In our last blog, we discussed the limitations of traditional equity strategies in an era of heightened equity market risks, as well as common instruments to address these endogenous and exogenous threats. In particular, we believe futures makes the most sense to pair with equites to add positive convexity to returns and enhance alpha over the long term.

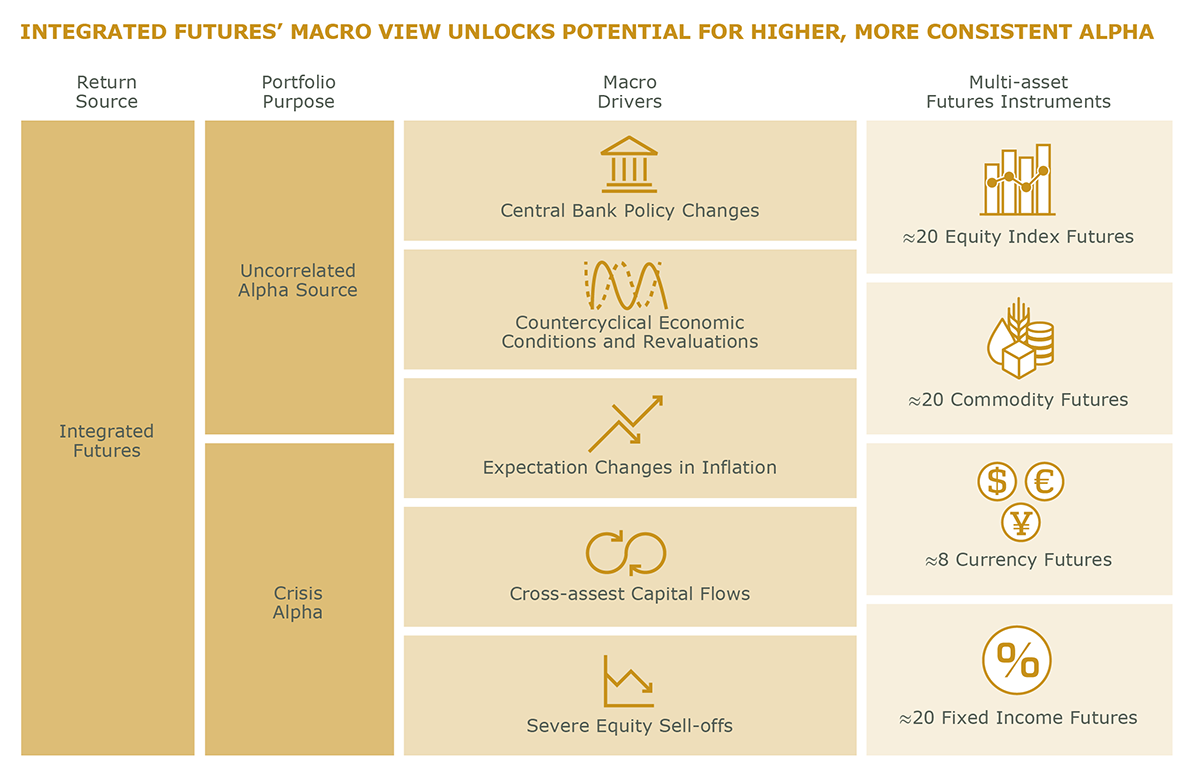

Effectively incorporating a diversified, long-short basket of multi-asset futures into an equity portfolio offers return opportunities, mitigates macro risk, and protects during drawdowns. This makes them an attractive option for diversification within a pension plan portfolio looking to improve risk-adjusted returns. This risk-adjusted return optimization is attributed to the capacity of futures trading to demonstrate strong performance in both upward and downward trending markets, supported by effective signals derived from changing market conditions. This is possible by taking successful long and short positions in futures contracts on commodities, interest rates, currencies, and equity indexes, providing a level of flexibility difficult to achieve with traditional allocations to asset classes (see below).

Further enhancing their attractiveness as a diversification tool is that successful futures implementation tends to perform best during periods of heightened volatility or uncertainty, which can often coincide with periods of equity drawdown. This is where successful managers have earned their reputation for return convexity, also aptly known as “crisis alpha.” The trend-following nature of such actively integrated futures programs can potentially allow them to capitalize on periods of uncertainty and serve as a hedge against equity market downturns. To summarize their primary potential benefits:

- Enhanced Returns: Successful implementation of long and short futures in different asset classes can potentially provide an additional source of return that is uncorrelated with equity markets. This can help improve the return of the overall equity portfolio when market regime shifts make active equity management more challenging, potentially leading to greater accumulated benefits for plan participants.

- Reduced Volatility and Downside: Incorporating a futures component can also help reduce the overall volatility of the equity portfolio, due to the low or even negative correlation with equities. This can make the plan’s investment performance less dependent on the performance of the equity markets, potentially reducing the impact of any downturns.

- Rapid Adaptation: Active futures strategies can focus on shorter time horizons than traditional equity portfolios, allowing them to potentially make rapid changes given the right signal. While equity strategies keep an eye toward long-term growth, they generally are constructed by design to change positioning more slowly and must keep trading costs in check. As such, they may not be as equipped to react to the next sudden change in the investment landscape when it happens.

- Liquidity Management: Futures are generally as liquid as equities – a key benefit for today’s pension plan administrators, as many plans have increased exposure to more illiquid private markets compared to decades past.

KEY CONSIDERATIONS

However, as with all investment decisions, the use of futures needs to be carefully considered in context of the specific plan. Factors such as the plan’s funding status, risk budgets, investment policy benchmarks, and fees can all impact whether and to what extent futures should be used in the portfolio – and how they’re best implemented. Plans may eschew what they perceive as a complex alternative because of poor experiences in the past, or unfamiliarity with evaluating managers in this space. However, there are solutions that mitigate many of these concerns while still providing for their improved outcomes to be realized.

Integrating Futures and Equities

While many may consider implementing futures as an overlay separate from their equity allocation, this has some drawbacks, including higher governance costs, worse capital efficiency, and higher fees.

Overlays require investors to perform their own risk management analysis, accounting for how the futures component will interact with their existing exposures. Further, they must evaluate an additional manager in a unique asset class, requiring multiple points of coverage, if they lack the expertise to actively trade futures based on trends and changing market conditions.

Overlays are also less capital efficient. In contrast, a modest position of futures within an equity strategy, such as a 5% cash allocation collateralizing a futures strategy, can make an outsized impact given the implied leverage offered by futures contracts – without changing the expected performance contours of an equity strategy.

The fusion of equities and futures comes with several advantages. It reduces the number of strategies, and therefore firms, to evaluate and monitor. It provides a turnkey solution that can be measured against a standard equity benchmark, potentially simplifying investment policy compliance and fitting within existing guidelines. Plans can also treat such a strategy like any other from a liquidity standpoint. Finally, an integrated equity and futures solution can adjust exposures against each component’s positioning, which may improve beta management against equities in swiftly changing market conditions.

We believe integrating futures into a traditional equity portfolio offers the best combination of return opportunity, downside-protecting convexity, nimble adaptation, and equity-matching liquidity to fill this need for asset owners. This approach aligns with the evolving market dynamics and the need to navigate time-varying risks. And including futures within an equity portfolio simplifies implementation while preserving benefits to the investor.