The equity landscape is evolving rapidly, presenting today’s investors with unprecedented challenges. Short-term market cycles have made it increasingly difficult to capture long-term alpha, navigate sudden spikes in volatility, and preserve the integrity of portfolio diversification. This new frontier of investing requires a fresh approach to equity investing that can address time-varying risks, including heightened volatility, frequent drawdowns, and shifting cross-asset correlations. In this blog post, we’ll summarize the key points of our in-depth paper and discuss an innovative solution for equity investors in today’s complex market environment.

Time-Varying Risks

VOLATILITY

Market volatility has increased, with economic cycles, geopolitical uncertainty, algorithmic trading, and market sentiment contributing to this phenomenon. Increasing and time-varying volatility has significant implications for investors, as it can erode returns, increase the likelihood of drawdowns, and complicate the task of portfolio diversification. To navigate this challenge, investors must adopt strategies that effectively manage volatility while capturing alpha.

DRAWDOWNS

Drawdowns have become more frequent and severe in recent years. The magnitude, frequency, and duration of these phenomena require investors to be prepared and develop strategies to manage and mitigate drawdown risk. A well-designed portfolio should be able to weather drawdowns without compromising its long-term performance.

CROSS-ASSET CORRELATIONS

Shifting correlations between asset classes can undermine portfolio diversification objectives, making it challenging for investors to construct portfolios that can withstand market fluctuations. By understanding how correlations change over time and incorporating this knowledge into their investment strategies, investors can better manage risk and improve portfolio resilience.

Revolutionary Solution: Alpha with Resiliency

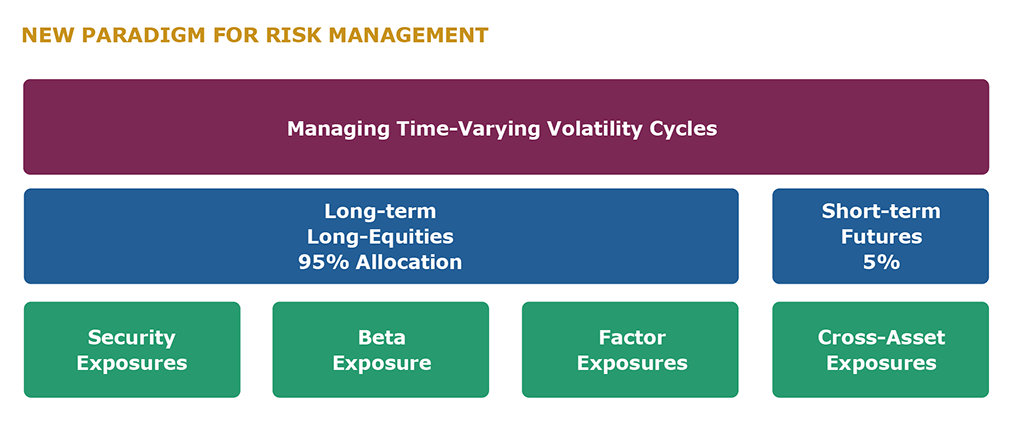

To address these time-varying risks, we propose an innovative approach to equity investing that systematically adjusts exposures in response to both short- and long-term risk cycles while offering convexity to hedge tail-risk events. This solution involves synthesizing managed futures into equity strategies, creating a versatile, all-season portfolio that can potentially deliver better diversification, risk reduction, and improved risk-adjusted returns.

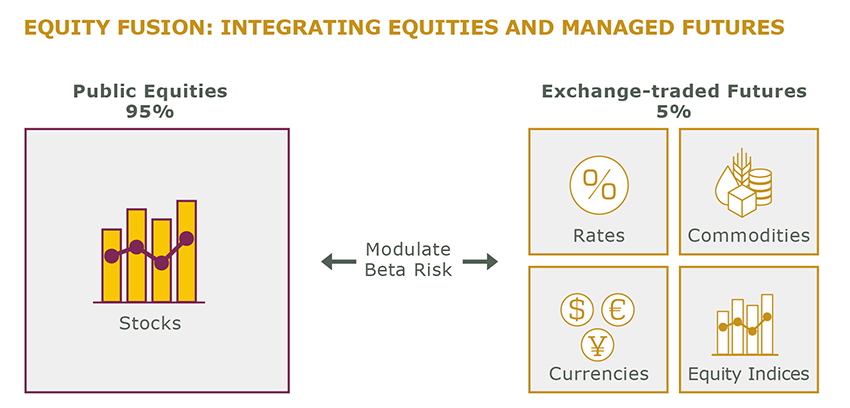

By allocating 5% of the cash in an equity strategy to collateralize a multi-asset, exchange-traded futures strategy, investors can create a new framework for time-varying risk management. This combination provides the necessary flexibility to respond to market changes while retaining the performance characteristics of a typical large-cap core equity strategy.

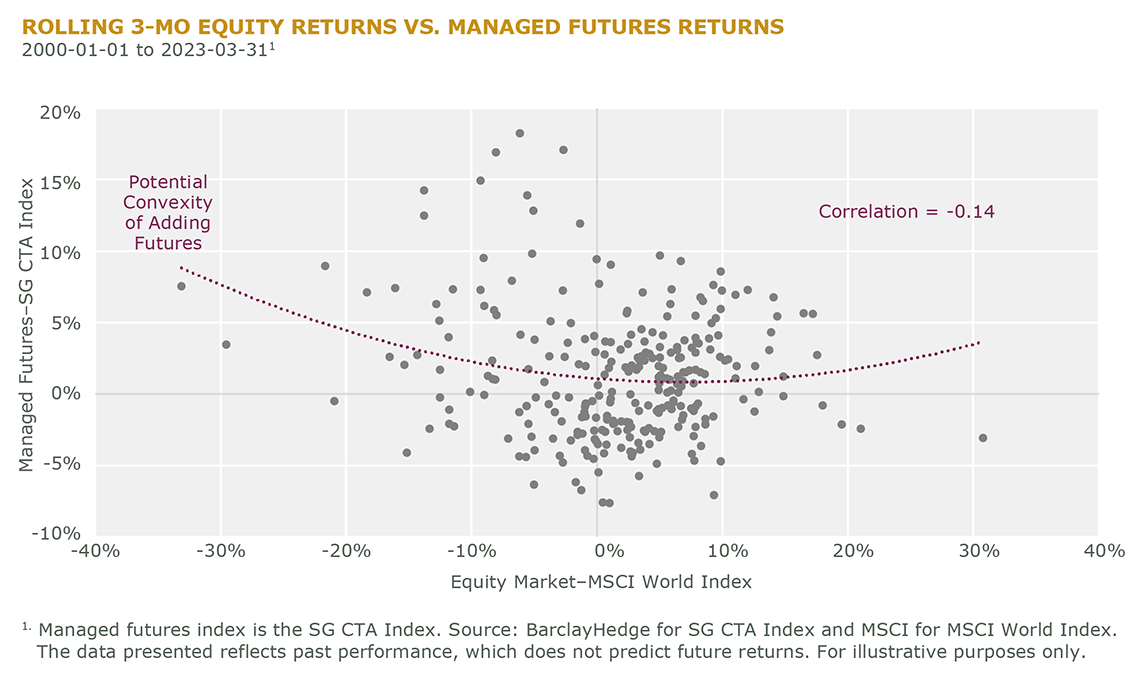

Access Convexity

The relationship between equities and managed futures is convex, meaning that as one asset class experiences losses, the other may experience gains. This non-linear relationship offers several potential benefits for investors, including better diversification, greater risk reduction, and improved risk-adjusted returns. By integrating managed futures and equities, investors can increase diversification within and across asset classes, reduce equity and overall portfolio risk, and potentially enhance returns.

Integration, Not Overlays

Instead of integrating equity and managed futures strategies, some investors might consider a managed futures overlay. However, we argue that an integrated approach is more practical and offers several advantages:

- Capital Efficiency: Integrating managed futures within an equity strategy allows for more efficient use of capital and margin requirements.

- Performance Efficiency: An integrated approach can be more responsive to changes in market conditions, maximizing potential benefits.

- Cost Efficiency: Managing both portfolio components within the same structure can reduce trading costs and simplify the investment process.

- Governance Cost: Particularly relevant for pension funds, integrating strategies can lead to lower governance costs compared to overlays, as it streamlines the decision-making process and reduces the need for additional oversight.

Modernize Your Equity Strategies

Equity investors face an increasingly unpredictable market environment characterized by relentless regime changes. Traditional risk management tools often fail to address these complexities without negatively impacting alpha. As a result, investors must look towards innovative approaches that can adapt to the evolving landscape.

Our in-depth paper presents a compelling case for integrating managed futures into equity strategies, creating a versatile, all-season portfolio that systematically adjusts to both short- and long-term risk cycles. This integration not only offers better diversification, risk reduction, and improved risk-adjusted returns but also proves to be more capital-efficient, performance-efficient, and cost-effective than a managed futures overlay.

In this era of market uncertainty, it is crucial for investors to adopt forward-thinking strategies that address the challenges of today’s markets while maintaining the potential for long-term success. By embracing the integration of managed futures in equity strategies, investors are better positioned to navigate the complexities of the modern financial landscape and achieve their investment objectives.

We believe the time has come to modernize your equity strategies, revolutionize your approach, and prepare your portfolio for the challenges that lie ahead. By understanding and addressing time-varying risks and adopting an innovative approach that integrates managed futures into equity strategies, investors can build resilient portfolios designed to thrive in the face of market turbulence and uncertainty.

Download the Full Paper

Equip yourself with the knowledge and tools necessary to navigate the complexities of the modern financial landscape and achieve your investment objectives. Download the paper now and learn how to transform your equities for the road ahead.