Foundations find themselves standing at a significant crossroads. The traditional equity mandates, which have long been a cornerstone in the investment portfolios of foundations, now seem less adept at navigating the frequent regime changes driven by a convergence of unprecedented macroeconomic risks. Today, leaders in the foundation sector are exploring alternatives, seeking alpha in less efficient markets while diversifying risk. However, these alternatives often come with their own set of challenges, including reduced liquidity and demanding due diligence requirements.

As we delve deeper into this complex landscape, we propose a fresh perspective, an innovative approach that stands as a beacon of hope in these complex times. This all-season equity strategy systematically adjusts to short- and long-term risk cycles, offering a shield against tail-risk events and a potential source of novel alpha. It’s not just about adapting to the modern investment landscape; it’s about aligning with the unique demands and aspirations of foundations.

A New Alpha Source Through Adaptive Rebalancing

Efficient markets with low risk premiums pose a complex challenge for investors. The integration of macro factor trading with equities opens a unique avenue for alpha generation through adaptive rebalancing. This strategy capitalizes on market fluctuations by integrating a macro factor trading component to realign the equity portfolio when positions drift or market volatility spikes. The macro factor trading component is a modest 5% cash allocation used to collateralize a multi-asset, exchange-traded futures strategy. The component attempts to deliver a novel alpha source, greater alpha resiliency, more precise risk management, and a more favorable liquidity profile than most alternative investments.

This strategy capitalizes on market fluctuations by integrating a macro factor trading component to realign the equity portfolio when positions drift or market volatility spikes.

In this evolving scenario, the adaptive rebalancing acts as a catalyst, enabling foundations to navigate market “wobbles” with agility and foresight. It’s a strategy that goes beyond mere adjustments, aiming to transform market fluctuations into opportunities for growth and stability.

Alpha Resiliency in the Modern Investment Landscape

The modern investment landscape is characterized by time-varying risks (See sidebar: The New Market Order). Our all-season equity approach is designed to protect alpha from the adverse effects of left tail-risk events. It recognizes the unique demands of foundations, offering a portfolio that aligns with their aspirations and needs.

In this context, alpha resiliency becomes a cornerstone, ensuring that foundations can weather the storms of modern market dynamics without compromising their core objectives. It’s about crafting a strategy that is resilient, adaptive, and aligned with the long-term goals of foundations, fostering stability and growth in a fluctuating market environment.

The New Market Order: Time-Varying Risks

Driven by heightened macro uncertainties, a new equity landscape is emerging, presenting today’s investors with unprecedented challenges. Short-term market cycles have made it increasingly difficult to capture long-term alpha and preserve the integrity of portfolio diversification.

The new frontier of investing requires a fresh approach to equity investing that can address time-varying risks, including heightened volatility, frequent drawdowns, and shifting cross-asset correlations.

|

|

|

| INCREASING VOLATILITY | FREQUENT AND SEVERE DRAWDOWNS | SHIFTING CROSS-ASSET CORRELATIONS |

| Market volatility has increased, with economic cycles, geopolitical uncertainty, algorithmic trading, and market sentiment contributing to this phenomenon. Increasing and time-varying volatility has significant implications for investors, as it can erode returns, increase the likelihood of drawdowns, and complicate the task of portfolio diversification. Today’s strategies must effectively manage heightened volatility while capturing alpha.

|

Drawdowns have become more frequent and severe in recent years. The magnitude, frequency, and duration of these phenomena require investors to be prepared and develop strategies to manage and mitigate drawdown risk. A well-designed portfolio should be able to weather drawdowns without compromising its long-term performance. | Shifting correlations between asset classes can undermine portfolio diversification objectives, making it challenging for investors to construct portfolios that can withstand market fluctuations. By understanding how correlations change over time and incorporating this knowledge into their investment strategies, investors can improve portfolio resilience. |

Precision Risk Management: A New Norm

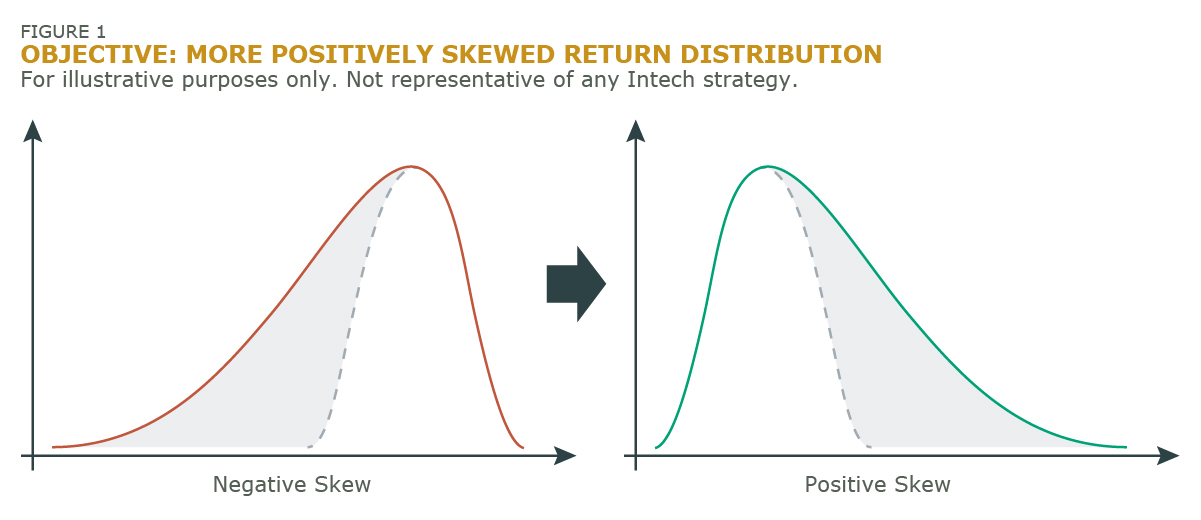

Risk management is evolving. It’s no longer about avoiding risk; it’s about managing it effectively, especially the shorter-term risks brought on by macroeconomic events. The integration of macro factor trading into the equity mandate allows for fine-tuning of risk management strategies. This facilitates prompt adjustments to market exposure, aiming to skew outcomes more positively (Figure 1).

In this new norm, precision risk management becomes a vital tool, enabling foundations to navigate the complexities of the market with a strategy that is both responsive and proactive. It’s about harnessing the power of innovation to craft strategies that are not only resilient but also capable of turning challenges into opportunities for growth and development.

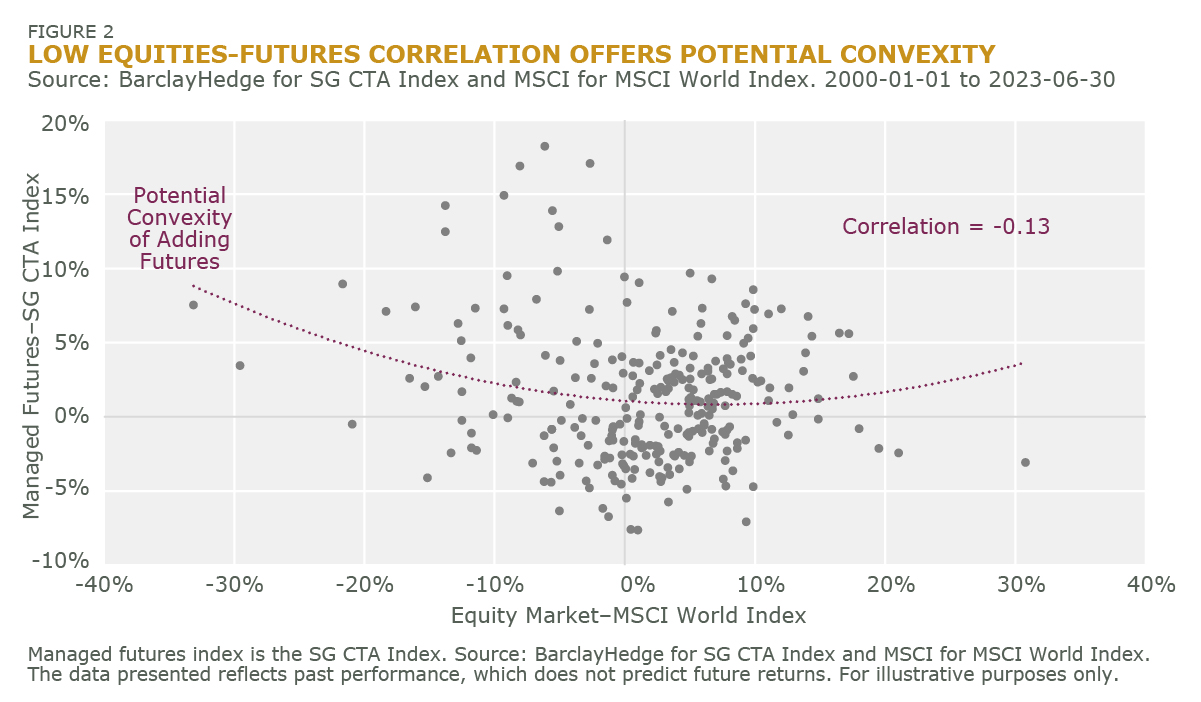

Downside Convexity: A Practical Tool

Downside convexity is not just a theoretical advantage. It serves as a practical tool for buffering drawdowns, a critical concern for foundations. This strategy seeks to limit losses during market downturns, improving the “denominator effect” and preserving the funding status of foundations. (Figure 2).

In the face of market volatility, downside convexity emerges as a beacon of stability, offering a cushion that helps preserve the integrity of foundation portfolios. It’s a strategy that goes beyond mere risk mitigation, aiming to foster resilience and stability in a market characterized by frequent fluctuations and uncertainties.

Liquidity Provision: A Central Consideration

Liquidity remains a central consideration in this approach, aligning with the operational demands of foundations and utilizing markets known for their liquidity. This strategy resonates with the unique investment landscape that foundations navigate, offering a harmonious balance between liquidity provision and growth.

In this complex landscape, liquidity provision becomes a central pillar, ensuring that foundations can meet their immediate obligations without compromising their long-term objectives. It’s a strategy that recognizes the unique role that foundations play in society, offering a balanced approach that harmonizes growth and liquidity provision.

It’s a strategy that recognizes the unique role that foundations play in society, offering a balanced approach that harmonizes growth and liquidity provision.

As we navigate this intricate journey, we invite you to delve deeper into the nuances of this all-season equity approach. We believe it stands as a thoughtful response to the challenges faced by foundations in the modern investment landscape. It’s a testament to the power of innovation and deep understanding, reflecting a commitment to serve foundations effectively in this ever-changing global market.

To learn more about this innovative approach and how it can transform your foundation’s investment strategy, we invite you to learn more in our comprehensive paper that sheds light on this new paradigm.