In the ever-evolving landscape of global equity markets, foundations find themselves at a crossroads, navigating unique complexities and nuanced requirements. The traditional approaches to investment no longer suffice, giving rise to the need for strategies that not only meet but anticipate the distinct challenges faced by foundations. It is here that the innovative all-season equity approach comes into play, offering a beacon of guidance in these turbulent times.

As we have explored in our series (see Navigating the Complex Landscape of Foundation Investments: A Series Exploration and A Tailored Equity Approach for Foundations), foundations operate under a different set of rules than their “E&F” partner. Their immediate obligations, coupled with a higher sensitivity to market downturns, necessitate a strategy that is both resilient and adaptive. The all-season equity approach is not a one-size-fits-all solution; it is a strategic partner offering a new way forward, a testament to the power of intention, innovation, and deep understanding.

A New Paradigm

The investment landscape for foundations is marked by unique complexities and nuanced requirements. From balancing growth and liquidity to managing the sensitivity to drawdowns and the challenges of efficient markets, foundations require a tailored approach that transcends conventional wisdom.

An all-season equity approach represents a thoughtful response to these challenges. By recognizing the specific liquidity management exercise that foundations face, this approach crafts a solution that aligns with their unique needs and aspirations. Leveraging the liquidity of public equities and the innovative use of macro factor trading for both risk management and alpha contribution, this approach offers a multifaceted strategy that resonates with the realities of foundation investments.

Growth with a Purpose

Growth is a common goal for both foundations and endowments, but the path to achieving it differs significantly. Foundations must balance the pursuit of growth with the realities of liquidity needs and drawdown sensitivity. It’s a delicate equilibrium that requires a thoughtful approach. Growth is not pursued at all costs; it’s pursued with an understanding of the unique role that foundations play in society.

Theoretical frameworks and strategic outlines are essential but often remain abstract for investors. The practical application of these concepts is where the real understanding emerges. The following case study, although hypothetical, serves as a bridge between theory and practice, crafted with careful consideration of the unique challenges and needs faced by foundations.

Case Study: A Practial Illustration

To truly grasp the potential of this approach, let’s consider a hypothetical yet realistic case study involving two entities: the FutureFocus Foundation and the Evergreen University Endowment.

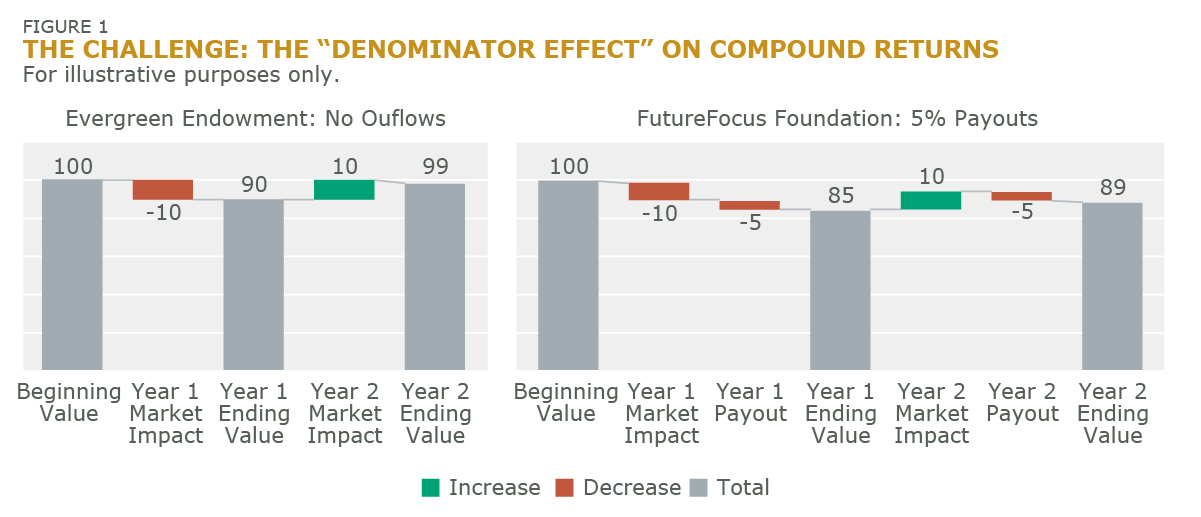

Liquidity management for FutureFocus Foundation is a distinct and complex exercise, markedly different from that of Evergreen. To illustrate the contrast, consider the endowment starting with a $100 million investment. If Evergreen loses 10% in the market, followed by a 2% downturn, and then gains 10% the next year, it would be back at $99 million, nearly recovering the initial loss. This scenario assumes no net outflows, a situation common to many prominent university endowments that benefit from continuous inflows from alumni covering, or nearly covering, their payouts.

Now, compare this to FutureFocus Foundation with the same starting investment. With no money coming in the door and a mandatory payout of 5 or 6% each year, the foundation faces a different reality.

If FutureFocus loses 10% in the market and spends 5%, the portfolio drops to $85 million. If the market rebounds by 10% the next year, but another 5% is spent, the portfolio remains in the 80s, resulting in a loss of 11-12% over two years, even when the market hasn’t moved significantly. This scenario highlights the massive “denominator effect” that can occur in foundations, leading to substantial losses over time (Figure 1).

This liquidity challenge explains why many foundations limit their holdings in private assets, as they can’t afford the illiquidity that university endowments might tolerate. The need for ready access to funds, coupled with the sensitivity to market fluctuations, creates a nuanced landscape that demands a better investment approach.

The Solution

The unique liquidity challenge faced by foundations, as contrasted with university endowments, requires a nuanced approach that recognizes the critical importance of funding status preservation. The innovative all-season equity approach offers a tailored response to this complex challenge through the following key design features:

- Improving the Denominator Effect: The potential convexity offered by integrated futures seeks to limit drawdowns, which serves to minimize the denominator effect and the negative impact on compound returns. This approach ensures that the foundation’s portfolio remains resilient, even in the face of market downturns, and helps maintain the foundation’s funding status.

- Enhancing Returns: Aside from compounding benefits, integrating futures offers a unique alpha source via adaptive rebalancing. Capitalizing on market fluctuations, or market “wobbles,” futures trading attempts to realign the equity portfolio if positions drift or volatility increases. By exploiting correlations between econometric factors and equity exposures, the approach targets additional returns, diversifies risk across asset classes, and mitigates stock-specific risks.

- Optimizing Liquidity Management: The unique liquidity needs of foundations require a tailored approach that ensures ready access to funds without compromising long-term goals. Given the inherent liquidity of public equities and futures, the all-season equity approach provides a harmonious balance between liquidity provision and growth. This aligns well with a foundation’s distinctive operational demands.

This is an outcome that should resonate with the specific needs and challenges of foundations. It’s a response that goes beyond conventional wisdom, crafting a solution that anticipates the unique liquidity management exercise faced by foundations. It’s an approach that stands apart, reflecting a commitment to serve foundations effectively, with a deep understanding of the role they play in society and the investment world.

Conclusion: A Strategic Partner for a New Era

As we navigate the ever-changing landscape of global markets, the need for tailored solutions becomes increasingly apparent. An all-season equity approach offers a glimpse into a new paradigm, one that recognizes the distinct needs of foundations and crafts a solution that not only meets but anticipates their unique challenges.

In a world where investment strategies often fall into broad categories, an all-season equity approach stands apart. It’s a testament to the power of intention, innovation, and deep understanding, reflecting a commitment to serve foundations effectively.

As we conclude this series, we invite you to delve deeper into this innovative approach. Learn more about how the all-season equity approach can be a game-changer in your investment strategy, offering a new way forward in a complex market landscape.

This material is for general informational purposes only and should not be construed as investment advice, as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation, or sponsorship of any company, security, advisory service, or fund nor does it purport to address the financial objectives or specific investment needs of any individual reader, investor, or organization. This material should not be used as the sole basis for investment decisions. The appropriateness of a particular investment or strategy will depend on an investor’s individual circumstances and objectives.

Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. There are numerous other factors related to the markets in general that should be considered before making any investment decision. All content is presented by the date(s) published or indicated only and may be superseded by subsequent market events or other reasons. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Intech is the source of data unless otherwise indicated and has reasonable belief to rely on information and data sourced from third parties.

Past performance does not guarantee future results. Investing involves risk, including the possible loss of principal and fluctuation of value. The value of an investment may go down as well as up and you may not get back what you originally invested. Nothing herein is intended to or should be construed as advice.

Futures are speculative, highly leveraged, and involve a high degree of risk. Volatility increases risk, particularly when trading with leverage. Futures and forward positions cannot always be liquidated at the desired price. Investments can be subject to low liquidity, meaning there may not be a seller or buyer available when the investor desires to invest or divest.

The hypothetical illustrations do not represent the returns of any particular investment and should not be used to predict or project performance.

In Australia, this information is issued by Intech Investment Management LLC (Intech) and is intended solely for the use of a wholesale clients as defined in section 761G of the Corporations Act 2001 (Cth) and is not for general public distribution. Intech is permitted to provide certain financial services to wholesale clients pursuant to an exemption from the need to hold an Australian financial services licence under the Corporations Act 2001. Intech is regulated by the United States Securities & Exchange Commission (SEC) under U.S. laws, which differ from Australian laws. By receiving this information, you represent that you are a wholesale client.

Intech is not permitted to offer products and services in all countries and not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Intech is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.