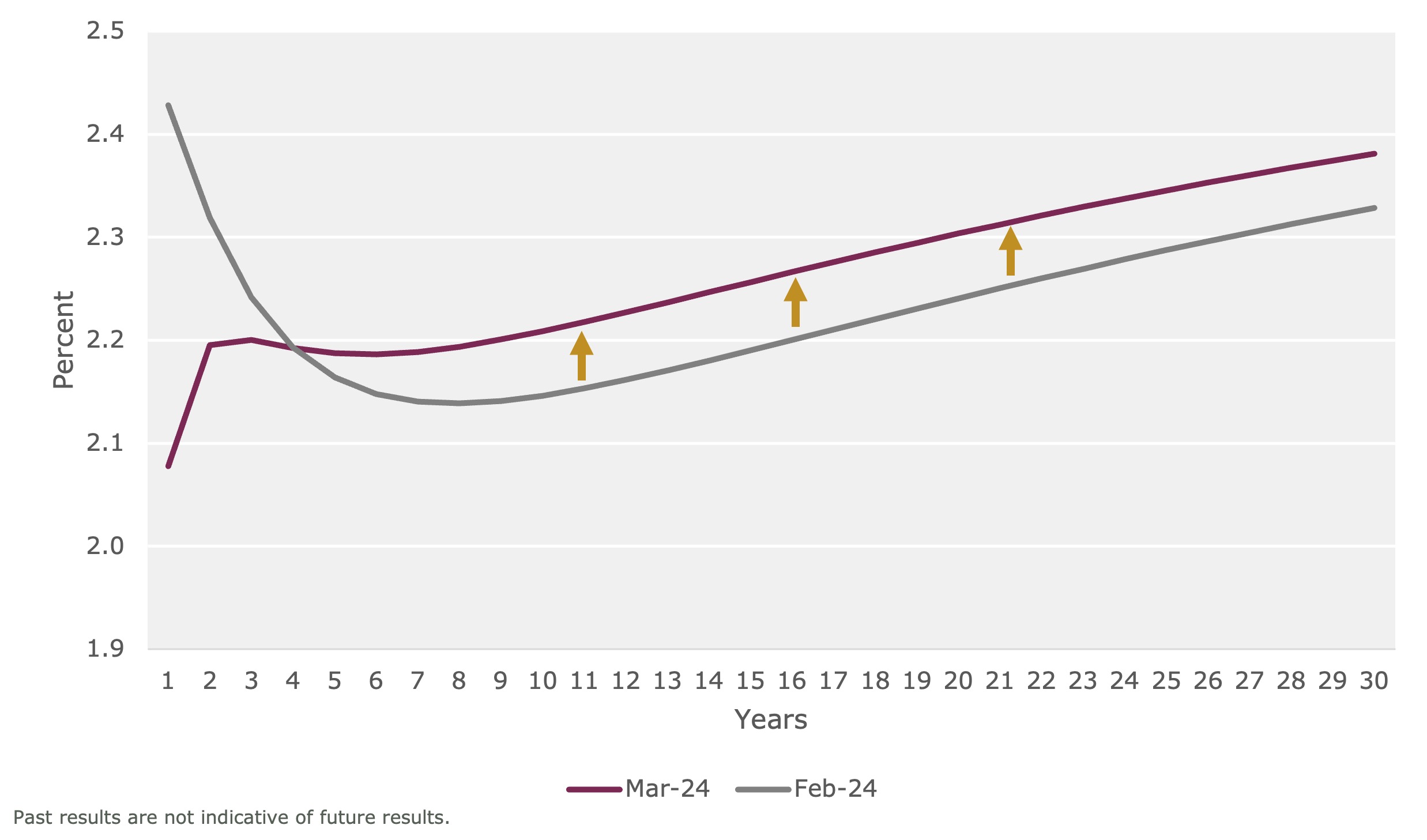

Uneven inflation indicators and corresponding rising interest rates were key in rising inflation expectations this quarter (Figure 2). The potential for sticky inflation, coupled with the likelihood of higher interest rates, poses challenges and opportunities within equity markets, prompting investors to seek strategies that can navigate these changing tides.

FIGURE 2: EXPECTED INFLATION TERM STRUCTURE

“Inflation Expectations.” Federal Reserve Bank of Cleveland, www.clevelandfed.org/indicators-and-data/inflation-expectations. Accessed 05 Apr. 2024.

Global Economic Shifts

Beyond domestic economic factors, global economic shifts — including Middle East tensions, supply chain disruptions, and varying recovery trajectories post-pandemic — are contributing to market uncertainty. Equity markets have ignored rising oil and bond yields all year, making earnings season that much more important. This global economic interplay further emphasizes the need for adaptable and resilient investment strategies in the face of heightened volatility and changing market dynamics.

Concentration Dynamics and Its Implications

Peak Concentration in Equity Markets

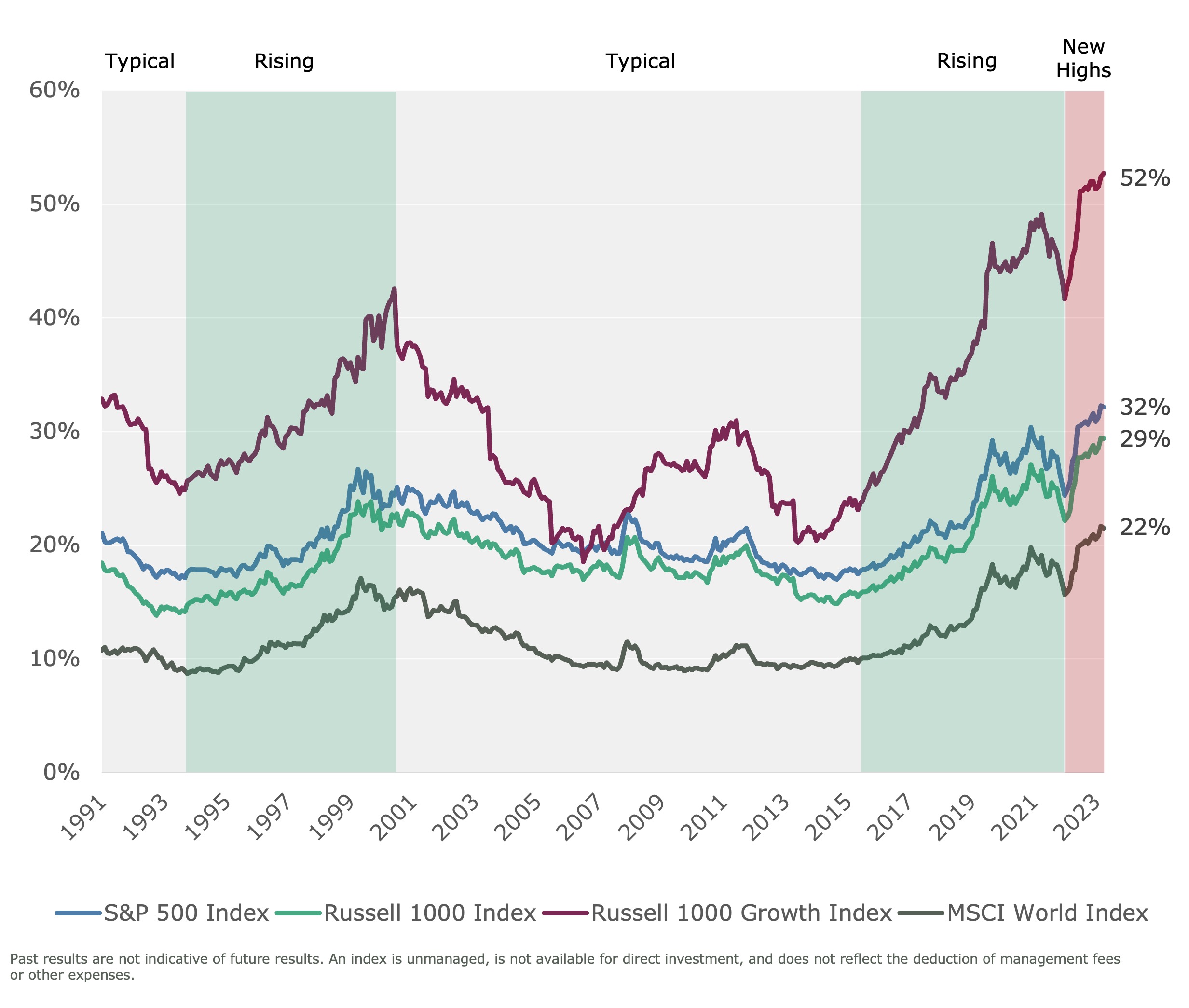

The current equity market scenario is distinguished by a pronounced concentration in large-cap technology stocks, significantly influencing market dynamics and shaping investment strategies. Both the S&P 500 and MSCI World Indexes have never seen these levels of concentration, highlighting a critical juncture for investors (Figure 3).

FIGURE 3: TOP 10 STOCK CONCENTRATION BY INDEX REACHES NEW HIGHS (1991-2023)

Enhanced Market Breadth: Indications of a Diversified Rally

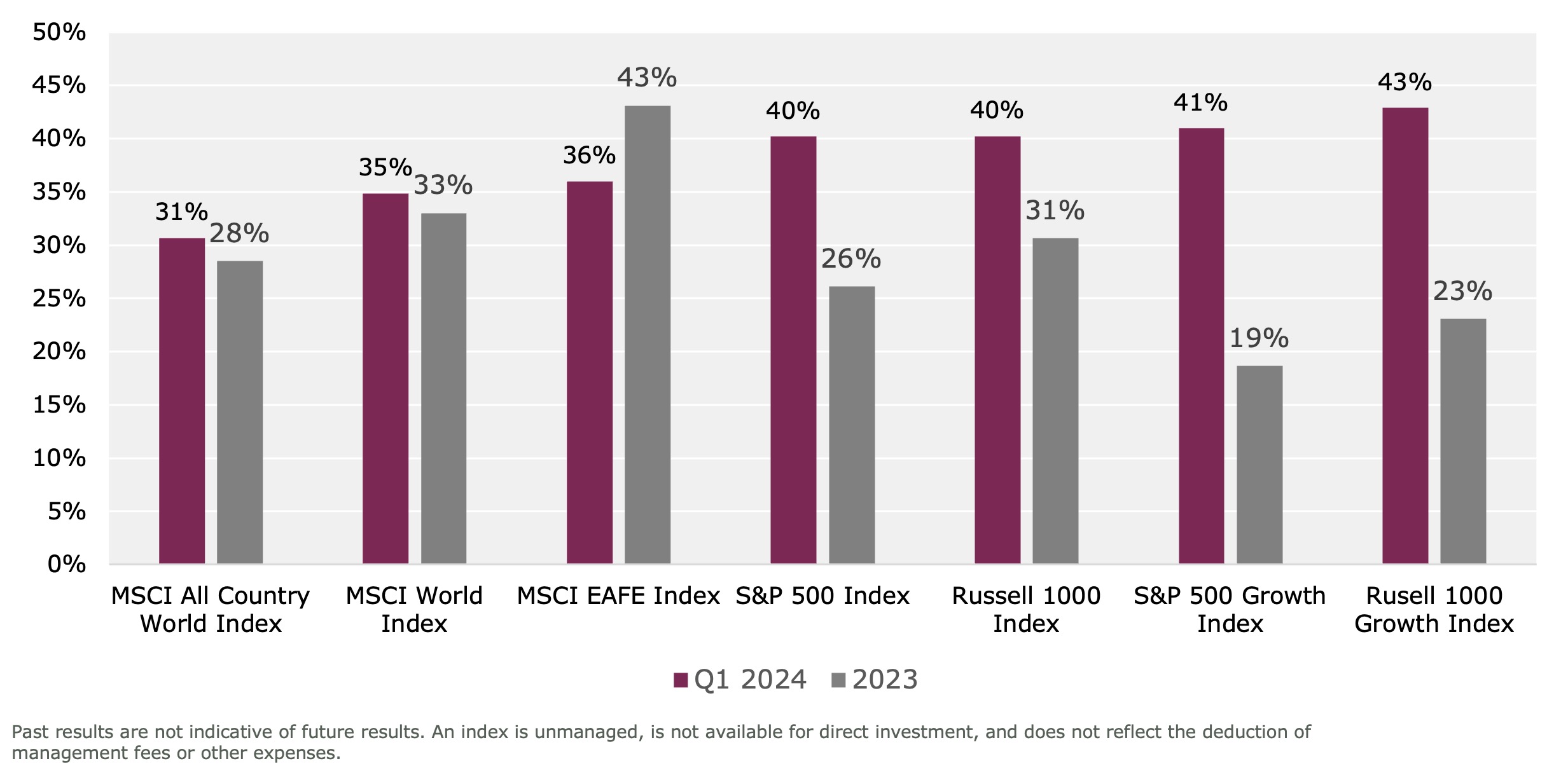

We are observing, however, a broadening participation across various sectors and stocks varying in market capitalizations in the closing weeks of the quarter. A higher share of stocks outperforming the market is a departure from the previous year’s tech-centric performance (Figure 4).

The implications are twofold: while this provides investors with a broader canvas of opportunity, it also introduces new risks for the tech sector, which may no longer sustain its disproportionate impact on market returns. As the dominance of the tech sector faces this emergent challenge, the risk profile for these stocks may need reassessment. Investors could find themselves at an inflection point, considering the potential for overexposure to a sector that may no longer be the sole driver of market performance.

The shift in market breadth serves not only as an indicator of a robust, diversified market but also as a harbinger of changing tides for sector-specific risks, particularly within technology equities.

FIGURE 4: PERCENTAGE OF STOCKS OUTPERFORMING – Q1 2024 vs. 2023

Impact on Index Performance and Risk Profile

The concentration in tech stocks has profound implications for market-cap-weighted indices, affecting their performance and elevating systematic risk. This concentration diminishes the traditional diversification benefits of these indices and makes them more susceptible to sector-specific fluctuations.

Reevaluation of Strategies

Given these dynamics, there is a growing need among investors to reassess their future equity strategy, particularly if they are passive. The heightened sector concentration and macro backdrop may call for investment approaches that can navigate these complexities.

Conclusion: Navigating the Future Investment Landscape

As we close our analysis of the first quarter of 2024, it’s evident that the investment landscape is at a critical juncture. The convergence of macroeconomic shifts, evolving market dynamics, and the recalibration of equity risk premiums are collectively reshaping investor perspectives and strategies.

Future Market Dynamics

The ongoing diversification in market participation, coupled with the changing role of major tech stocks, points to a more complex yet potentially rewarding investment environment. This diversification suggests a landscape where risk and opportunity are more evenly distributed, necessitating a keen eye for emerging trends and inefficiencies.

In this evolving context, the value of enhanced equity strategies and adaptable investment strategies becomes paramount. Strategies that can identify favorable fundamentals and volatility characteristics, dynamically respond to market shifts, manage risk effectively, and capitalize on emerging opportunities are likely to be at the forefront of investor preferences.

Looking Ahead

As we navigate through 2024 and beyond, the key for investors will be to maintain flexibility, stay informed, and be ready to adjust their approaches in response to the ongoing market evolution. The future landscape promises opportunities for those equipped to navigate its complexities, highlighting the importance of insight, foresight, and adaptability in investment decision-making.

Understanding Intech’s Size Exposure and Performance Dynamics

Intech’s investment process uses stock price volatility and correlations to create a portfolio that is potentially more efficient than its benchmark, prioritizing mispriced stocks with improving fundamentals. We then attempt to capture a trading profit by systematically rebalancing the portfolio to replenish diversification.

Essential to the process is constructing a portfolio where the weighted average variance of its holdings exceeds the overall portfolio variance. Such portfolios typically have a lower average market capitalization, as smaller stocks often show greater volatility than larger ones. This smaller market cap profile can lead to a size effect that either boosts or impedes performance contingent on market conditions.

In May 2023, Intech implemented enhancements to address this size exposure, carefully adjusting our portfolio construction to mitigate adverse effects and potentially enhance performance under various market conditions.

Download our report for a more complete look, including Equity Market Returns and a snapshot of our Equity Market Stress Monitor.

Q2 2024 Equity Market Observations