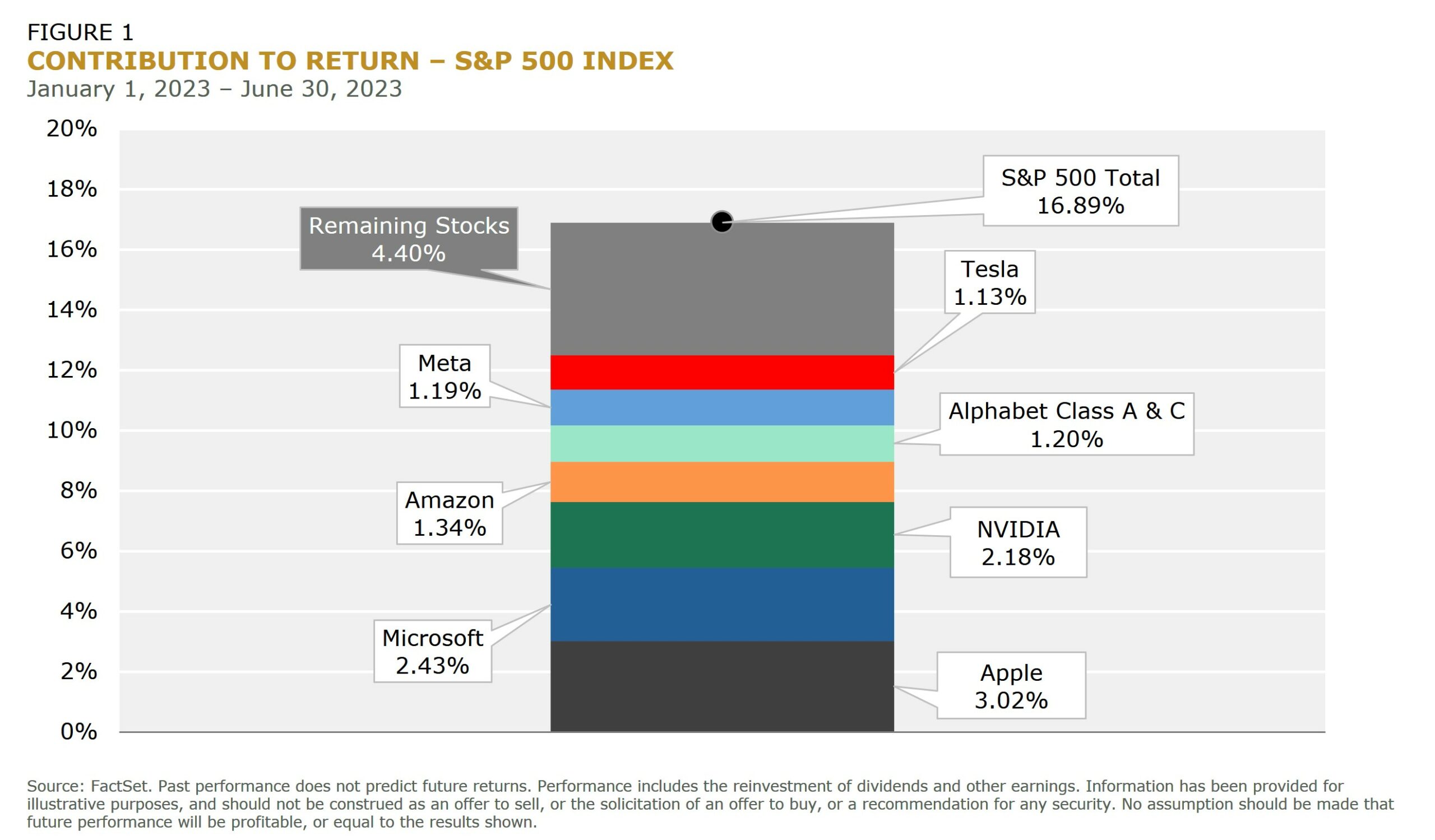

The dynamics of the market are constantly evolving, and the current trend is both fascinating and consequential. The stock market, like any system, has its own set of rules and behaviors. One of those behaviors is the tendency for a small number of companies to drive the majority of market gains. This has been observed throughout history, and we’re seeing it now with a group of tech companies including Apple, Microsoft, Alphabet, Amazon, and Nvidia (Figure 1). However, it’s crucial to recognize that this is not an anomaly, but a recurring pattern within the market system. Understanding this pattern, and its implications, is essential for investors.

Current Landscape

In 2023, the tech sector has been carrying the stock market, with the S&P 500 showing gains almost entirely from the Magnificent Seven: Apple, Microsoft, Nvidia, Amazon, Meta, Tesla and Alphabet (Figure 1). These companies have been riding a wave of excitement over generative AI technology, strong earnings, and market anticipation of a shift away from rate hikes.

This concentration of gains, however, has led to some concern. The sheer size of these companies’ share of the S&P index is considerable, and some see this dominance as a warning sign, suggesting the market as a whole may not be performing as well as it seems.

But it’s important to remember that this concentration is not unusual. Many of the original FAANG (Facebook, Apple, Amazon, Netflix, and Google) stocks in the 2010s make up the Magnificent Seven. And during the late 1990s, the “Four Horsemen” — Microsoft, Cisco, Oracle, and Intel — led the market’s charge.

In fact, some say what we’re seeing today might even be less extreme than in some previous periods. During the dotcom bubble of the late 90s, market concentration in some respects (i.e., trading volume) was even more severe. Many traditional managers say the current situation seems more resilient due to healthier fundamentals, more reasonable valuations, and lower equity positioning across strategies.

That being said, there’s always the potential for disruption. The market, after all, is a complex system, influenced by a multitude of factors. By understanding these dynamics, we can better navigate the financial seas and make more informed decisions.

As we move forward, it will be important to keep a close eye on these market leaders and the factors that are driving their performance. The concentration of gains in these tech companies has significant implications for investors, for the tech industry, and for the economy as a whole.

Historical Perspective

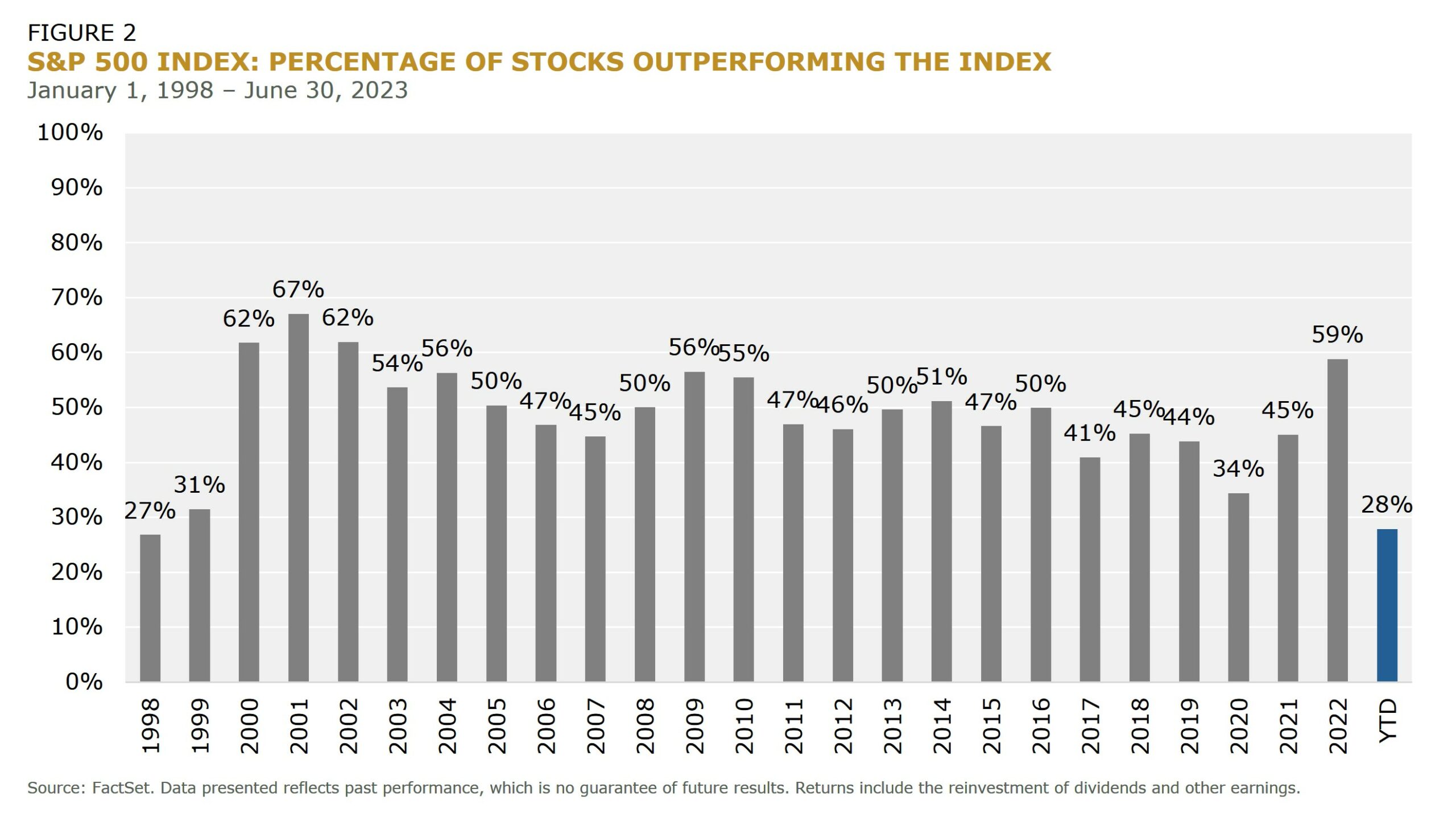

Throughout history, we can observe a pattern where a small number of companies, often in emerging industries, come to dominate the stock market’s gains (Figure 2). Let’s take a journey back in time to better understand this phenomenon.

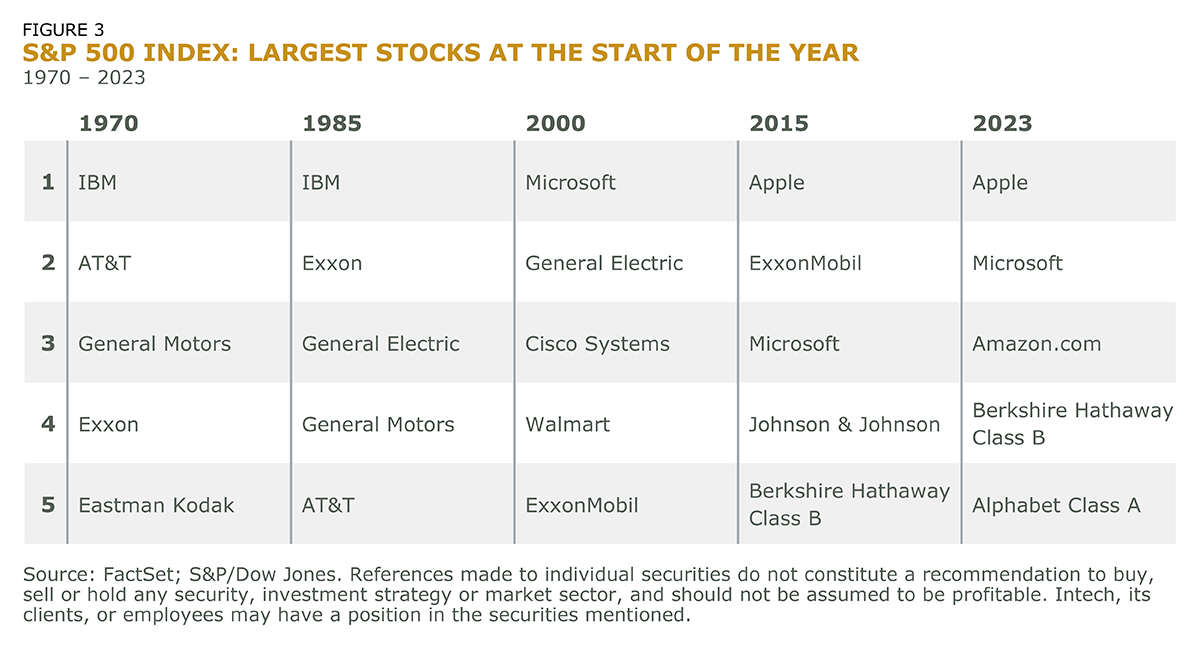

In the late 1960s and early 1970s, we saw the “Nifty Fifty” dominate the market. These fast-growing companies, which included the likes of IBM, McDonald’s, and Xerox, were seen as “one-decision” stocks: companies you could buy and hold forever. They were seen as unstoppable, until the 1973-74 stock market crash reminded everyone that no company, however dominant, is immune to economic cycles.

Then, in the late 1990s, we witnessed the rise of the “Four Horsemen” – Microsoft, Cisco, Oracle, and Intel. These tech titans led the market’s charge during the dotcom boom. Their growth seemed unstoppable, fueled by the rise of the Internet and the seemingly limitless possibilities it offered. But the boom was followed by a bust, and the dotcom bubble burst in 2000, leading to widespread losses and a painful recession.

In the 2010s, a new group of tech companies came to the fore: the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google). These companies, powered by the rise of digital technology, mobile devices, and online advertising, drove significant market gains. They seemed to defy traditional market wisdom, growing rapidly and commanding high valuations despite often modest profits (or, in some cases, no profits at all).

Each of these periods of market concentration was followed by a market correction of some sort, but it’s essential to note that the corrections did not erase the fundamental impact these companies had on their industries and the economy. Indeed, many of these companies continue to be dominant players today.

Now, in the 2020s, we’re seeing a similar story unfold with a new set of tech companies, including Apple, Microsoft, Alphabet, Amazon, and Nvidia. The key driver this time is the rise of artificial intelligence, which is seen as the next big frontier in technology.

Thus, the lesson from history is that market concentration among a small number of companies is not unusual. It often happens in times of rapid technological change and innovation. However, history also teaches us that these periods of concentration are not permanent, and market leadership can and does shift over time (Figure 3).

The Impact of Today’s Market on Diversified Strategies

Central to Intech’s investment process is diversification. We believe in creating portfolios more efficient than an index and then rebalancing them regularly to capture a trading profit. It’s served our clients since 1987. But what happens when market concentration and narrow breadth come into play?

When a few companies dominate the market’s gains, it can present challenges for diversified portfolios. After all, if a handful of tech stocks are driving the majority of the market’s returns, a portfolio that is spread across many different companies and sectors may underperform a concentrated bet on those few high-flying stocks.

Similarly, when market breadth is narrow – meaning that a small number of stocks contribute the majority of the market’s returns – it can also be difficult for diversified portfolios to keep up. This is especially true when the companies driving the market’s gains are in emerging, high-growth technology like AI, which may not be well-represented in more traditional, diversified portfolios.

But here’s the key: while market concentration and narrow breadth can pose challenges in the short term, we believe that diversification is still the best approach for long-term, risk-adjusted returns. Why? Because while it’s tempting to chase the hot stocks of the day, history has shown that market leadership can change quickly and dramatically. As we’ve seen, high-flyers of one era can quickly become the laggards of the next.

Moreover, while a concentrated bet on a few high-growth companies can pay off in the short term, it also exposes investors to significant risks. If those few companies stumble, the losses can be severe. And predicting which companies will continue to outperform in the future is a notoriously difficult task.

Therefore, while we monitor market concentration and breadth closely and consider their implications for our investment strategies, we remain committed to our diversified approach. It is a proven strategy for achieving steady, consistent returns over the long term, regardless of short-term trends in market concentration and breadth.

Our Strategies Amid Market Concentration and Narrow Breadth

In an environment where a handful of companies dominate the market’s gains and where market breadth is narrow, how do we at Intech adapt our strategies?

First and foremost, we stick to our principles. We believe that true, lasting success in investing comes from a disciplined, systematic approach that doesn’t chase after short-term trends or get swept up in market exuberance. Our focus remains on building diversified portfolios that are designed to weather a variety of market conditions and deliver consistent, risk-adjusted returns over the long term.

That said, we’re not blind to the realities of the market. We recognize that today’s concentration and narrow breadth we’re seeing today represent a shift in the market landscape, and we’re actively exploring how our models can maneuver in this landscape while carefully considering the risks to the downside. At the same time, we will continue to diversify our portfolios across a wide range of investments to spread risk and increase the likelihood of achieving steady, consistent returns.

In short, while we recognize the challenges posed by market concentration and narrow breadth, we see them not as roadblocks but as navigational aids. They are signposts that help inform ongoing improvement of our investment process, but they don’t alter our core strategy or our principles. We believe this approach will serve our clients well as we navigate today’s evolving market landscape.

Conclusion

As we grapple with the current market landscape characterized by high concentration and narrow breadth, it’s crucial to remember that these conditions, while challenging, are not unprecedented. Market history is full of cycles, and our current situation is yet another turn of the wheel.

While the dominance of a few tech companies may seem unsettling, it’s important to note that the principles of sound investing remain unchanged. Diversification, balance, and a long-term perspective are as relevant today as they were in the past. They guide us as we navigate through the ebbs and flows of market cycles.

The challenge for us, as investors, is to respond to these conditions in a thoughtful and measured way. This means not getting carried away by market exuberance, and not becoming overly pessimistic when faced with market downturns. Instead, we aim to maintain a balanced perspective, making careful decisions based on thorough analysis and sound principles.

In the end, our focus is not on predicting the market’s next move, but on constructing portfolios that can weather a variety of market conditions and deliver consistent, risk-adjusted returns over the long term. This approach, guided by our principles and shaped by our understanding of market dynamics, will enable us to continue to serve our clients effectively, no matter what the market brings.