Long-term institutional investors are facing a number of challenges within modern equity markets: time-varying risks in the form of increased volatility, more frequent and more violent drawdowns, and breakdowns in asset-class correlations that leave them nowhere to hide in a crisis. In this blog, we’ll discuss the limitations of existing approaches to equity allocations, along with common alternatives they may consider to navigate ongoing and unforeseen threats in today’s investment landscape, and beyond.

The Limitations of Traditional Equity Strategies

Pension funds have traditionally relied on equities as a primary source of returns due to their potential for long-term growth. However, the limitations of this approach have become evident in the face of changing market dynamics. Traditional equity strategies are susceptible to heightened volatility and vulnerability during market regime changes. The correlation within equities and across asset classes can shift abruptly, wiping out diversification benefits. Moreover, lower return assumptions have pressured pension funds to find sufficient return sources to meet their long-term obligations. Consequently, there is a growing recognition that traditional sources of growth are becoming less suitable.

After over a decade of unprecedented fiscal and monetary policy intervention, macro threats are increasing the frequency of market regime changes, posing significant challenges for pension funds. These changes can be triggered by various factors, including economic recessions, geopolitical events, policy decisions, and technological disruptions. Such shifts can lead to increased market volatility, heightened systemic risks, and amplified correlations among equities – and worse – among other traditional asset classes. Pension funds that rely on equities as the main source of growth (and risk), while investing in other asset classes as diversifiers, face greater vulnerability in this emerging environment.

The frequency of these market regime changes has amplified the importance of effectively managing these risks. Recognizing the limitations of traditional equity strategies, investors need new ways to augment their investment outcomes.

Common Instruments for Navigating Macro Threats

Deploying futures or options are common ways to mitigate and exploit the short-term risks presented by macro threats. They offer unique risk and return characteristics: the potential to generate returns that are less dependent on traditional equity markets, while mitigating time-varying risks through diversification. An ideal complementary alpha source would improve equity outcomes, crucially, without materially changing the long-term characteristics of the equity mandate, thereby allowing investors to retain investment policy benchmarks.

These methods and their direct relationship to equities may make them more appealing than increasing portfolio allocations in less-correlated, but also less-liquid, investments such as real estate, private equity, and infrastructure.

| Strategy | Characteristics | Advantages | Disadvantages |

| Options | A derivative contract that offers the right to buy or sell an asset at a specific price on or before a certain date. |

|

|

| Managed Futures | Contractual agreement to buy or sell a particular commodity or financial instrument at a pre-determined price in the future. |

|

|

OPTIONS: FLEXIBILITY AND DOWNSIDE PROTECTION

Options are derivative contracts that provide the holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. They offer flexibility in constructing investment strategies, allowing investors to tailor their risk and return profiles according to their objectives, including downside protection. However, options have many drawbacks, making their application in risk management challenging (see table below).

CHALLENGES WITH OPTIONS TRADING

| Complexity | Options trading can be complex, especially for multi-leg strategies, and require professional expertise. Mistakes due to complexity can result in losses. |

| Transaction Costs | The costs of trading options can be high, particularly for the active trading required to hedge short-term risks. Costs include spreads, commissions, and platform fees. |

| Time Decay | Options are subject to time decay – unique to options – which erodes their value as the expiration date approaches. |

| Total Loss Risk | Options trading entails the potential for a total loss of the investment if the option expires worthless. |

| Liquidity | Options on less popular stocks or indices can suffer from poor liquidity, leading to wider bid-ask spreads and potential difficulties when entering or exiting positions. |

FUTURES: RETURN CONVEXITY AND ALPHA SOURCE

A strategy employing futures can provide exposure to a variety of asset classes, such as equities, fixed income, commodities, interest rates, and currencies via both long and short positions in futures contracts. This diversification potential can enhance portfolio returns by capitalizing on diverse market opportunities.

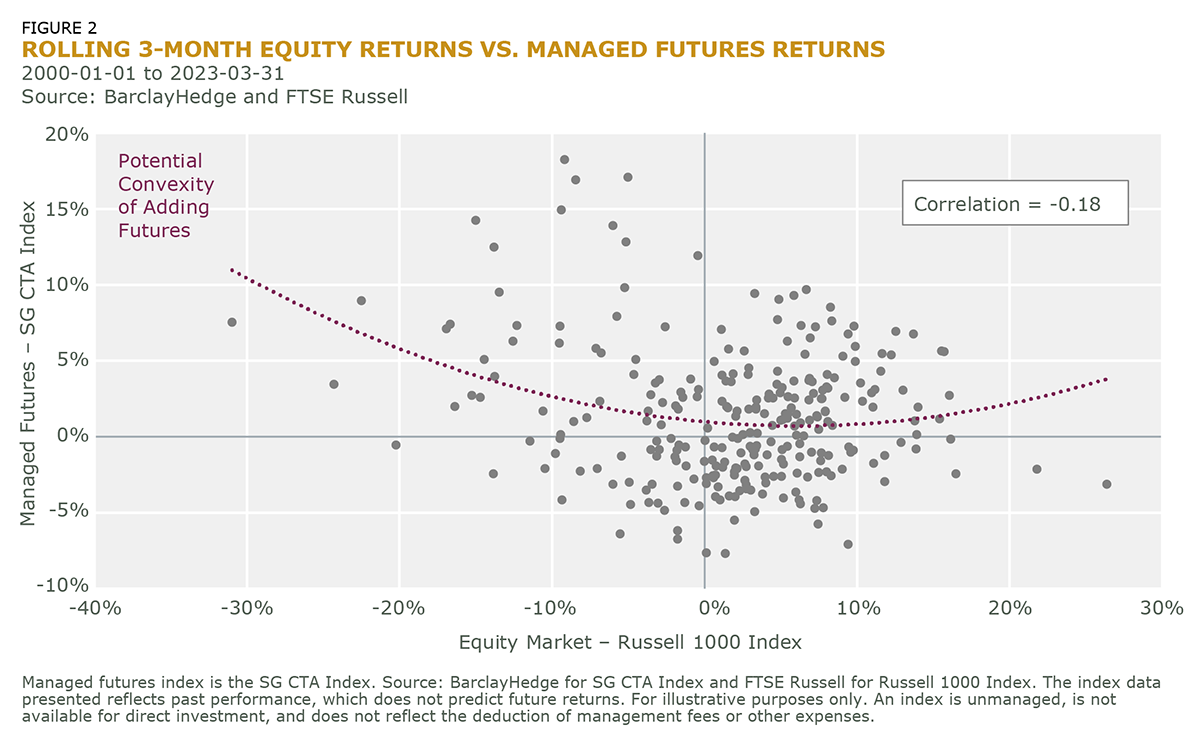

Futures inherent leverage makes them cash-efficient, requiring a relatively small allocation to cash collateral to make a significant impact on the portfolio. Historically, managers using futures have typically provided positive convexity of returns, or greater outperformance during the worst drawdown periods (see chart below). Additionally, futures are not subject to time decay, but options lose value over time, meaning managers have to roll their positions constantly. This can be a costly and time-consuming process that can be avoided by using futures. Compared to options, futures also have lower transaction costs, including commissions and bid-ask spreads. The cost advantage can be significant, especially for strategies that benefit from frequent trading activity from macro shocks and exogenous risks.

The primary drawbacks of incorporating futures is that they require particular expertise to execute successfully and leverage can also amplify losses, but skilled managers have demonstrated the ability to post consistently high Sharpe ratios using these instruments. We believe they represent the best tool available, given the risks facing modern markets, and we’ll explore the attractive combination of potential benefits futures bring to the table in the next section.

What About Convertibles and Low Volatility Equity?Convertibles: Hybrid Securities for Equity Participation Low Volatility Equity Strategies: Reducing Downside Risk |

Traditional equity strategies face limitations in navigating time-varying risks associated with frequent market regime changes. Potential solutions – including futures, options, convertibles, and low volatility equity strategies – offer unique characteristics, such as active trading strategies, downside protection, equity participation, and reduced downside risk, which can complement traditional equity approaches.

These are each potential diversifiers to the relatively substantial risk source of long-only equities that can improve risk-adjusted returns. However, in our next post, we’ll make the case for integrating futures with traditional equity strategies as a way to increase returns, improve diversification, and enhance the overall risk-return profile.