Time flies when you’re making progress! It’s hard to believe that just over a year has passed since our management buyout from Janus Henderson. At Intech, we’re working harder than ever to build on the groundbreaking work of our founder, Dr. Fernholz, who introduced Stochastic Portfolio Theory some 35 years ago. Since the MBO, we’ve been focused on retooling our company to drive innovation faster in order to deliver even more value to our clients. Today, I’m excited to share some of the progress we’ve made on this journey.

Prioritizing What Matters

With the increased flexibility afforded by the MBO, our first order of business was to reinvest in our core competency: investment management. Over the last year, that meant reallocating resources toward talent, modernizing research systems, improving trading, and addressing our clients’ investment needs. We’ve acted on all four fronts.

Investment Talent

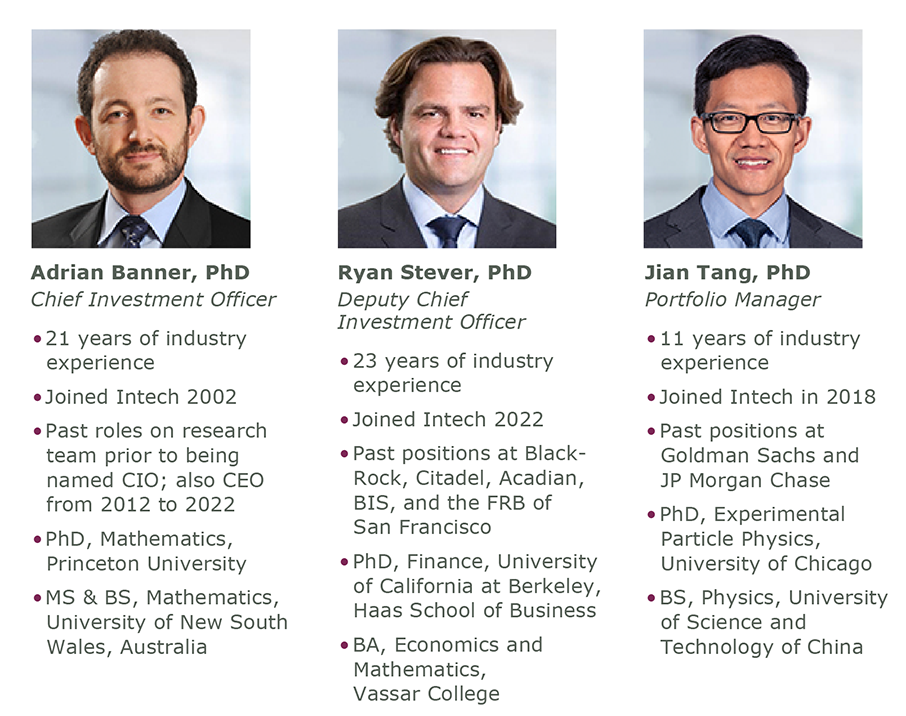

We have made strategic personnel changes to our investment team that we believe position us to deliver the best possible outcome for our clients.

Just before the close of the MBO, we proudly announced that Dr. Jian Tang, an assistant portfolio manager, was promoted to portfolio manager. Dr. Tang has been an integral part of our team for several years and has demonstrated a deep commitment to our clients and our investment philosophy. He has continued to excel in his new role and contribute to our firm’s continued growth and success.

Dr. Adrian Banner, as most of you know, transitioned his CEO responsibilities to me early last year and began dedicating 100% of his focus to portfolio management and research. This enabled us to introduce Enhanced Volatility Modularization, which allows us to add new alpha sources rapidly, keeping pace with capital markets’ dynamics.

The addition of Dr. Ryan Stever as our Deputy CIO has further strengthened our team. Dr. Stever brings a wealth of experience and expertise from his senior equity research positions at BlackRock, Citadel, and Acadian Asset Management. His contributions to our investment process have helped us make even stronger investment decisions for our clients.

STRATEGIC INVESTMENT PERSONNEL CHANGES

Overall, these personnel changes demonstrate our commitment to investing in talent, innovation, and excellence. We are confident that our team will position us for even greater success in the future and enable us to deliver exceptional results for our clients.

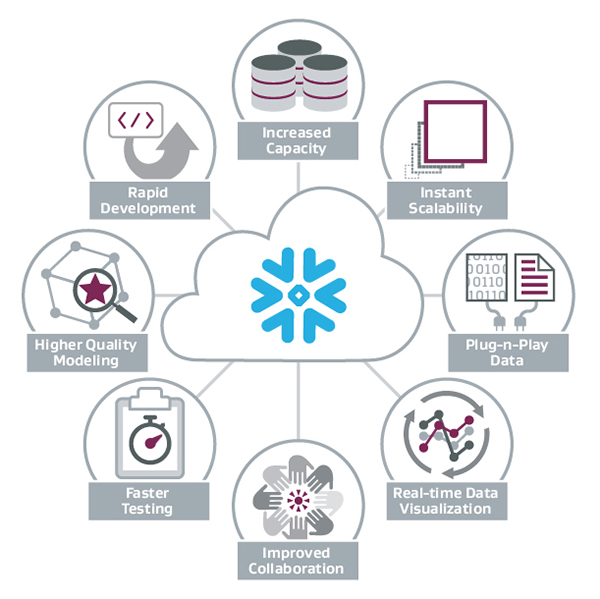

New Cloud-based Research Platform

We are excited about transitioning our R&D technology and data platform from an on-premise infrastructure to a state-of-the-art 100% cloud-based computing environment. This move represents a leap forward in our investment research and modeling capabilities by significantly improving the productivity of our investment team, and empowering the utilization of big data and modern data science tooling, including AI.

We want to emphasize that this important transition will not change our investment philosophy or commitment to the Stochastic Portfolio Theory framework. Rather, the new platform will enable our investment professionals to evolve our processes at a cadence consistent with the rate of change in today’s capital markets.

SNOWFLAKE-DRIVEN R&D PLATFORM IN BETA TESTING

One of the key benefits of moving to a cloud-based computing environment is its instant scalability. We can spin up and retire data environments effortlessly, add third-party tools as necessary, onboard new data sources efficiently while ensuring integrity, and make us nimbler overall. Our ability to “fail faster,” while experimenting with new investment strategies in a low-risk environment, promotes innovation and ultimately drives better client outcomes.

Dr. Ryan Stever and Henry Meng have been working diligently with our new Chief Technology Officer, Paul Cassell, and others to build the new infrastructure, which is now in beta testing. Paul’s contributions to this effort cannot be overstated as he has brought to bear his 25+ years of industry experience, including eight years as the Chief Information Officer at the NYSE.

Electronic Trading Implementation

At Intech, trading is an integral part of our investment process, so improving trading practices is essential to delivering better investment results for our clients. Over the past year, we have made significant strides in this area. I worked closely with our trading team to conceive and implement highly systematic algorithmic trading capabilities for U.S. equity markets, affecting all of our U.S. and Global strategies. This new trading platform has reduced our explicit trading costs and commissions while also minimizing our implicit trading costs, such as market impact.

“This new trading platform has reduced our explicit trading costs and commissions while also minimizing our implicit trading costs…”

We are excited about the improvements in trading outcomes, as we believe they will translate into improvements in client outcomes. To that end, we are implementing a soft-dollar commission program to help us offset the ever-increasing costs of data – the lifeblood of our investment process. We are confident that this program will increase access to the best data, allow for better investment opportunities, and ultimately, enhance client results.

New Product Development

We recognize that our clients’ investment needs are constantly evolving, especially in light of worsening equity volatility, more frequent and severe drawdowns, and shifting asset-class interdependencies. To better serve them, we’ve launched new U.S. and Global equity strategies designed to address the challenges of today’s fast-moving, macro-risk-driven market environment.

Typically, investors adjust asset allocations by adding esoteric, less-liquid assets to their portfolios. However, we believe that equities, which are typically the largest risk contributor, should be the starting point. Our new strategies seek to offer several benefits, including:

- Adding excess return over benchmarks

- Lowering volatility relative to benchmarks

- Providing convexity in equity market tail-risk events

- Stabilizing portfolio diversification amidst cross-asset correlation shifts

Importantly, these are not “defensive” equity strategies. While we purposefully incorporated some defensive features, we’ve designed them to participate fully in bull markets and perform well in all market conditions.

We’re confident that these new strategies will help our clients better navigate the changing investment landscape and achieve their long-term goals.

INTRODUCING INTECH ALL MARKET CORE EQUITY STRATEGIES

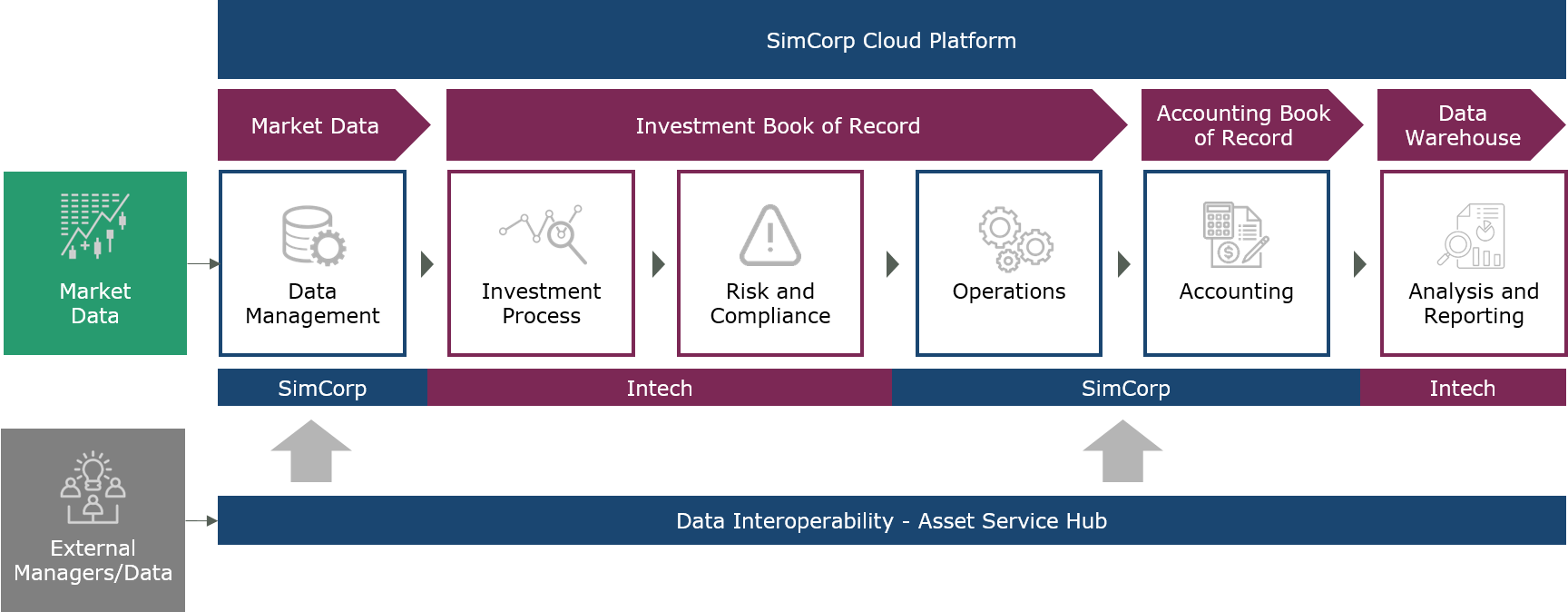

Modernizing Front-to-Back Office Operations

We are also thrilled to provide you with an update on our efforts to separate our investment operations from our former parent company’s infrastructure. Our goal is to continuously improve our services to you, and we believe that this transformation will enable us to do just that.

Last year, we engaged OPCO Advisory to help us in the search for a new operations partner. After an extensive evaluation process, we chose SimCorp, a global provider of operational software and services to investment managers. We have selected their full lifecycle management service to support all of Intech’s post-trade, performance, compliance, and activities related to our investment book of record. We will also implement SimCorp’s Snowflake-powered data warehouse and cloud-native client portal.

NEW INVESTMENT OPERATIONS INFRASTRUCTURE

One of the key benefits of our partnership with SimCorp is a more holistic overview of our business operations, seamless integration of managed processes, and transparent access to data across all of our post-trade operations and related reporting. These capabilities will enable us to make even stronger investment decisions for our clients.

We are confident that our partnership with SimCorp will support our future growth aspirations with a highly scalable, innovative platform. This will enable us to offer you even more efficient and effective investment solutions in the future.

We want to make sure you know that this transition is being handled with great care and precision. We are in the throes of the transition today and expect implementation to occur in Q4, which will include an extensive period of parallel production testing. Our team is working tirelessly to ensure a seamless changeover without disruption to services.

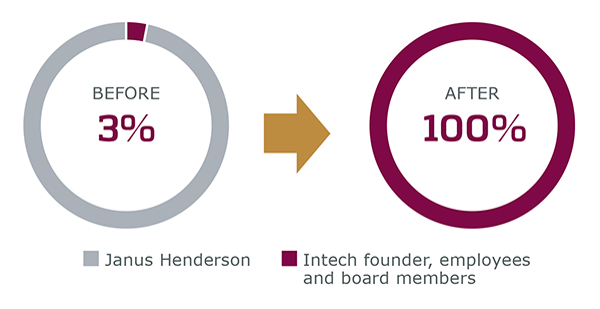

100% Employee Ownership

Our employees are our most valuable asset and we recognize that their dedication is critical to our success. That’s why we’ve created a new equity ownership plan where every full-time employee as of January 1, 2023 was granted a genuine equity stake in the company.

OWNERSHIP BEFORE MBO VS. TODAY

We’re confident that this broadly distributed equity ownership plan will further align our interests with those of our clients by fostering a stable and dedicated team of investment professionals. We also believe that it will be instrumental in attracting and retaining the very best talent in the industry to the benefit of our clients.

Looking Ahead

Since the MBO, Intech has been squarely focused on retooling our company to deliver even more value to our clients and drive innovation. We’ve made significant progress in areas such as talent, technology, trading, product development, operations, and employee ownership. We believe that these changes will position us for even greater success in the future and enable us to potentially deliver incomparable results for our clients. We remain committed to our founding principles and the innovative spirit of Dr. Fernholz, and we look forward to continuing to build on his pioneering work in the years to come.

This material is for general informational purposes only and should not be construed as investment advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation, or sponsorship of any company, security, advisory service, or fund nor does it purport to address the financial objectives or specific investment needs of any individual reader, investor, or organization. This material should not be used as the sole basis for investment decisions. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. There are numerous other factors related to the markets in general that should be considered before making any investment decision. All content is presented by the date(s) published or indicated only and may be superseded by subsequent market events or other reasons. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Intech is the source of data unless otherwise indicated and has reasonable belief to rely on information and data sourced from third parties.

Past performance does not guarantee future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The value of an investment may go down as well as up and you may not get back what you originally invested. Nothing herein is intended to or should be construed as advice.

In Australia, this information is issued by Intech Investment Management LLC (Intech) and is intended solely for the use of a wholesale clients as defined in section 761G of the Corporations Act 2001 (Cth) and is not for general public distribution. Intech is permitted to provide certain financial services to wholesale clients pursuant to an exemption from the need to hold an Australian financial services licence under the Corporations Act 2001. Intech is regulated by the United States Securities & Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. By receiving this information, you represent that you are a wholesale client.

Intech is not permitted to offer products and services in all countries and not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Intech is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.