Identifying and quantifying the underlying co-movements within and across asset classes is essential in creating a diversified portfolio and mitigating idiosyncratic risk. It helps inform your strategic allocation decisions around maximizing returns for a given level of risk. Unfortunately, these historical relationships do evolve over time and can break down dramatically over the short term.

Shifting intra- and cross-asset interdependencies undermine diversification and return consistency while increasing the risk of significant losses during market downturns. In response, investors have added more esoteric – and less liquid – asset classes to bolster diversification, but this approach may have diminishing returns and potential blind spots. Therefore, we believe investors should also modernize the strategies that typically hold their largest source of risk: equities.

Time-Varying Correlations

The latest generation of investors is experiencing a much different environment than their predecessors. Correlations between asset classes always change over time due to a range of factors, including changes in globalization, economic conditions, geo-political stability, market sentiment, financial innovation, and central bank policy (see “Drivers of Changing Correlations”). As such, investors need to be vigilant and responsive in managing their portfolios to mitigate the risks associated with these changes.

Drivers of Changing CorrelationsShifts in asset class interdependency since the turn of the century is a complex phenomenon driven by various economic, technological, and financial factors. Globalization Central Bank Policy Technology Financial Innovation |

Equity Correlations

Diversifying risk within the equity asset class may be easier to implement than across asset classes, given the equity market’s breadth, liquidity, lower transaction costs, and regulatory framework. Nonetheless, sudden, short-term changes in correlations can erase diversification benefits, typically occurring at the most inopportune times. Investors need equity portfolios that adapt to these risk regimes without compromising returns.

“…sudden, short-term changes in correlations can erase diversification benefits, typically occurring at the most inopportune times.”

Regional Diversifiers

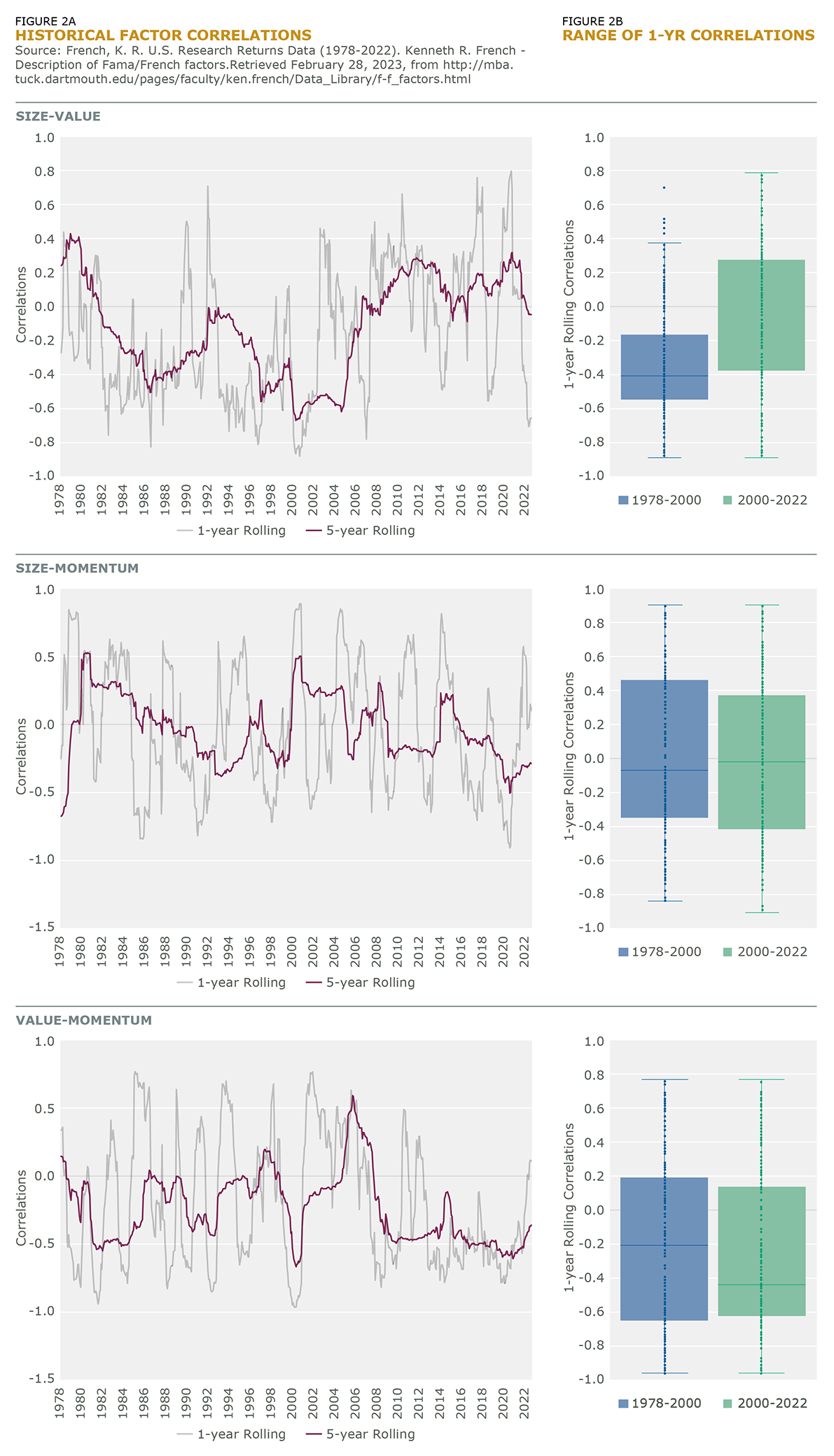

The benefits of cross-border investing have long been an important part of an investor’s diversification toolkit, but as world economies became more globalized and homogeneous, diversification advantages became more elusive. The steady rise in 5-year correlations between the S&P 500 and the MSCI EAFE indexes illustrates this shift over the last generation (Figure 1A). However, short-term correlations still shift dramatically, as investors contend with 1-year correlations fluctuating from +0.96 to -0.24 (Figure 1B).

Factor Diversifiers

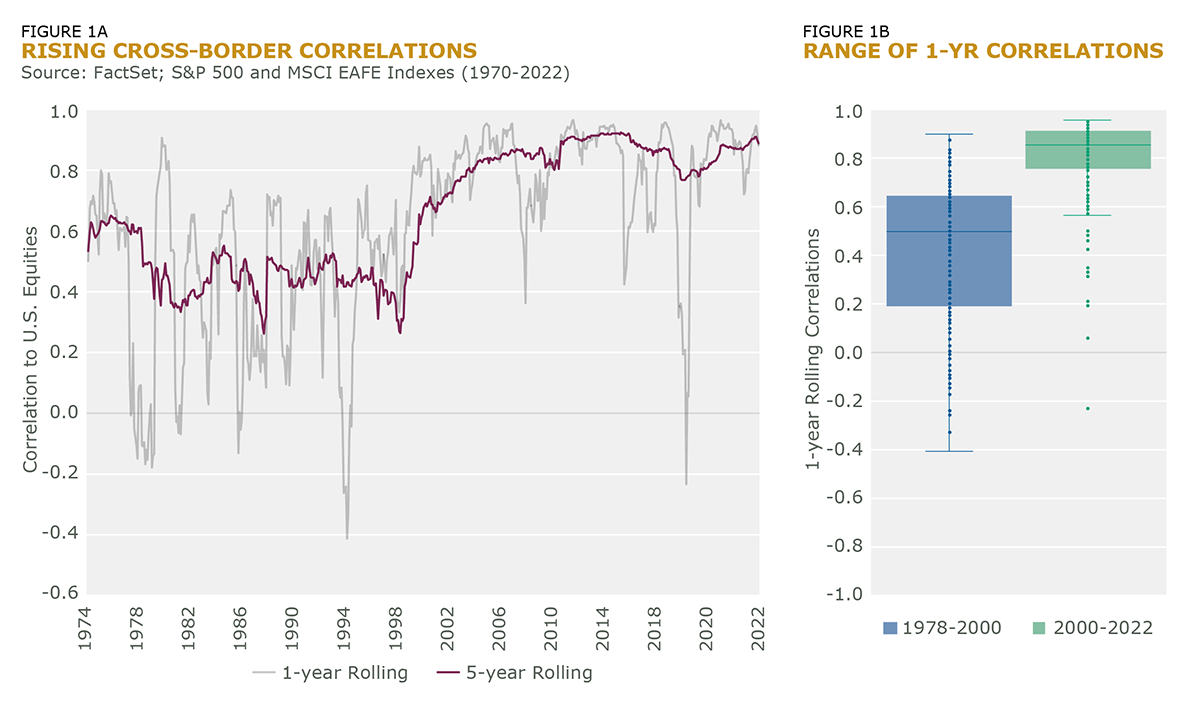

Equity investors will attempt to use factor diversification to build more resilient portfolios, as they seek exposure to sources of return and risk beyond traditional market exposure. Unlike international diversifiers, long-term factor correlations over the last four decades are more range-bound; however, the extremes of that range can be significantly positive or negative, subjecting policy allocations to unpredictable outcomes (Figure 2A). What’s more, just like international diversifiers, factor correlations can be subject to quite extreme short-term dislocations. For example, one-year rolling factor correlations over our entire sample (1978-2022) have ranged from +0.90 to -0.96 across factors (Figure 2B).

Pairwise Stock Correlations

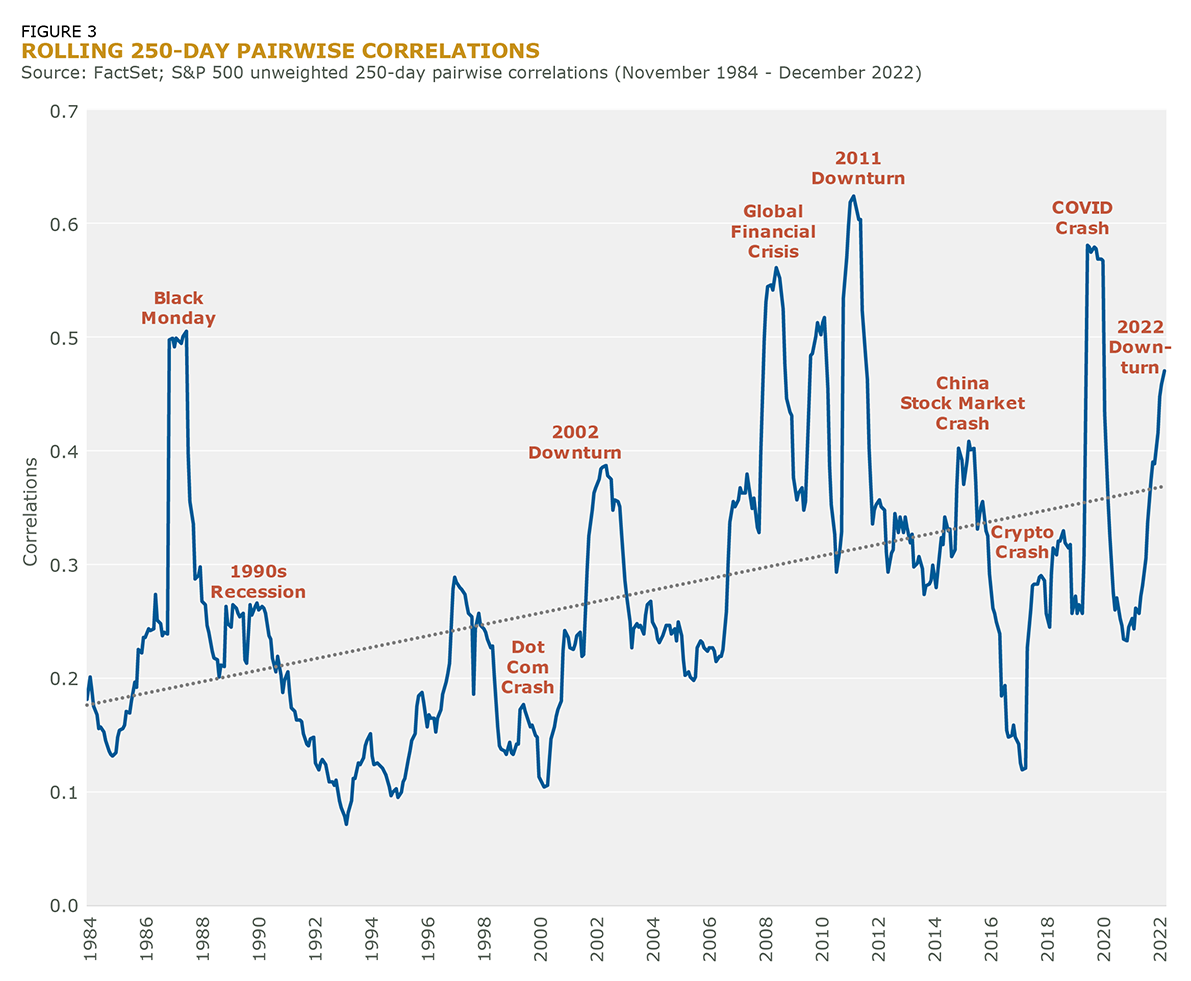

During market drawdowns, which have been occurring more frequently and in greater magnitude, equity investors have seen a sharp increase in systematic risk and rising spikes in pairwise correlations (Figure 3). Yet, these environments are exactly when you need diversification, making drawdown mitigation only possible with opportunistic hedging.

Asset Class Interdependency

Mitigating capital losses from your public equities allocation typically requires adding as much investment breadth as possible across low and uncorrelated asset classes. The problem is that cross-asset class correlations are also affected by globalization, monetary policy, economic environments, and other factors. What’s worked in the past won’t necessarily work in the future, especially over the short term, and most investors don’t have policy allocations with that kind of variability.

“What’s worked in the past won’t necessarily work in the future, especially over the short term, and most investors don’t have policy allocations with that kind of variability.”

To illustrate our point, we’ll examine just three asset classes often used as potential portfolio diversifiers to equities: bonds, commodities, and currencies.

Bond Diversification

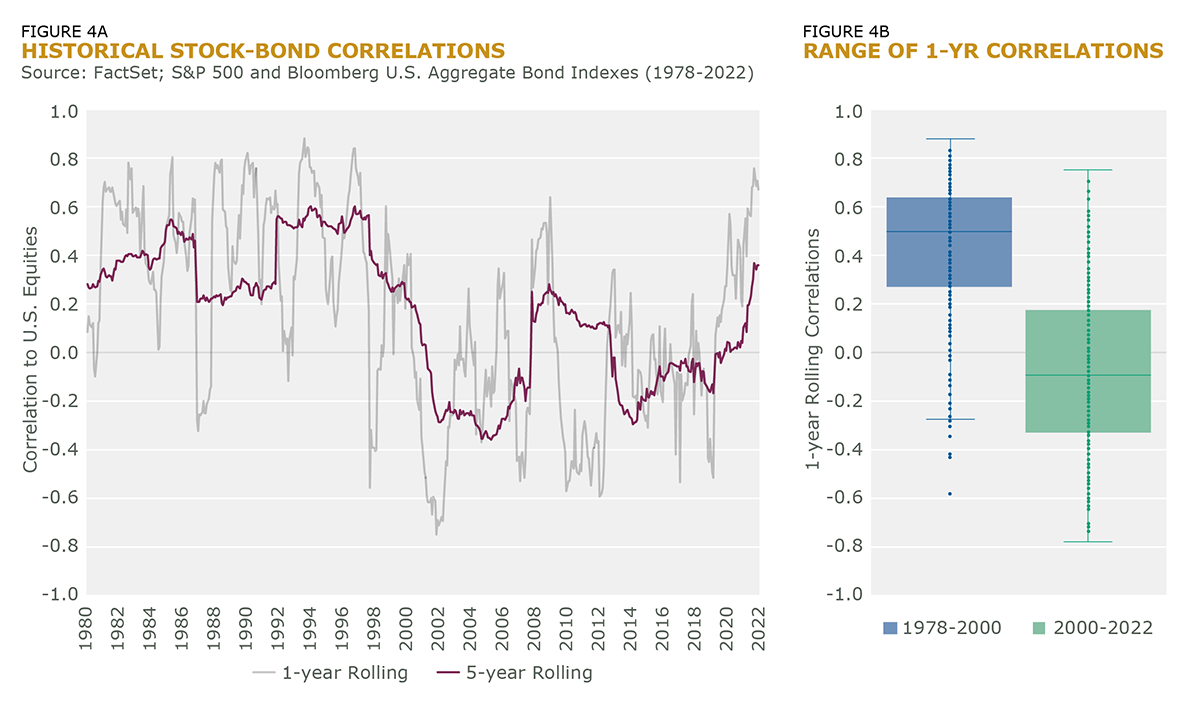

Asset managers spilled much ink over the rise in stock and bond correlations last year. This low correlation relationship seemed to vanish overnight with the prospect of higher rates and inflation. Students of market history may have known better since positive stock-bond correlations are well documented (Figure 4A), but how many had incorporated higher correlations into their allocation models? And even if investors did anticipate correlations trending higher, they probably didn’t account for rolling one-year correlations reaching +0.75 in 2022 (Figure 4B), which took a toll on “balanced” portfolios.

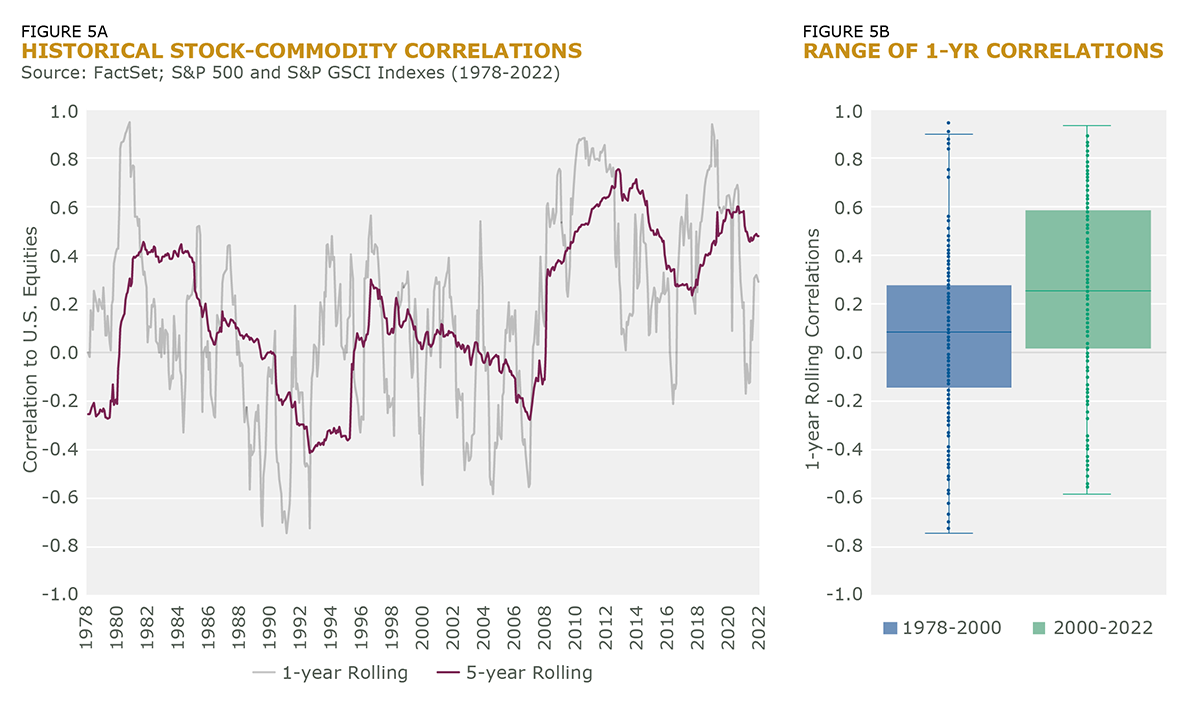

Commodities Diversification

The payoff from commodities has been a boon to investors in recent years, as commodity prices spiked during the 2020 pandemic. Commodities’ traditional role as a hedge against inflation spikes appears to be intact, and historically, they’ve provided some diversification benefits to equities (Figure 5A). However, as investors increasingly include commodities in their portfolios, their value as portfolio diversifiers has diminished in recent years. The median 5-year correlation to equities has risen from -0.41 to +0.35 during the 22 years before and after the year 2000, respectively. Yet, even with higher long-term correlations, since the start of the century, one-year correlations with equities have ranged between -0.58 to 0.95 (Figure 5B). That’s quite a whipsaw in their diversification benefit, especially considering their long-term returns haven’t been that compelling.

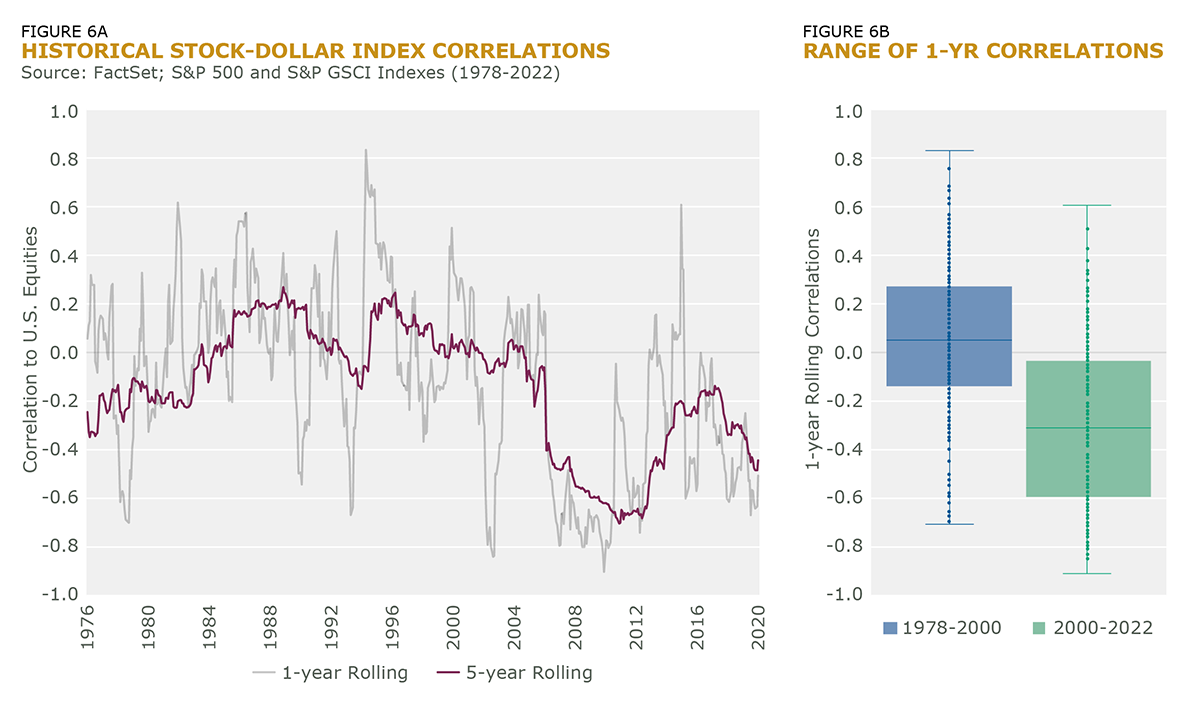

Currency Diversification

For U.S. equity investors, the relative strength of the U.S. dollar to other currencies can be a helpful diversifier to equities because it’s generally negatively correlated with equities. During times of market uncertainty, investors may seek safe-haven assets like U.S. Treasury Bonds or cash, including U.S. dollars, which can drive up the dollar’s value relative to other currencies and offset losses in equity positions (Figure 6A). But this relationship is not always negative (Figure 6B) and is heavily influenced by the global economy and monetary policy, which can introduce other risks to a portfolio. And, importantly, it may not provide as many diversification benefits to other asset classes.

Corralling Correlations

While cross-asset class diversification potentially offers risk reduction and return enhancement, it can also be more challenging to implement and manage than diversification within equities for several reasons:

Complexity

Each asset class has unique risk and return characteristics, and correlations between different asset classes can vary depending on a myriad of market conditions. Using forecasting models to predict near- or long-term correlations based on these combinations of conditions is a thorny endeavor, as every market state is unique.

Expertise

Managing a diversified portfolio across asset classes requires a deep, specialized understanding of each asset class and its interactions under various market conditions, including their return contributions. Adding asset classes to reduce volatility can drag returns or, worse, sink them if correlations suddenly increase.

Liquidity

Some asset classes, like private equity, real estate, or infrastructure, may have limited availability or liquidity, making it more challenging to adjust portfolio allocations as market conditions change.

Governance Cost

Making asset allocation adjustments for any reason is a complex, time-consuming process, requiring collaboration and communication across investment teams, consultants, and trustees. Making frequent allocation adjustments in the face of material correlation changes is impractical.

Another Way: Modernize Your Equity Strategies

Intech has been thinking about this growing problem for our clients. Equities are the cornerstone for most portfolios because they provide the potential for attractive long-term returns. Unfortunately, they also contribute to portfolio volatility and the potential for deep losses; therefore, investors seek other asset classes and strategies that presumably offer attractive conditional correlations – assuming they can predict them.

To address the shortcomings of traditional portfolio construction in today’s environment, Intech built an equity strategy that seeks to reliably deliver diversification benefits within equities and across asset classes in all markets.

The strategy attempts to stabilize diversification benefits for investors by efficiently adapting to short- and long-term shifts in correlations within equities and across various asset classes to help investors target:

- Expected portfolio-level diversification

- Reduced systemic risk exposure

- Convexity in a market tail event

- Higher risk-adjusted returns

The Intech team is excited to introduce this new, innovative investment solution in the coming months. Designed for today’s evolving equity markets, the strategy seeks to consistently outperform the capitalization-weighted equity market with less risk while boosting performance during extreme short-term market moves.

If you’d like to learn more, download our paper or please get in touch with us.